Two years of energy crisis, climate urgency, and public scrutiny have made reputation one of the sector’s most valuable and vulnerable assets.

Caliber’s 2023 global data shows that while trust in the sector has remained stable overall, national and demographic differences reveal deeper, long-term energy and utilities industry challenges.

From the UK’s sharp reputational decline to polarization in the United States, the findings show how power and utilities companies are balancing public expectations, government pressure, and the realities of transition.

This article draws from Caliber’s Global Energy Reputation Report, US Energy Reputation Report, and Top Energy Companies 2023 Rankings, combining them into one clear narrative for leaders shaping communication, policy, and brand reputation strategy in the utilities sector.

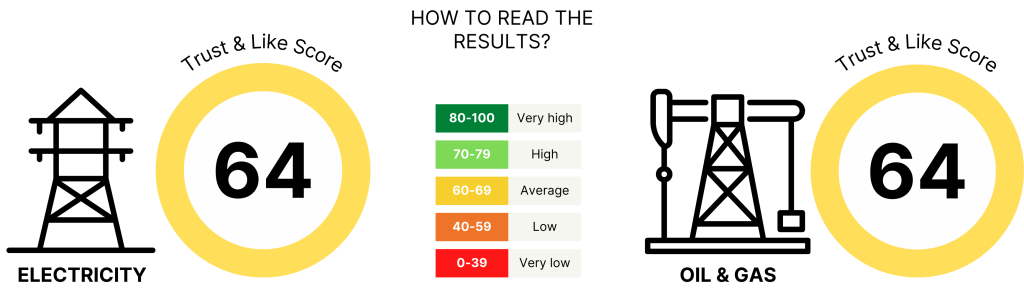

At a global level, the corporate perception & reputation of the energy and utilities sector has remained unchanged since 2021. Both the Electricity and Oil & Gas subsectors hold an average Trust & Like Score (TLS) of 64, an “average” rating on Caliber’s normative scale.

Yet, that apparent stability conceals important nuances. The UK’s reputation has dropped sharply, while the US and Brazil saw improvements. In France and Germany, sentiment weakened slightly; Japan and China remained stable.

In 2024, global energy demand grew by 2.2%, led by a 4.3% surge in electricity consumption— significantly outpacing global GDP growth of 3.2%.IEA

This rising demand puts pressure on companies in the utilities sector to expand capacity while managing emissions and public expectations.

