Mining companies are the bedrock of the global economy.

They produce the raw materials required by numerous industries, from electronics to energy, aerospace to automobiles.

But, as our recent report on the mining, metals and minerals (MMM) sector reveals, it has its work cut out – reputationally.

Overall, the sector received a Trust & Like Score – our chief reputational metric – of 66.

A company’s Trust & Like Score is based on the degree to which survey respondents say they trust and like that company.

The sectoral score is therefore the average of all surveyed companies.

The mining sector’s overall score of 66 officially ranks as Average – and it’s hardly surprising. After all, extractive industries rarely win prizes for popularity or transparency.

What’s more, our survey respondents pinpointed serious issues for mining companies to address – like the reduction of carbon emissions and of harm to people and the planet.

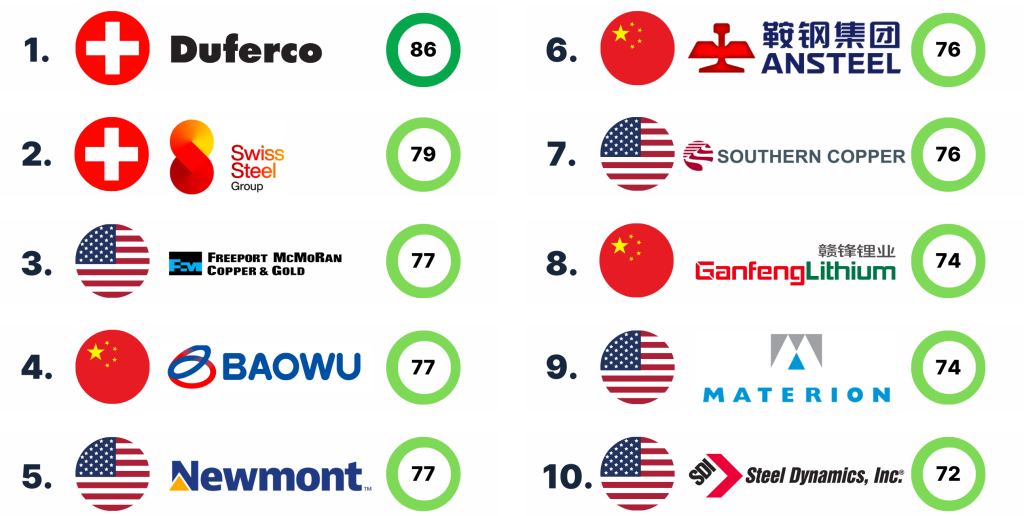

Many of the mining companies referenced in our recent sector report received individual Trust & Like Scores well above 66 – and many got scores well below average, of course.

One thing that unites many of these industry powerhouses is their longevity. Many of the mining companies with a high Trust & Like Score were founded decades ago, indicating a long history and legacy.

Many also play a significant role in their base country’s economy as taxpayers and employers.

By contrast, what unites many of the mining companies with lower Trust & Like Scores are fragmented operations and/or “house of brands” set-ups, both of which help make the umbrella brand less visible domestically.

Of course, some also have less-than-stellar environmental records, too.

Below we take a look at which of the world’s biggest mining companies topped this year’s list. Together they’re helping shape the future of the world’s mining and metals industry.

What also unites many of these industry powerhouses is their apparent commitment to more sustainable industry – including responsible sourcing and community engagement.

Overview: Founded in 1979 by Italian entrepreneur Bruno Bolfo, Duferco is the world’s leading steel trader with a “hybrid” business model that includes distribution and production activities in over 40 countries. The company remains under the leadership of Bolfo and his family and celebrated its 40th anniversary in 2019 by gathering all of its worldwide employees.

Footprint: Though its HQ is in Luxembourg, Duferco has a significant corporate presence in Switzerland, where we fielded questions about the company this year.

Going green: Duferco focuses on “sustainability and safety”. According to its website, the company has since 2018 “embarked on a progressively detailed reporting process, giving more and more prominence to its environmental, social and governance (ESG) performances.” It’s also part of a $141m agreement to produce “green” aluminum in Bosnia.

