Health innovation is moving faster than ever, and with it comes greater public scrutiny. Trust in the pharmaceutical industry is now as critical as the medicines it produces.

Size and revenue may dominate headlines, but evidence shows that being big doesn’t always mean being trusted.

In this article, we’ll explore:

Pharma companies plays a critical role in global healthcare. They develop life-saving medicines and breakthrough treatments that improve the lives of millions worldwide.

The top players are driving advancements that range from vaccines that prevent deadly diseases to therapies for managing chronic conditions.

This constant innovation strengthens not only individual health outcomes but also the broader healthcare system. It helps societies manage both current and emerging health threats.

Beyond healthcare, the pharma industry is a major economic force. It creates jobs, fuels growth through large-scale R&D investments, and pushes forward technologies that also benefit biotech and medical device industries. With global operations across multiple markets, these companies also foster international collaboration and contribute to economic stability.

This analysis draws on insights from Caliber’s 2024 Global Reputation Report, along with official industry data.

When people refer to the “top pharmaceutical companies,” they usually mean those with the highest annual revenues — companies that lead the global market in terms of sales, R&D investments, and global reach. These firms are often referred to as Big Pharma and represent major players in therapeutic areas ranging from oncology to vaccines.

According to CompaniesMarketCap.com, the leading pharma companies in 2024 have reported revenues ranging from $35 billion to over $370 billion — driven by high-demand therapies in oncology, immunology, vaccines, and metabolic diseases.

Pharmaceutical sales remain one of the clearest indicators of industry performance — reflecting not only product innovation but also the ability to expand into new markets. Group sales figures further underline the scale of these companies and their outsized role in shaping global healthcare.

Top 10 biggest Pharmaceutical Companies in the World by Revenue, according to Companies Market Cap data in (Last updated in December, 2025)

Rank | Company | Revenue |

|---|---|---|

1 | CSV Health | $394.08 B |

2 | Johnson & Johnson | $92.14 B |

3 | Sinopharm | $80.09 B |

4 | Roche | $69.07 B |

5 | Merck | $64.23 B |

6 | Pfizer | $62.78 B |

7 | AbbVie | $59.64 B |

8 | Eli Lilly | $59.41 B |

9 | Astra Zeneca | $58.12 B |

10 | Novartis | $56.37 B |

The United States continues to dominate the global pharmaceutical market, home to industry giants such as Pfizer, Johnson & Johnson, and Merck & Co.

Switzerland and Germany also hold strong positions through companies like Roche, Novartis, and Bayer, while the UK contributes major players such as GSK and AstraZeneca.

Meanwhile, Denmark punches above its weight thanks to Novo Nordisk — the company behind the blockbuster weight-loss drug Wegovy. Although Novo Nordisk didn’t meet the global familiarity threshold to appear in Caliber’s overall Trust & Like Score ranking, it was the top-ranked pharmaceutical company in Denmark by public perception, scoring particularly high on Innovation and Inspiration.

Read also: 9 of the biggest reputational risks and how to mitigate them

Caliber’s 2024 Global Reputation Report tells a different story — one centered not on revenue, but reputation.

Using its proprietary Trust & Like Score (TLS), Caliber measured public perception across 13 countries and found that some of the world’s biggest pharmaceutical companies are not always the most trusted.

