Nearly a Quarter of Consumers Are Likely to Switch Banks in the Coming Year Amid Declining Public Support for Industry, Shows New Reputation Report from Caliber

Copenhagen, Denmark – June 28, 2023 – Caliber, a global data provider for stakeholder tracking, today announced the release of its 2023 Financial Services Reputation Report.

The report, which provides a global snapshot of how financial institutions are perceived, surveyed over 10,000 consumer respondents globally between January and May. This year’s report compares results to the company’s survey from 2021.

Caliber’s report reveals that public support for the financial services sector has declined since 2021:

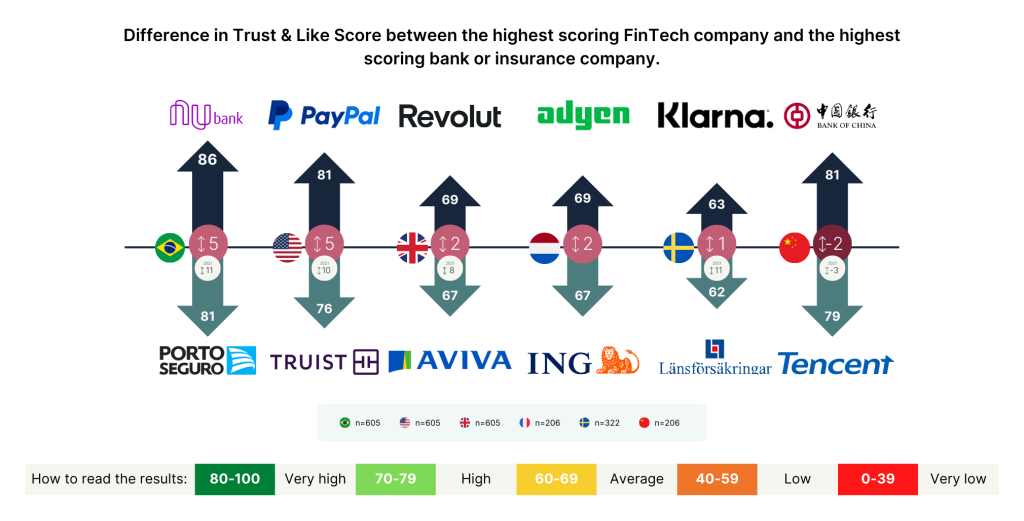

Trust & Like Score is at the core of a proprietary measurement system used by Caliber to show the strength of a company’s brand and reputation.

The system combines several attributes related to brand, reputation, ESG and behavior, as well as information on demographics, professional background and the touchpoints through which stakeholders interact with companies, summarized by a score on a 0 to 100 scale. Scores above 80 are considered “Very High”.

“Taken together, these numbers ought to concern the financial services sector. People tend to stay with their bank for a long time, so while traditional banks remain a safe harbor for customers in the current macroeconomic climate, they shouldn’t take that for granted.

The data clearly shows that the fintech sector is quickly growing in popularity, especially in the U.S., and customers are increasingly willing to explore alternatives to traditional financial services. Banks, insurance companies and other financial services providers around the world must heed this trend.Shahar Silbershatz, CEO & Founder of Caliber Tweet

The report revealed that consumers are increasingly more focused on emerging brands – including new entrants in the fintech sector. People continue to view the fintech sector as more trustworthy than the banking sector – though that gap has narrowed since 2021.

Based on Trust & Like Score, in the U.S., the gap between the most reputable bank and the most reputable fintech company narrowed from 10 points in 2021 to five in 2023.

The report also reveals that while the traditional banking sector is more widely known, it has more negative perceptions than fintech. 15% of respondents said the banking industry triggered “negative associations”, compared to just 2% who said the same of fintech.

This, and the more tailored service offered by fintech companies, have affected consumer perceptions and behaviors, particularly among Millennials and Gen Z. According to the report:

Based on the insights gained from monitoring and analyzing the data, formulate appropriate, concrete actions to address stakeholder concerns and improve perceptions.

Communicate the results of these actions and initiatives to stakeholders transparently, as proof points of delivering on the corporate strategy and intent.

Sharing progress and outcomes reinforces the organization’s commitment to stakeholder engagement, builds trust, and enhances the credibility of corporate affairs and communication departments.

Finally, Caliber’s data reveals what drives consumers when choosing a financial services provider. In particular, the report shows that:

“The reputation of the financial services industry is largely upheld by perceptions of its services and business conduct, while it struggles with creating interest and connecting with the public on its relevance for society and its values and purpose beyond business services,” said Silbershatz. “To address the risk of customer churn, financial institutions must prioritize customer-centric practices and social responsibility.”

To view the full global report findings, click here. For a report on U.S. findings, click here. The Global Top 101 brands list can be found here.

© 2024 Group Caliber | All Rights Reserved | VAT: DK39314320