Trust & Like Score: 86 (Switzerland)

Overview: Swiss Steel Group specializes in special long steel products. In particular, it’s one of the leading global manufacturers of tool steel and non-corrosive long steel and one of the largest companies in Europe for alloyed and high-alloyed constructional steel.

Footprint: Based in Emmenbrücke, Switzerland, the group boasts a significant international presence. It has close to 10,000 employees and in-house production and distribution companies in more than 30 countries.

Green steel: The company processes 2 million tons of steel scrap every tar, which it says has helped it “reduce the carbon footprint of our products to well below the industry average.” This year, the company won a German Sustainability Award, one of the most prestigious awards of its kind. “For us, sustainability is not only a strategic corporate goal but also a social responsibility towards future generations,” said CEO Frank Koch.

Trust & Like Score: 79 (Switzerland)

Overview: Founded in 1912, Freeport is a top mining company with international operations and proven and probable reserves of copper, gold and molybdenum.

Footprint: With headquarters in Phoenix, Arizona, its portfolio includes significant mining operations in both North and South America, as well as one of the world’s largest copper and gold deposits in Indonesia.

People power: A titan of the US mining industry, Freeport says, “the safety and health of all employees is our highest priority” and that “our greatest strength is our people”. As part of its efforts to be a responsible mining company, it also has a sustainability strategy to build “a more sustainable future for our business and stakeholders”.

In September, Freeport published its annual climate report, which outlined its progress in advancing “its climate strategy focused on reducing greenhouse gas emissions, enhancing its resilience to climate risks and contributing responsibly produced copper to the global economy.”

Trust & Like Score: 77 (United States)

Three Chinese companies make the top 10 mining companies by reputation: two steel manufacturers – Baowu and Ansteel – and Ganfeng Lithium, a major lithium mining company.

The other four companies are all American. They include the world’s largest gold mining company, Newmont, and Southern Copper.

National psychology and cultural norms may explain the composition of our ranking. In some countries (such as China), respondents may consider it rude to give companies low Trust & Like Scores, while in others (such as Japan), respondents may see very high scores as less credible.

Generally, too, there is greater scrutiny of business in northern European countries, resulting in lower scores, and less scrutiny in others (such as Brazil) where large companies are often viewed as more reliable than public authorities, resulting in higher scores.

Overview: As a result of several mergers, the company commonly known as Baowu is now the world’s largest steel enterprise – and entirely owned by the Chinese state.

Footprint: Baowu’s headquarters are in the Baosteel Tower, in Shanghai. The company produced 132 million tons of steel in 2022 and employs over 220,000 people worldwide.

Mission critical: Baowu’s stated goal is “jointly building industrial ecosphere to promote the progress of human civilization”.

To that end, in 2021, it unveiled a global alliance to cut greenhouse gas emissions in China. The aim of the Global Low-Carbon Metallurgical Innovation Alliance is to tackle climate change and cut emissions in the world’s biggest steel producer.

According to media reports, “the alliance hopes to advance technological cooperation and promote engineering and industrialization of low-carbon technique”.

Trust & Like Score: 77 (China)

Overview: Founded in 1916, Newmont is now the world’s largest gold mining company – and it also produces copper, silver, zinc and lead.

Footprint: Headquartered in Denver, Colorado, the company boasts extensive mining operations across North America, South America, Australia and Africa.

Gold standard: According to Newmont, “the protection of the health and wellbeing of our people, environmental stewardship and being a catalyst for sustainable economic empowerment in our host communities are not just the right things to do, they’re good for our business.

”The company has also been recognized for its corporate transparency, responsibility and active promotion of qualified women in mining. In May 2023, it completed the industry’s biggest deal to date, snapping up its Aussie rival Newcrest for $19.2 billion.

Trust & Like Score: 77 (United States)

Overview: Formed in 1997 through a merger of Pangang Group and Anshan Iron and Steel, Ansteel is known as the “cradle of China’s steel industry” and remains one of the country’s largest state-owned steel producers.