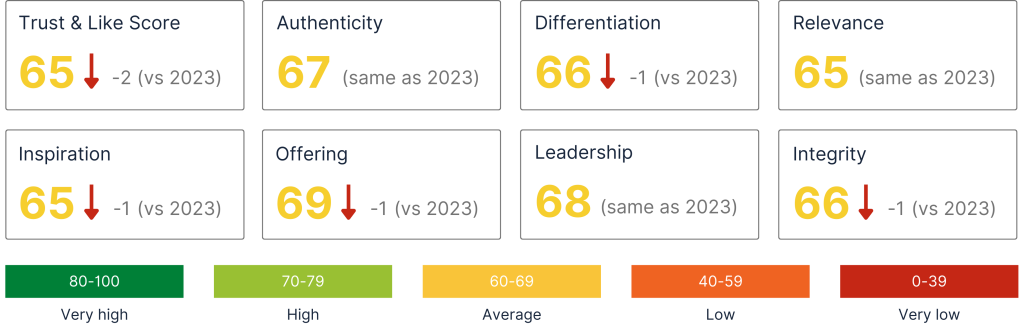

Caliber’s 2024 Global Reputation Report shows, that the world’s top pharmaceutical companies don’t necessarily enjoy strong reputations. The sector’s overall Trust & Like Score — our core measure of public perception — stands at 65.

Of the 16 sectors Caliber tracks, pharma ranks near the bottom, on par with telecoms and just ahead of the energy sector.

(Note: The Trust & Like Score reflects the average level of trust and affection respondents express toward a company. Sector scores represent the average across all companies in that sector.)

The sector’s reputation also declined from 2023, with notable drops in several key attributes — Differentiation, Inspiration, Offering, and Integrity.

As shown in the report, these scores fell compared with last year, while Authenticity, Relevance, and Leadership remained steady.

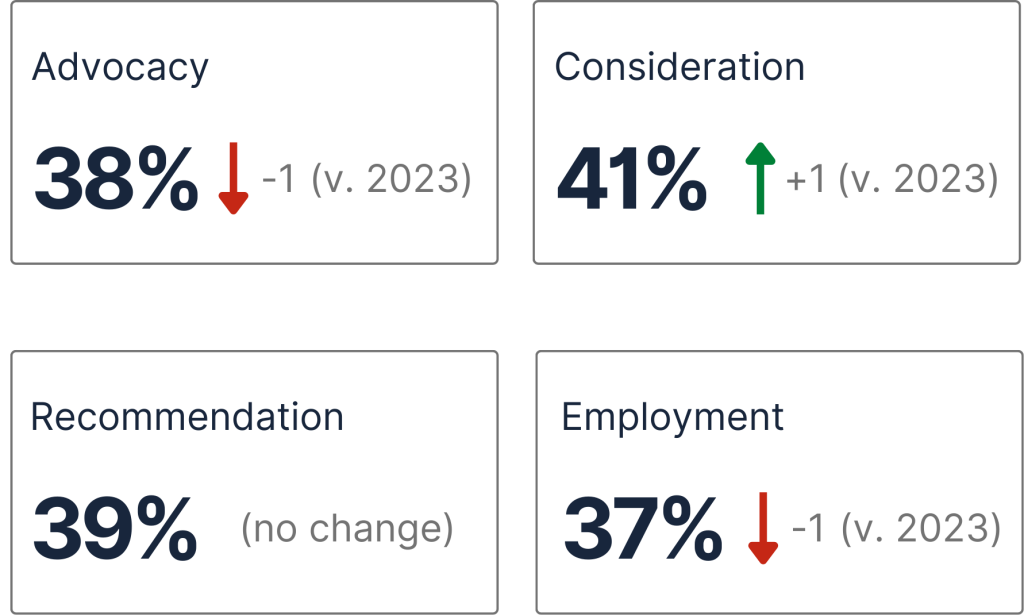

Stakeholder behavior followed a similar pattern.

Respondents were slightly less likely to speak positively about the industry (Advocacy) or consider working in it, though interest in buying products or services from pharma companies ticked slightly upward.

There is some good news. Innovation remains pharma’s strongest reputational attribute — and the only one rated “High” rather than “Average.” That fits the nature of the sector: pushing scientific boundaries and developing life-changing medicines.

In 2024, the industry’s reputation for innovation was reinforced by the rapid growth of diabetes and obesity drugs, along with promising developments in Alzheimer’s and cervical cancer treatments.

The timeline below shows how the average Trust & Like Score (TLS) for companies in Caliber’s pharmaceutical index evolved over the last 12 months.