Read also: Explore the key factors that influence corporate reputation

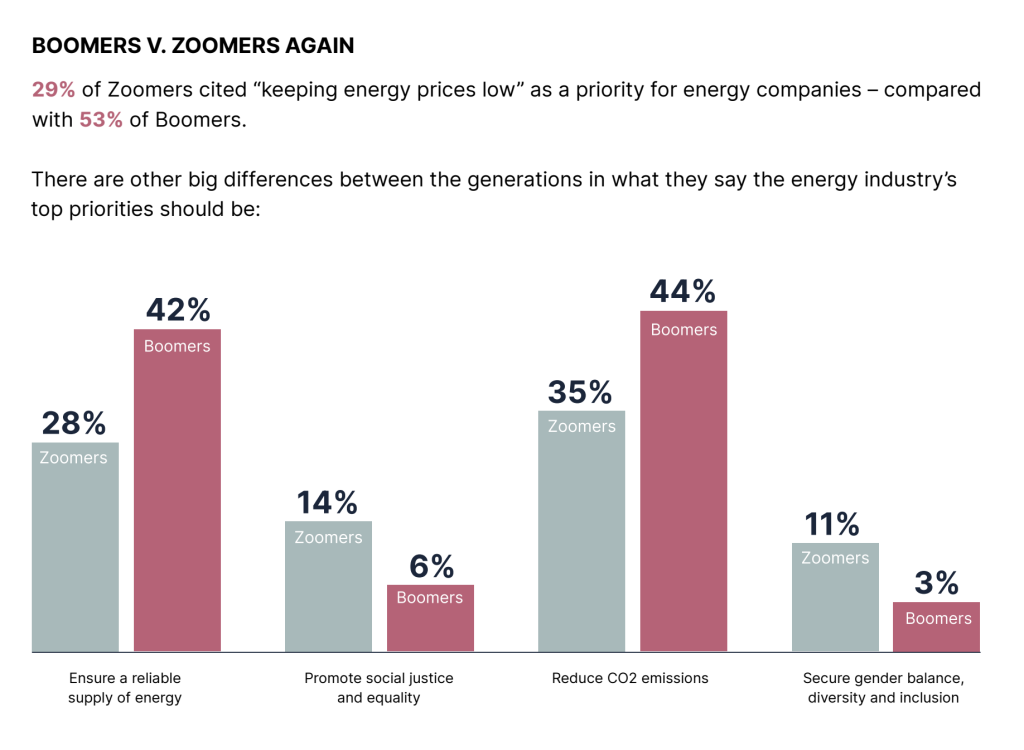

Generational data tells a compelling story.

Younger people — particularly those aged 18–24 — view Electricity companies more positively than Oil & Gas, with TLS averages of 71 and 66, respectively. Among middle-aged adults (35–64), that pattern reverses.

This may come down to lived experience. Younger groups are less exposed to household energy bills, while older consumers — often paying the highest costs — are more skeptical.

Caliber’s findings also show that income matters: higher-income respondents rate both subsectors more favorably. Financial resilience appears to buffer reputational strain from rising prices.

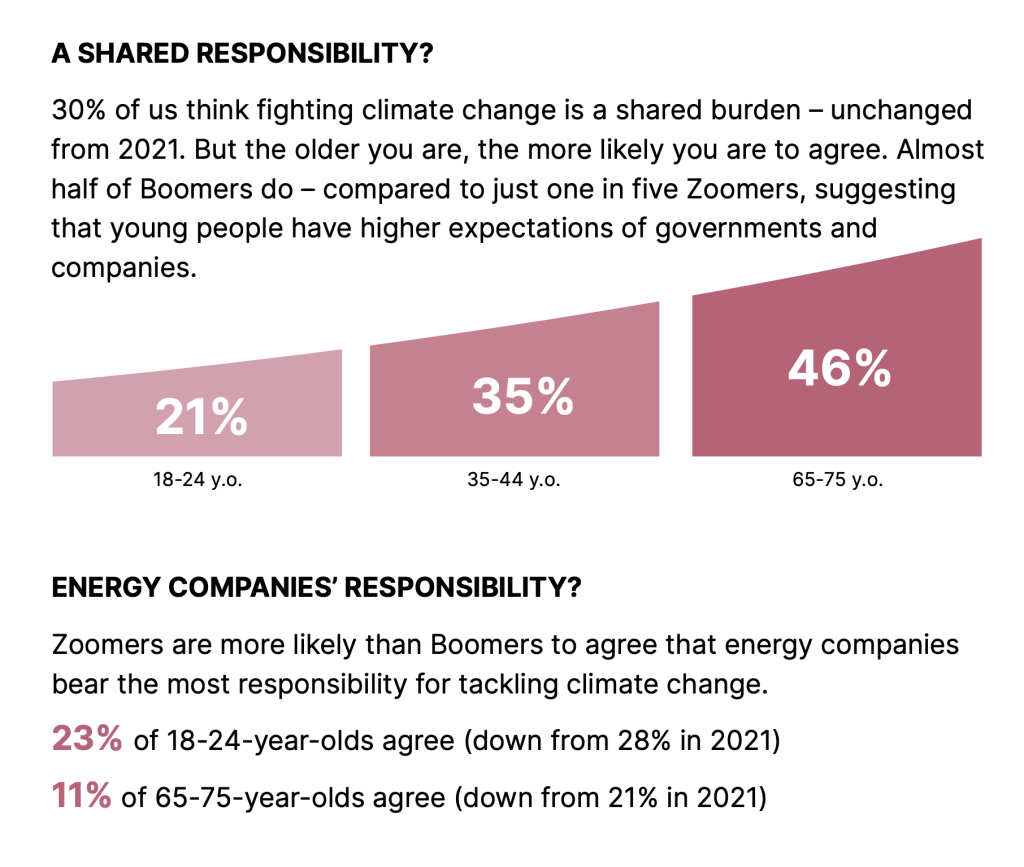

When asked who bears the most responsibility for fighting climate change, the world’s public is divided. Roughly 30% say “all of the above” — that it’s a shared responsibility between consumers, companies, and governments.