Footprint: Headquartered in Liaoning province, Ansteel sells products in over 70 countries and regions. Customers include ThyssenKrupp, Volkswagen and BMW, and its steel was used to build many iconic structures, including the Qinghai-Tibet Railway and the Hong Kong-Zhuhai-Macao Bridge.

Man of steel: One of the company’s most legendary employees was Meng Tai – a steelworker at the old Anshan plant. Meng was named a “National Model Worker” in 1950 and twice a “National Advanced Producer” in subsequent years. His exploits and accolades have since inspired books and feature films in China.

Despite its celebrated past, Ansteel has its eyes firmly on the future. In 2019, the company reported a breakthrough in the production of an ultra-high-strength and low weight steel for automobiles, designed to save energy and cut emissions.

Trust & Like Score: 76 (China)

Overview: Founded in 1952, Southern Copper emerged from the 2005 acquisition of Southern Peru Copper by Mexican copper producer Minera México. It is one of the world’s largest integrated copper producers and has the largest copper reserves of the industry.

Footprint: Headquartered in Phoenix, Arizona, Southern Copper operates copper mining units and metallurgical facilities in Mexico and Peru and conducts exploration activities in Argentina, Chile, Ecuador, Mexico and Peru.

Community spirit: As part of its sustainable development policy, Southern Copper has made investments aimed at making it “an engine of positive change for the economies in which we operate” and strives to be “good neighbors to improve the quality of life of our people and that of the communities where we operate”.

A case in point? In Peru, where Southern Copper’s the third-largest copper producer, protests over environmental fears at its Tia Maria site have reportedly cooled this year. “There has been a lot of progress with the project,” a company executive told Reuters. “The animosity has subsided a lot.”

Trust & Like Score: 76 (United States)

Overview: Founded in 2000, Ganfeng Lithium is one of the world’s leading lithium companies, with operations ranging from upstream “lithium resource development” to downstream “lithium battery manufacturing and battery recycling”.

Footprint: Headquartered in China’s Jiangxi Province, Ganfeng has operations in Australia, Argentina and Mexico. With lithium an increasingly hot commodity amid the global shift to renewables, ithas also been acquiring stakes in lithium mines and salt lakes abroad.

Supermarket sweep: With Ganfeng’s products used in EVs, energy storage systems, electronics and chemicals, it’s been dubbed a “lithium supermarket” for its range of offerings.

In May 2023, it invested in Australia’s Leo Lithium to expedite a project in Mali, and the following month a salt lake project in Argentina became operational after a three-year delay.

Trust & Like Score: 74 (China)

Overview: Founded in 1931, Materion is an advanced materials supplier. Translation? It makes products we come in contact with every day – like the metal alloys that keep the electrical connectors connected on commercial airplanes or materials used in the semiconductors of our smartphones.

Footprint: Materion is based in Cleveland, Ohio, but has 36 worldwide locations and over 3,600 employees. Its products and services reach more than 60 countries.

Space invader: Materion’s beryllium is used in the hi-tech mirrors of NASA’s newest space telescope, which will allow astronomers and scientists to see billions of light years from Earth.

In October, the company said it had also been awarded a US$5 million contract from the United States Air Force Research Laboratory to expand its ongoing research and development of 3D printing, for beryllium and aluminum-beryllium alloys.

Trust & Like Score: 74 (United States)

Overview: Founded in 1993, Steel Dynamics is a major American steel producer and metal recycler. It’s engaged in the entire steel manufacturing process, from raw materials to diverse steel products.

Footprint: Headquartered in Fort Wayne, Indiana, Steel Dynamics has a steelmaking and coating capacity of about 13 million tons, and facilities throughout the US and in Mexico.

Circular thinking: As part of its drive to make its operations carbon neutral by 2050, Steel Dynamics operates “using a circular manufacturing model, producing lower-carbon-emission, quality steel”.