The sector’s reputation proved volatile, dropping to a TLS of 60 in January 2024 before climbing back to 74 just weeks later. In the final quarter, however, the score fell sharply again, signaling a loss of stakeholder trust — possibly in response to external developments.

While it’s difficult to pinpoint exact causes, shifts in public perception likely corresponded with major media coverage and industry headlines shown below.

Caliber’s ranking of the world’s leading pharma companies is based on their Trust & Like Scores (TLS) — our core measure of public perception.

Research shows that stakeholder behavior closely correlates with how much people trust and like a company. For that reason, the TLS is central to how Caliber measures brand and reputation strength.

To understand what drives these perceptions, Caliber also examines related attributes across Brand, Reputation, Behavior, and ESG, alongside data on demographics, professional background, and the touchpoints where stakeholders interact with companies.

For the 2024 Global Reputation Report, Caliber surveyed respondents in 13 countries, asking them to rate 34 pharmaceutical companies with a global market capitalization of at least USD 25 billion at the end of 2023.

Before rating, respondents were screened for awareness and familiarity. They first selected companies they recognized from a series of logos, then rated their familiarity on a 1–7 scale, where 1 = not at all familiar and 7 = very familiar.

Only those scoring 4 or higher were invited to rate each company’s reputation. This ensured that feedback came from people who knew the companies well enough to give informed opinions.

As a result, only eight companies met Caliber’s 15% global familiarity threshold. Low familiarity is typical in B2B sectors like pharmaceuticals, where product brands are often more visible than the corporate names behind them.

Some well-known players still fell below this threshold, including Novo Nordisk (14%), BioNTech (12%), Sanofi (10%), Eli Lilly (9%), Takeda Pharma (8%), Merck & Co., Merck KGaA, and Boehringer Ingelheim (all 7%).

Although these companies are less familiar to the general public, they remain well known among industry insiders — such as healthcare professionals, analysts, payers, and employees — which can still translate into high Trust & Like Scores within those groups.

Rank | Company | Trust & Like Score |

|---|---|---|

1 | Roche | 66 |

2 | Novartis | 64 |

3 | GSK | 64 |

4 | Bayer | 64 |

5 | Johnson & Johnson | 63 |

6 | Pfizer | 57 |

7 | Moderna | 56 |

8 | Astra Zeneca | 52 |

Headquarters: Basel, Switzerland

CEO: Thomas Schinecker

Trust & Like Score: 66

Roche tops the global reputation ranking for pharma companies. Its leadership stems from pioneering work in oncology, immunology, and diagnostics, with blockbuster drugs such as Herceptin and Avastin.

The company continues to lead in personalized healthcare, developing targeted therapies and diagnostics that improve patient outcomes. Roche invests billions annually in R&D to advance its drug pipeline.

During the COVID-19 pandemic, Roche’s diagnostics division played a pivotal role by delivering accurate testing worldwide. The company is now expanding into inflammatory bowel and cardiometabolic diseases, while also strengthening its neurology and immunology portfolio with treatments such as Ocrevus and Hemlibra.

Headquarters: Basel, Switzerland

CEO: Vasant Narasimhan

TLS: 64

Novartis, ranks second globally by reputation. Known for its diverse product portfolio spanning oncology, immunology, neuroscience, and ophthalmology, the company’s breakthrough therapy Kymriah became the first FDA-approved CAR-T cell cancer treatment.

Novartis combines innovation with accessibility, expanding patient access to advanced therapies and integrating digital health technologies into drug development. Its strong ESG performance and pipeline of late-stage assets position it for long-term growth.

Headquarters: Brentford, United Kingdom

CEO: Emma Walmsley

TLS: 64

GSK is a global leader in vaccines, respiratory medicines, and HIV treatments. Its shingles vaccine Shingrix is one of the most successful in recent years.

The company is investing heavily in oncology and immunology R&D, with a pipeline that includes new cancer and respiratory therapies. GSK also prioritizes global health, focusing on diseases affecting lower-income countries.

Following its demerger that created Haleon, GSK has sharpened its focus on biopharma innovation and long-term growth.