Only 19% globally point to companies in the energy sector as primarily responsible, and just 14% name national authorities. The figure drops to 9% in the US.

This disconnect between public expectations and institutional accountability underscores one of the sector’s most complex challenges: while companies are under mounting pressure to lead, the public doesn’t necessarily see them as the ones who should.

Read more: The US energy sector reputation report

If the global average hides subtle differences, the UK stands out as an outlier.

Since 2021, British energy companies have seen the steepest decline in stakeholder perception & sentiment. Trust & Like Scores fell by three points for electricity companies and seven points for oil and gas.

Nearly half of Britons (49%) now say they have a worse perception of the sector than before the crisis, compared to a global average of 30% and 24% in the US. Only 19% report a better perception.

The reputational decline appears tied to the cost-of-living crisis and frustration over record profits. As household bills rose and headlines highlighted corporate windfalls, public empathy collapsed.

60% of UK respondents say keeping energy prices low should be the industry’s top priority — far higher than the global average (41%). For many, affordability has eclipsed sustainability.

The data also reveals how rising costs have shaped behavior.

However, only 13% switched to a more efficient energy supplier, and just 8% installed solar or renewable systems.

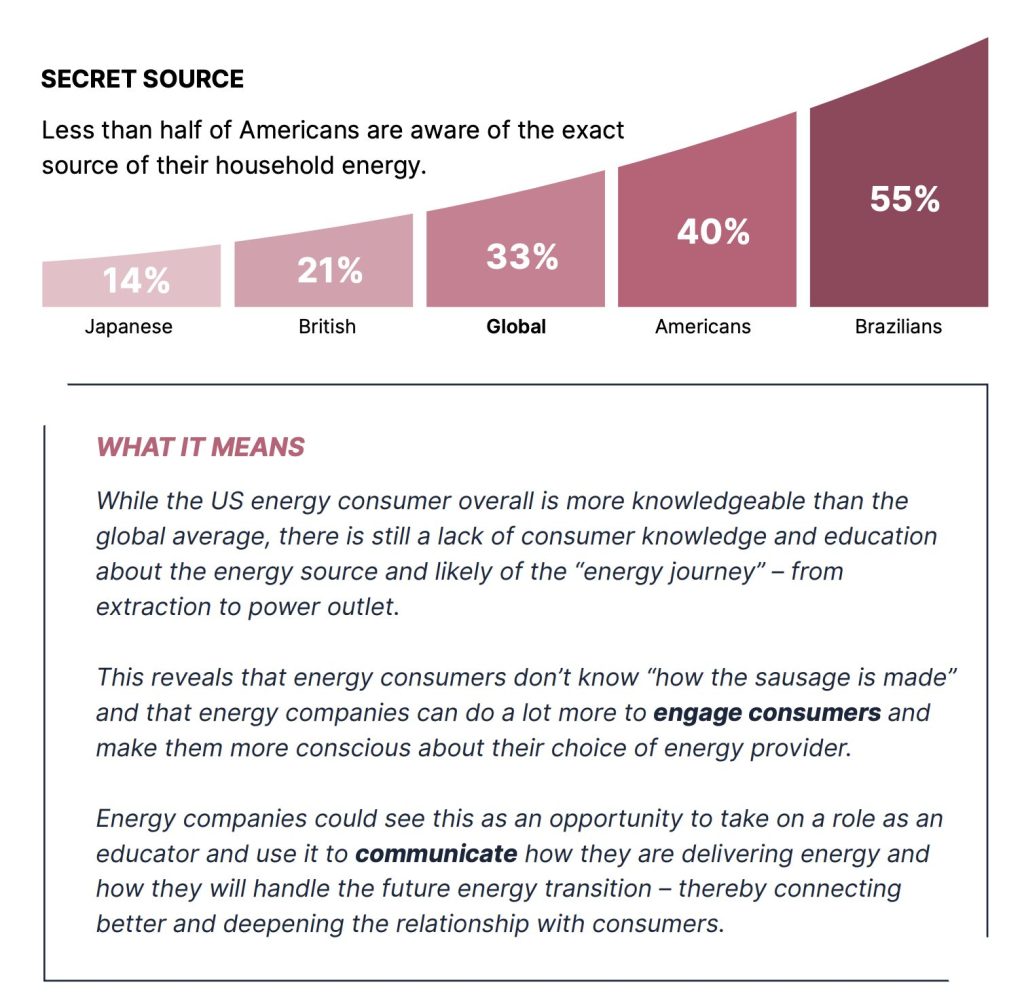

Just 21% of Britons know their exact household energy source — among the lowest globally. This lack of awareness reflects a broader communication gap: energy companies have not yet succeeded in helping consumers understand the energy journey from source to socket.

Inefficient infrastructure and outdated communication practices further contribute to this gap, hindering both consumer understanding and overall operational effectiveness.

Across Europe, household energy prices sharply rose in 2022–2023, with retail gas and electricity tariffs increasing by approximately 50% to 100% in many markets.

Such steep hikes reinforce the perception that brands in the utilities sector are profiting while consumers struggle.

Implication: For UK energy brands, restoring trust means more transparency, education, and empathy. Communicating both progress and purpose — not just profit — is key.

Across the Atlantic, the story is different. The US energy sector’s reputation has improved since 2021. Both Electricity and Oil and Gas industry increased their TLS by four points, rising to 73 and 66, respectively.

