Do the world’s mining companies have a false sense of security about their reputation?

That’s one of the conclusions of our latest sectoral deepdive – the 2023 Mining, Metals and Minerals Global Reputation Report.

Our new report is based on a survey of almost 40,000 respondents in seven countries – and at first glance, few of its insights will raise eyebrows.

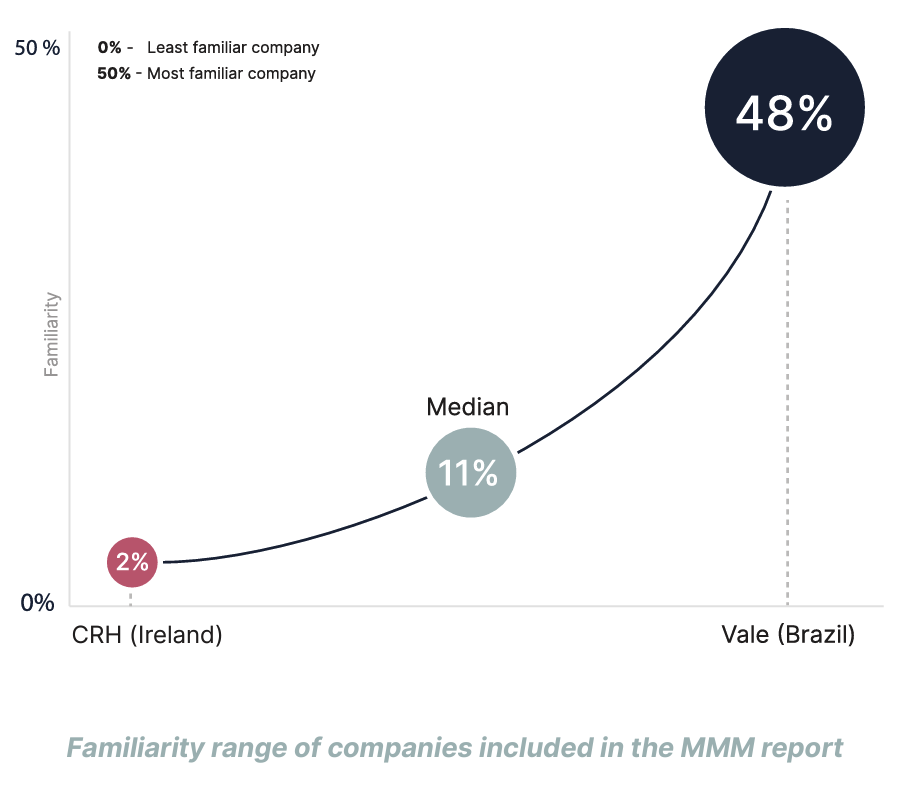

Companies in the mining, metals and minerals (MMM) sector like to keep a low profile – an industry-wide shyness that’s reflected in the very low Familiarity scores they get.

Only 15% of our initial pool of respondents are familiar with at least one company referenced in the report – meaning they have some sort of qualified knowledge about it beyond its name (and were thus permitted to answer our follow-up questions).

Overall, too, the sector has a Trust & Like Score – our chief reputational metric – of 66.

That puts it on a par with the Automotive and Chemicals sectors – and above the Energy, Banking and Telecoms sectors.

MMM’s middling reputation shouldn’t come as a shock, though: extractive industries rarely win prizes for popularity or transparency.

What’s more, MMM companies are perceived most favorably for their offering, ability to innovate and leadership – and less favorably for their impact on the planet, their relatability and how ethically they conduct business. No surprises there, either.

Here’s the thing, though.

Given that MMM companies tend to fly beneath the radar, respondents who are familiar with them are more likely to be industry experts or insiders.

In other words, they know what they’re talking about – making their perceptions particularly germane.

So, while it’s hardly surprising that respondents rate the sector better on Innovation and Offering than on ESG, it’s telling what they pinpoint as serious issues for it to address.

Indeed, our report reveals widespread concern about the sector’s environmental impact.

Equally telling are the respondents’ views on red tape.

According to our survey, most people think the sector needs more regulation, not less.

In fact, almost 60% of respondents are inclined towards more regulation – and only 4% say the sector should definitely be less regulated.

Again, if we assume the respondents are particularly knowledgeable about the industry, their apparent enthusiasm for regulation suggests the sector may be facing a deep pool of reputational risk – and that, to mitigate that danger, self-regulation won’t cut it.

What, then, should we make of the sector’s reputation? Yes, it’s better than some and on a par with others. Yes, perceptions of the sector appear to be improving.

But the status quo may give the sector a false sense of security. If we assume our survey respondents understand the sector’s reputational risks, we can also assume they would be amplified if more people knew about them.

In other words, MMM companies enjoy less visibility and scrutiny. If that were to change, – because of a corporate scandal or environmental disaster – they could face more scrutiny than ever, only without the protection of a robust reputation.

© 2024 Group Caliber | All Rights Reserved | VAT: DK39314320