Headquarters: Leverkusen, Germany

CEO: Bill Anderson

TLS: 64

Bayer remains a major force in pharmaceuticals and life sciences, with key products like Xarelto (anticoagulant) and Eylea (macular degeneration treatment).

Alongside pharma, Bayer maintains strong consumer health and agriculture divisions, making it one of the most diversified healthcare companies worldwide.

Recent financial results show growth across core segments, supported by ongoing R&D investment and a commitment to sustainability and unmet medical needs.

Headquarters: New Brunswick, New Jersey, USA

CEO: Joaquin Duato

TLS 63

Johnson & Johnson — one of the world’s most diversified healthcare companies — leads in oncology, immunology, neuroscience, and infectious diseases through its Janssen division.

The company’s COVID-19 vaccine contributed significantly to global immunization efforts. Beyond pharmaceuticals, J&J maintains strong medical device and consumer health businesses.

With continued investment in R&D and strategic acquisitions, Johnson & Johnson is reinforcing its leadership position and expanding its innovation pipeline.

Headquarters: New York City, New York, USA

CEO: Albert Bourla

TLS: 57

Pfizer is one of the world’s most recognized pharmaceutical companies, known for its extensive portfolio of vaccines and treatments.

The company gained worldwide recognition for developing one of the first COVID-19 vaccines in partnership with BioNTech, driving record revenue growth.

Beyond COVID-19, Pfizer remains a leader in oncology, immunology, and cardiovascular health. A robust pipeline and recent acquisitions strengthen its research capabilities and long-term prospects.

Headquarters: Cambridge, Massachusetts, USA

CEO: Stéphane Bancel

TLS: 56

Moderna’s success with its mRNA-based COVID-19 vaccine propelled it to global prominence. The company’s innovative mRNA platform now underpins a pipeline targeting infectious diseases, cancer, and rare disorders.

Ongoing R&D efforts highlight Moderna’s ambition to revolutionize medicine through mRNA technology, which proved transformative during the pandemic.

Headquarters: Cambridge, United Kingdom

CEO: Pascal Soriot

TLS: 52

AstraZeneca is a global leader across oncology, cardiovascular, respiratory, and immunology treatments. The company gained global recognition for developing its COVID-19 vaccine with the University of Oxford.

AstraZeneca continues to invest in antibody-drug conjugates and inflammation research, with multiple phase III trials supporting a strong long-term growth outlook. Its commitment to innovation keeps it among the industry’s most respected players.

Several companies consistently rank among the top three by Trust & Like Score (TLS) across multiple countries:

Many companies also perform strongly in their home markets.

Across markets, the three standout reputation attributes among top-ranked companies are Inspiration, Offering, and Innovation.

Caliber’s data reveals a widening gap between commercial success and public trust in the pharmaceutical sector.

The past year marked a turning point for the pharmaceutical industry, driven by blockbuster weight-loss drugs such as Wegovy and Zepbound. These treatments have captured global attention — promising to transform lives and reshape how society defines health and wellness.

Yet the narrative is far from simple. Alongside optimism, there’s growing debate about their broader effects on industries like fitness and food, where shifting demand could disrupt long-standing business models.

The rise of weight-loss drugs has also reignited conversations about body positivity and the ethics of promoting pharmaceutical solutions for weight management. Meanwhile, high prices and limited supply have put pressure on healthcare systems and patients, raising questions about access and equity.

Production challenges add another layer: the focus on these new treatments has contributed to reduced output of essential medicines such as insulin — underscoring the need for balanced innovation that supports equitable healthcare for all.

From a reputation perspective, the dynamic is particularly striking. The two companies without products on the market — Pfizer and AstraZeneca — are already widely associated with weight-loss drugs, while the two leading manufacturers — Novo Nordisk and Eli Lilly — are attracting surprisingly less public attention.

Typically, latecomers can learn from early entrants’ reputational lessons. But in this case, Pfizer and AstraZeneca are already part of the conversation — whether they want to be or not. They may need to help shape the sector’s narrative sooner rather than later.