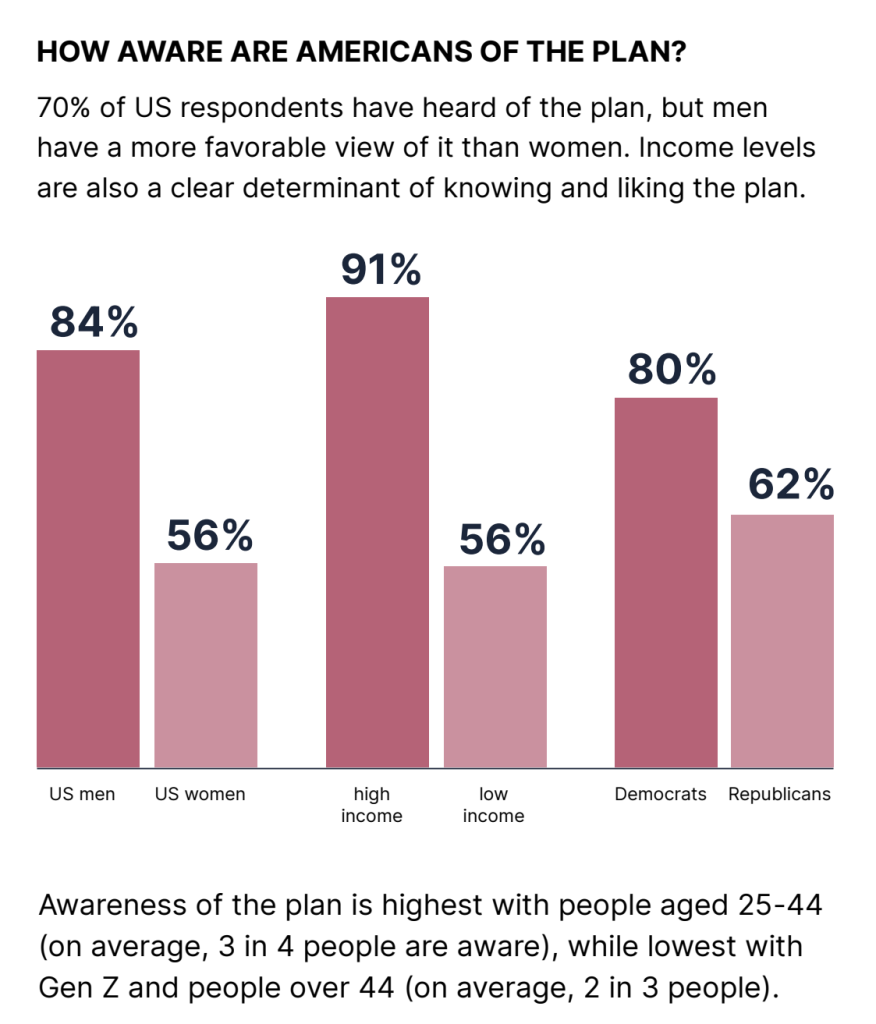

Nearly three-quarters of Americans (73%) support the transition from fossil fuels to renewable energy, including 62% of Republicans and 87% of Democrats. Yet, perceptions of the Biden Administration’s Energy Infrastructure Reinvestment (EIR) program reveal a deep partisan split.

While 88% of Democrats aware of the program support it, only 51% of Republicans do.

Although 70% of Americans have heard of the EIR plan, awareness skews male and higher-income. Only 56% of women and 60% of low-income respondents are aware.

In the U.S., average monthly electricity bills have increased by more than 25% over the past decade in many states. Rising bills magnify scrutiny of how utility companies manage costs and investments.

For energy companies, this underlines a key reputational challenge: stakeholders support the idea of clean energy but remain uncertain about how — or who — will lead it.

Even among supporters, Americans express shared concerns:

There is also awareness of the potential risks and opportunities associated with the energy transition, including potential cyber threats and challenges in integrating new technologies, as well as opportunities for innovation and increased resilience.

Republicans, in particular, cite political bias (41%) and over-ambition (32%) as concerns. Democrats are divided on ambition — 20% say too ambitious, 20% say not ambitious enough.

Only 40% of Americans can name the energy source powering their home. That’s better than the UK but still highlights a major opportunity for improved public understanding.

Implication: US energy companies have a chance to strengthen public trust by engaging proactively in education, depoliticizing the energy debate, and contextualizing transition efforts in practical, human terms.

Addressing these knowledge gaps will require utilities sector to build new capabilities in customer education and technology adoption.

Across regions, one pattern persists: younger generations view the energy sector through a more values-driven lens, while older generations focus on affordability and security.

Caliber’s data shows that only 29% of Zoomers say affordability should be a top priority, compared to 53% of Boomers. Conversely, younger groups place greater emphasis on diversity, equality, and social impact.