Its commitment to sustainability also includes a dedicated focus on its relationships with employees, stakeholders and the environment. In September, it reached an agreement with Mercedes-Benz to supply the automaker with 50,000 metric tons of carbon-reduced steel each year.

Trust & Like Score: 72 (United States)

Metals, materials and mining companies tend to keep a low profile – an industry-wide shyness that’s reflected in the very low Familiarity scores they get in our sector report.

But that means the survey respondents who were able to answer additional questions about the mining companies referenced in our report are more likely to be industry experts or insiders. In other words, they know what they’re talking about – making their perceptions particularly germane.

What’s especially revealing is that they pinpointed emissions reduction and harm to people and the planet as serious issues for the sector to address.

As many of the mining companies in our top 10 are taking steps to address these issues, it’s clear what other companies need to do to improve their reputation among stakeholders.

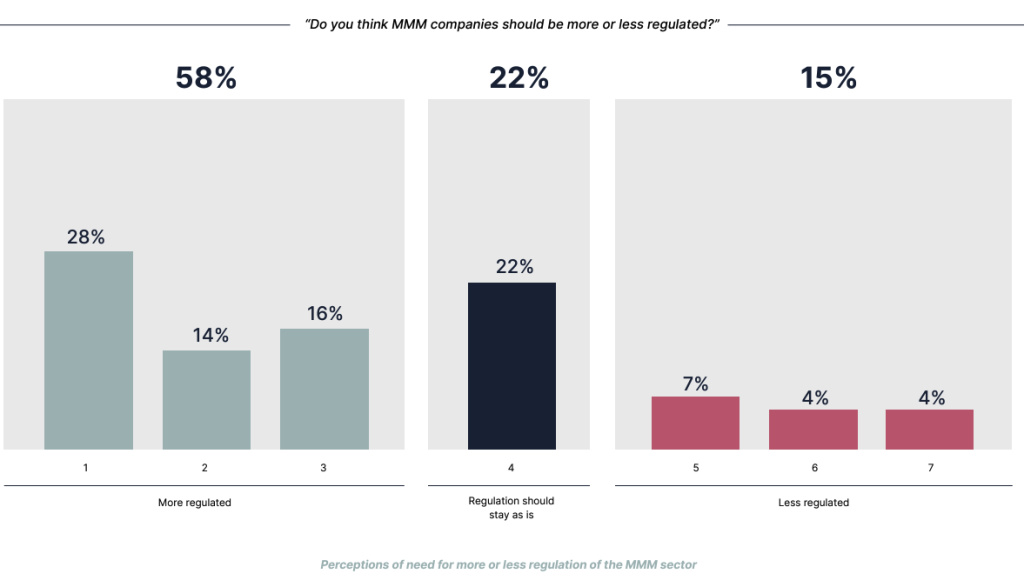

Equally telling are our respondents’ views on red tape. According to our survey, most people think the sector needs more regulation, not less.

Again, if we assume the respondents are particularly knowledgeable about the industry, their apparent enthusiasm for additional regulation suggests the sector may be facing a deep pool of reputational risk – and that, to mitigate that danger, self-regulation won’t cut it.

Likewise, if we assume respondents understand the reputational risks facing mining companies, we can also assume the risks would be bigger if more people knew about them.

In other words, by flying under the radar, many mining companies enjoy less visibility and less scrutiny. If that were to change – in the wake of an environmental scandal, say – some mining companies could come under the microscope like never before. For many, the problem is simple: they won’t have the protection of a robust reputation to fall back on.

As ever, the solution for the world’s biggest mining companies is to be better prepared. That means taking a more proactive approach to managing their story and using the right tools to monitor their stakeholder universe.

It also means striving to be as open and honest – and as authentic and relatable – as possible to build up the best reputational bulwark: trust.

Download the full mining sector reputation report. Or, to learn more about how we can help your company understand its stakeholders better and become more trusted, drop us a line.

© 2024 Group Caliber | All Rights Reserved | VAT: DK39314320