Caliber’s data shows that public opinion on weight-loss drugs is divided:

Surprisingly, Pfizer and AstraZeneca — neither of which currently have approved obesity treatments — are more strongly associated with weight-loss drugs than Eli Lilly and Novo Nordisk, the two market leaders.

The rapid rise of GLP-1 drugs has sparked important ethical debates, including:

The takeaway: pharmaceutical companies must balance innovation with equity — and treatment with trust.

Based on Caliber’s 2024 Global Reputation Report and broader market trends, key challenges include:

Trust remains fragile. Innovation continues to be the industry’s most praised attribute, yet only a minority of consumers believe pharmaceutical companies act in the public interest.

Without stronger efforts in communication, ethics, and accessibility, this trust gap could widen further.

The world’s leading pharmaceutical companies continue to advance global health through research, innovation, and the development of life-saving treatments.

As the industry’s influence grows, reputation is becoming its most important competitive advantage. The companies that lead in trust, transparency, and innovation will define the future of global health — not just those with the biggest balance sheets.

Leaders such as Roche, Novartis, GSK, Bayer, Johnson & Johnson, Pfizer, Moderna, and AstraZeneca are already shaping this future through their commitment to innovation, sustainability, and corporate responsibility.

James is a communications strategist and senior content lead at Caliber, where he writes about corporate reputation, stakeholder intelligence, and brand trust. He draws on more than a decade of experience helping organizations turn data into stories that build credibility and connection.

Follow Caliber

According to 2024 revenue data on Companies Market Cap, the top pharmaceutical companies are CVS Health, Walgreens Boots Alliance, Johnson & Johnson, Sinopharm, Roche, Merck, Pfizer, AbbVie, AstraZeneca, and Novartis.

Based on Caliber’s Trust & Like Score, the most trusted pharmaceutical companies in 2024 are Roche, Novartis, GSK, and Johnson & Johnson. These rankings are derived from public perception data collected across 13 countries.

Headquartered in Bagsværd, Novo Nordisk is a global leader in diabetes care, hormone therapy, and obesity treatment. Its blockbuster drugs Ozempic (for type 2 diabetes) and Wegovy (for weight loss) have driven massive global demand and revenue growth.

As of 2024, Novo Nordisk is not only Denmark’s largest pharmaceutical company but also one of Europe’s most valuable companies by market capitalization. It operates in over 80 countries, serving millions of patients worldwide.

In Caliber’s 2024 Global Reputation Report, Novo Nordisk ranked as Denmark’s most trusted pharmaceutical company, earning top scores for Innovation and Inspiration — reflecting strong national brand equity and public trust.

“Big Pharma” refers to the world’s largest pharmaceutical corporations with significant influence over drug development, healthcare policy, and public health spending.

While these companies are recognized for medical innovation, they are also scrutinized for high drug prices, lobbying practices, and ethical controversies surrounding access and transparency.

Trust in the pharmaceutical industry remains fragile. While innovation is the sector’s strongest reputational attribute, only 22% of global respondents believe pharma companies are helping solve global health crises, and 12% think they are exploiting them — highlighting a persistent trust gap.

Blockbuster weight-loss drugs such as Wegovy and Zepbound have generated major profits — but also public concern. Many see them as expensive “quick fixes”, raising questions about accessibility, marketing ethics, and their broader influence on health culture.

The pharmaceutical industry’s reputation is complex and polarized, reflecting a tension between its scientific achievements and public skepticism.

According to Caliber’s 2024 Global Reputation Report, the global Trust & Like Score for the sector declined slightly to 65 (down from 67 in 2023). This indicates average trust levels overall, with wide variation by region and company.

Only 22% of respondents believe pharma companies are helping solve a health crisis, while 12% think they are taking advantage of it — reinforcing the reputational gap.

Rebuilding trust will require greater transparency, ethical leadership, and active public engagement, especially as the industry expands into new frontiers such as weight-loss drugs, gene therapies, and AI-driven medicine.