Implication: Communication strategies must evolve. The sector’s stakeholders are no longer a monolith. Tailoring messages to reflect generational values — from environmental leadership to economic resilience — is now essential. Meeting these diverse expectations is critical for the long term success of energy companies.

The Top Energy Companies Ranking report reveals which brands are earning the most trust and admiration across key markets. Based on 12,307 ratings across 13 countries, Caliber’s Trust & Like Score measures the strength of a company’s reputation — from integrity and innovation to ESG performance and leadership.

Many of the top-ranked companies are recognized for their innovative projects in renewable infrastructure, grid modernization, and sustainability.

Learn more: How to track ESG Perception Performance

NextEra Energy, the world’s largest utility company by market cap, leads with strong stakeholder recognition for clean energy and innovation. At the opposite end, Halliburton ranks lowest, with a TLS of 56, reflecting public concerns over controversies and environmental legacy.

Top performers include ABO Wind (74), Gelsenwasser (72), Snam (72), and Vestas (71) — a clear sign of trust in companies driving renewable energy leadership.

The lowest-ranked include BP (45) and Shell (49), both facing reputational headwinds from climate scrutiny.

In Asia, State Grid Corporation of China (83) and China Energy (82) lead, while Japan’s Japex (67) and Inpex (66) top local rankings

Brazil’s Cemig (85) and Engie (83) are global frontrunners, reflecting the country’s growing confidence in energy providers balancing performance with sustainability.

Drawing across all markets and demographic data, the energy and utilities industry challenges fall into three broad categories: Overcoming these challenges often requires replacing legacy systems and investing in digital upgrades. Improving efficiency is a central objective for utilities as they modernize operations.

Energy companies remain under intense scrutiny for pricing practices. Cost-of-living concerns dominate public sentiment, especially in Europe. High profits amid high prices have intensified perceptions of unfairness, eroding trust even when performance improves.

