On the surface, the reputation of banking hasn’t changed since our last report on the global financial services sector.

We surveyed over 10,000 people worldwide, including more than 1,300 Americans — and the banking sector today is just as trusted and liked as it was in 2021.

Indeed — not least because the survey took place between January and May 2023 — a time of ongoing economic turmoil, from soaring inflation to the collapse of three US banks, including most notably Silicon Valley Bank.

Possibly. To curb inflation, the Fed has raised the base rate 10 times since March 2022. Which means higher borrowing costs for consumers, making it more expensive to buy a house, say, or finance a business.

Rate rises are good news for savers, who can shop around for a new savings account. And right now, many of the most attractive high-yield savings accounts are being offered not by big institutions but by online banks — including fintech companies. Speaking of which…

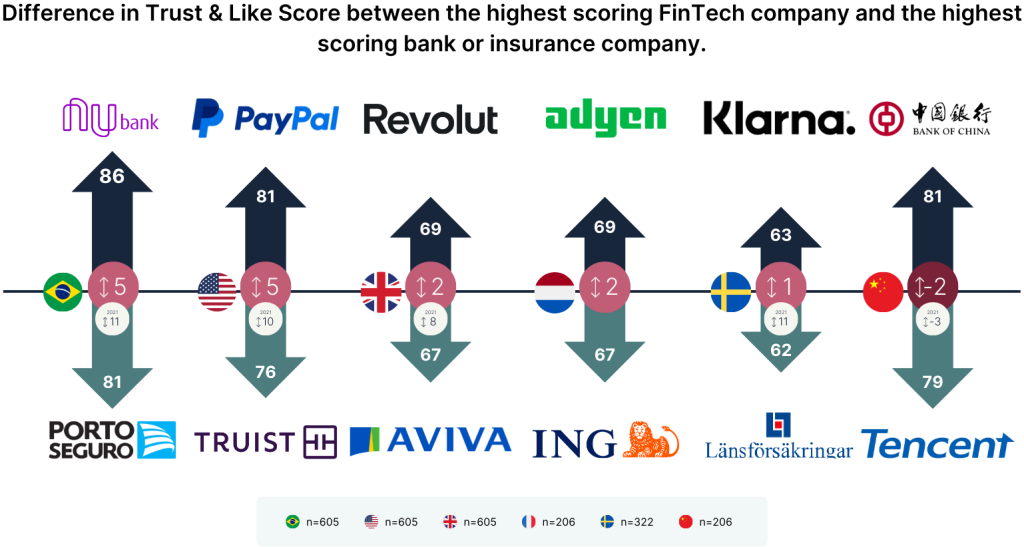

According to our report, fintech is (still) viewed as more trustworthy than traditional financial institutions, though the gap has narrowed since the 2021 report.

Because traditional banks have more “baggage”: 15% of respondents said the banking industry triggered “negative associations” — such as high fees, complexity, dishonesty, and greed — compared to 2% who said the same of fintech — which may be perceived as more innovative, exciting, and in touch with what customers want.

Both globally and in the US, people say easy digital access to their finances — via a smartphone, say — is the primary factor when using financial services. Also key? Good customer service and communication with their service provider.

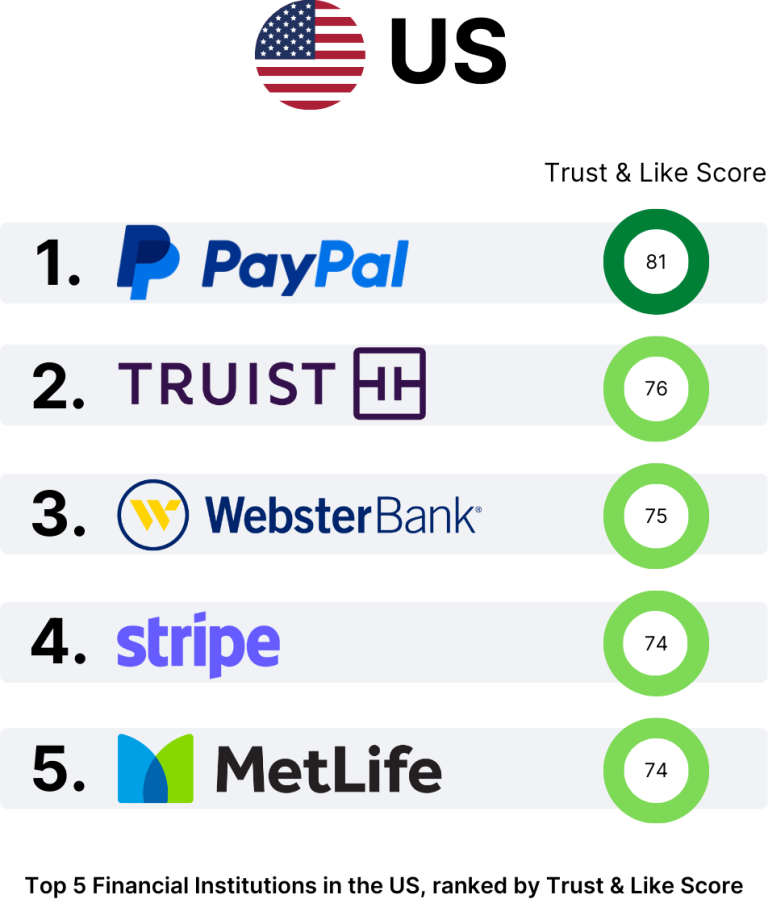

Pretty much. PayPal is the most trusted and liked financial institution in the US — followed by Truist Bank, Webster Bank, Stripe and MetLife. PayPal, Stripe, Square and Robinhood are all among the world’s 10 most liked and trusted fintech companies.

With its tailored services and products, fintech seems to appeal most to Millennials and Gen Z. Younger generations are much more likely to use fintech products and services than older ones. More than a third of 18- to 24-year-olds prefer fintech/paytech alternatives for online payments and money transfers.

The banking sector is also struggling to attract eyeballs. Globally, the percentage of people familiar with the sector’s largest institutions fell 12 points to 55% in 2023.

The percentage of those familiar with the largest institutions who don’t engage with them rose 5 points to 37%. And compared to 2021, fewer say they’re likely to advocate for, consider, recommend or work in the sector.

Traditional institutions have narrowed the gap on fintech, reputation-wise. Why? Perhaps because people are more likely to stick with – and trust — what they know when the going gets tough.

In a gloomy economy, traditional banks may still be seen as something of a safe harbor — a perception borne out, perhaps, by the Fed’s recent stress tests.

Since 2021, plenty of flashy fintech companies have gone bust, which may have dented the reputation of the fintech sector per se.

Younger people’s spending power is only increasing. That’s good news for flashy new entrants, less so for traditional banks, who should act now to stay competitive.

Simply offering better products for a start — like easy-to-use digital tools and good customer service. According to our report, people also want the financial services sector to look out for its customers more — such as by reducing bank charges and being more transparent.

People also say they want financial institutions to make more positive contributions to their community and society — such as by increasing access to financial services and investing more responsibly. Overall, too, banks should look to make themselves more interesting and relatable to the customers they want to attract.

– and an example of how to win new customers. Singaporean bank UOB recently saw a 45% increase in credit-card applications across Southeast Asia when it offered cardholders exclusive access to … Taylor Swift tickets.

© 2024 Group Caliber | All Rights Reserved | VAT: DK39314320