Across markets, most consumers cannot name their energy source. This gap in understanding leaves room for skepticism and misinformation. Transparent storytelling about energy generation, investment in renewables, and customer impact can help rebuild credibility.

Introducing new software solutions and digital tools is essential for utilities to improve data collection, management, and customer communication.

In the US, climate policy has become politicized, splitting perception along party lines. Companies that communicate consistently — with clarity and neutrality — can become trusted facilitators of progress rather than targets of blame.

Younger audiences expect corporate activism on climate and equality. Older stakeholders expect reliability and fair pricing. Addressing both without alienating either group is a communications challenge requiring ongoing stakeholder intelligence and real-time perception tracking.

The energy and utilities industry challenges are as much about perception as performance.

While the global reputation of the sector remains steady, the forces shaping it — affordability, politics, generational values, and transparency — are in flux.

Caliber’s data shows that real-time stakeholder insight is not a luxury; it’s a strategic necessity. Companies that listen continuously, engage transparently, and act responsibly can navigate uncertainty with confidence — and build the long-term trust their stakeholders expect.

James is a communications strategist and senior content lead at Caliber, where he writes about corporate reputation, stakeholder intelligence, and brand trust. He draws on more than a decade of experience helping organizations turn data into stories that build credibility and connection.

The top challenges include managing public trust, communicating the clean energy transition, addressing affordability pressures, and bridging generational divides in stakeholder expectations.

Globally, it has remained stable with a Trust & Like Score of 64, but national differences are stark — the UK’s reputation fell, while the US improved.

Globally, NextEra Energy, Cemig, and State Grid Corporation of China hold the highest Trust & Like Scores in Caliber’s 2023 rankings.

By being transparent about impact, communicating progress clearly, educating consumers on energy sources, and listening to real-time stakeholder sentiment to adapt messaging and policy.

The energy industry faces three interconnected problems: trust, transition, and transparency.

Trust erosion.

Many consumers view energy companies as profiting during crises while households struggle with high costs. This perception gap has weakened public confidence, especially in Europe, where nearly half of UK respondents report a worse view of the sector than before the energy crisis.

Uneven transition to clean energy.

While 73% of Americans support renewable energy, opinions diverge sharply across political lines and income groups. Balancing decarbonization with affordability remains a major challenge.

Communication and knowledge gaps.

Only about one in three people globally know the exact energy source powering their home. This lack of understanding leaves room for misinformation and reduces engagement in sustainable behavior.

Together, these issues define a new reputational challenge for the industry: proving that energy companies can deliver affordable, reliable, and clean energy — and communicate that progress clearly to their stakeholders.

The most significant trend is the convergence of reputation, regulation, and real-time data.

Stakeholders expect energy companies not only to provide affordable and reliable energy but also to prove that they are reducing emissions, supporting communities, and acting transparently.

Real-time reputation tracking and stakeholder intelligence — like Caliber’s continuous monitoring platform — now play a central role in helping energy companies understand and manage these expectations.

Read also: Real-Time Stakeholder Perception Tracking — Discover why tracking stakeholder perceptions in real-time helps energy and utilities companies respond to shifting public expectations and maintain trust.

In short, the energy and utilities industry is shifting from a performance-driven model to a perception-driven one, where reputation data directly influences business decisions, policy engagement, and investment confidence.

The energy crisis is the result of multiple structural and situational factors that have compounded over time:

Geopolitical conflicts — such as the war in Ukraine disrupting gas and oil supplies.

Global supply chain instability following the COVID-19 pandemic.

Rising global demand from population growth and industrial recovery.

Underinvestment in renewable infrastructure and grid modernization.

Dependence on fossil fuels with limited diversification of energy sources.

Slow regulatory response and inconsistent national energy policies.

Speculative market behavior affecting oil and gas prices.

Aging infrastructure and inefficiencies in energy transmission.

Extreme weather events linked to climate change, straining supply systems.

Limited consumer awareness and energy efficiency adoption, leading to higher demand pressure.

Together, these causes create a volatile environment where affordability, sustainability, and energy security compete for priority — forcing companies and governments to make difficult trade-offs.

You may also be interested in

Follow Caliber

Get the results of our latest research directly in your inbox!