As tariffs continue to dominate headlines, our latest survey — of over 1,000 US adults in late May — provides a portrait of public opinion. While Americans are split on whether tariffs are beneficial, a deeper analysis reveals clear divides by age, sex, income and political affiliation.

From differing views on the economic impact of tariffs to the factors that influence purchase decisions, our data reflects a nation not just uncertain but often deeply divided on what tariffs mean and whom they serve.

Yet the data also reveals a rare outbreak of agreement among Republicans and Democrats — namely, that cost/price is the biggest factor when purchasing goods subject to tariffs; that tariff-impacted companies should “be transparent” about the impact on consumers, and that they should “absorb the costs” of tariffs.

Only by listening to stakeholders and paying attention to the areas of both agreement and disagreement will companies successfully navigate the emerging “tariff economy”.

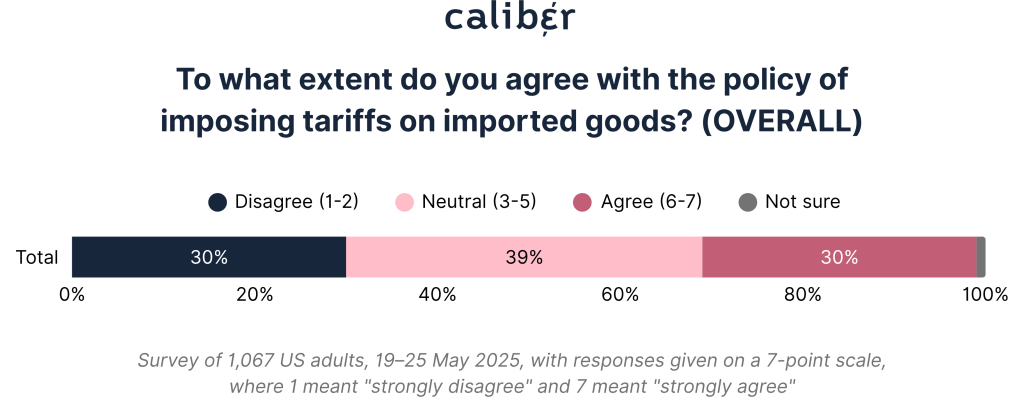

First, we asked respondents to what extent they agreed with the Trump administration’s policy of imposing tariffs on imported goods. The country as a whole is split:

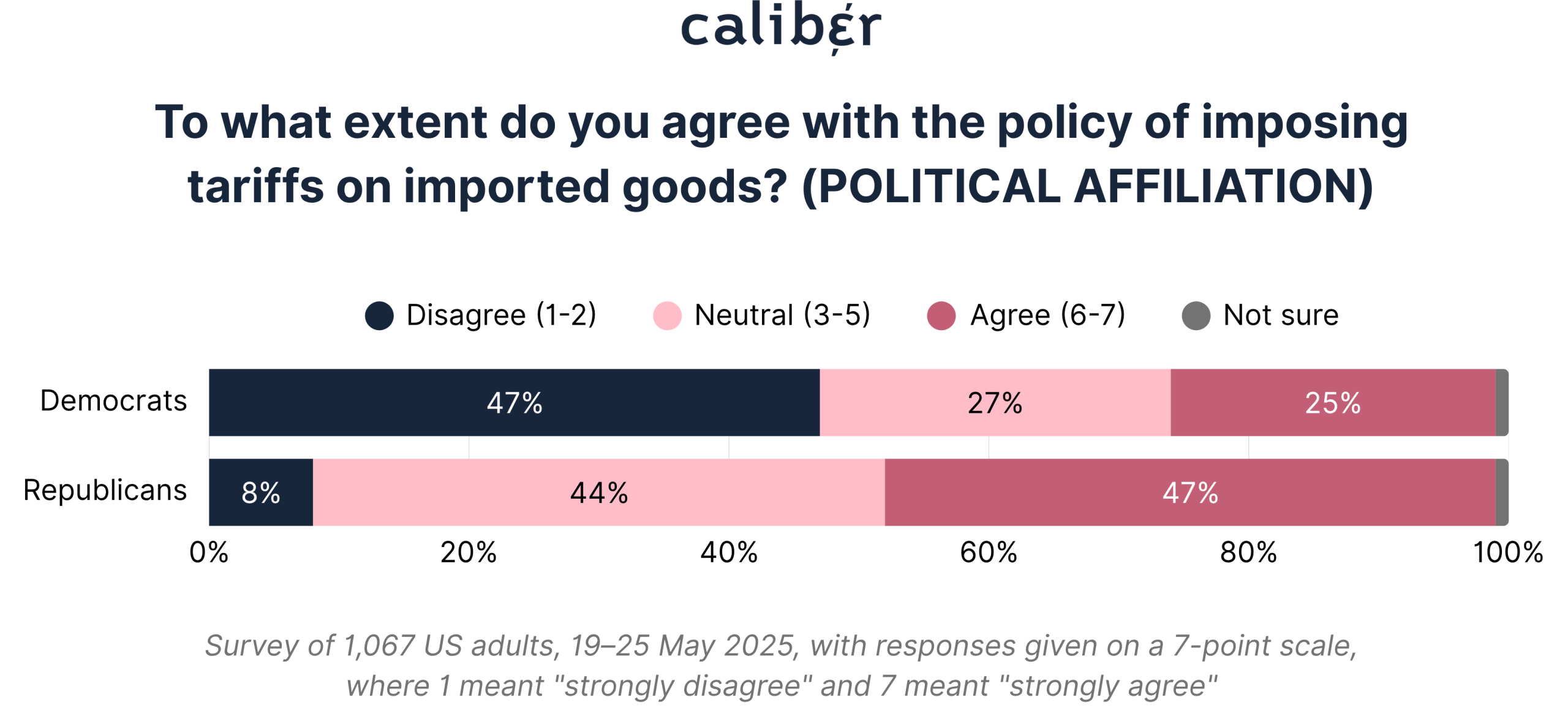

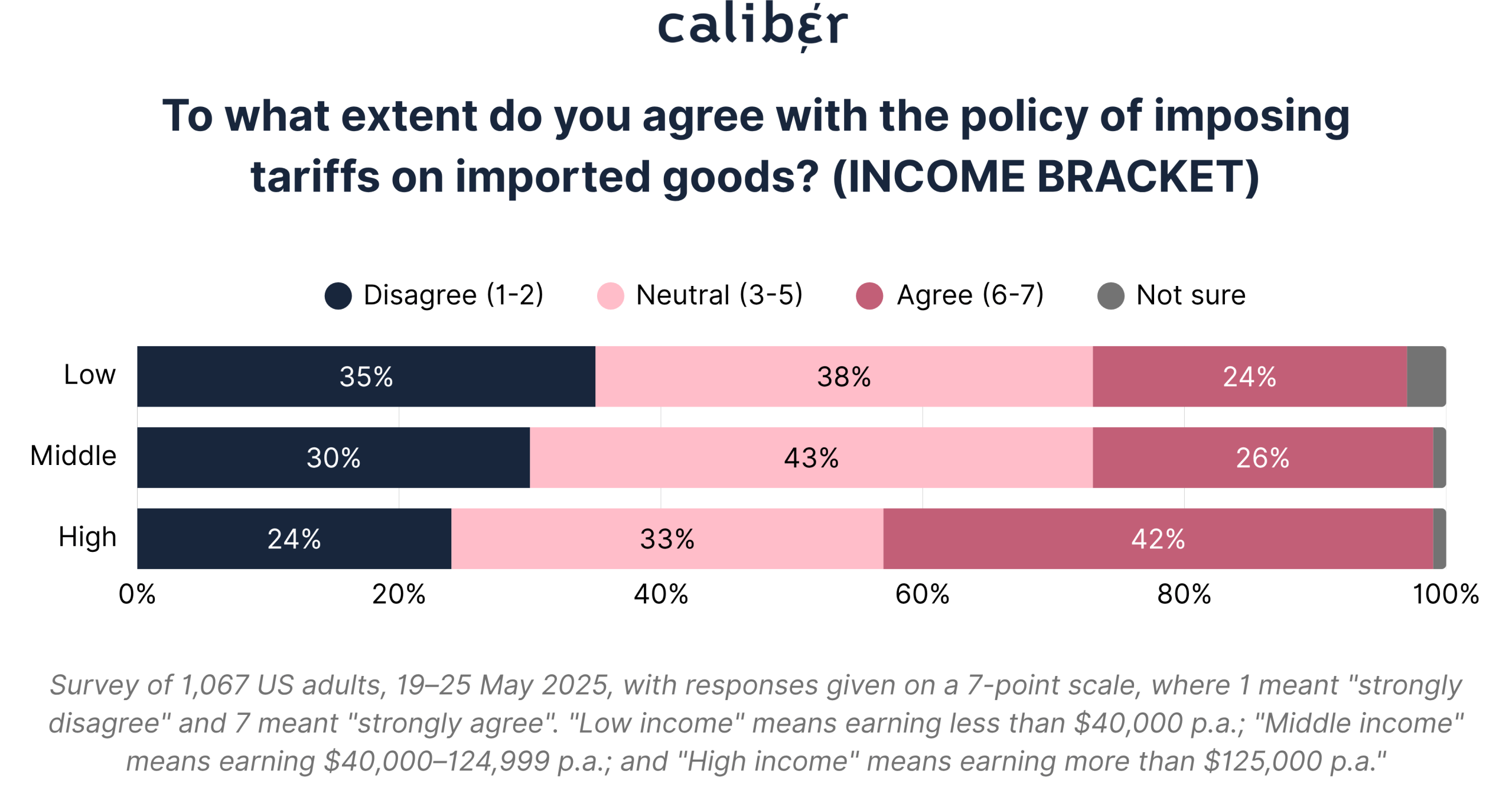

This split highlights a lack of consensus — if not clarity — on the economic value of tariffs. It also masks deep divisions:

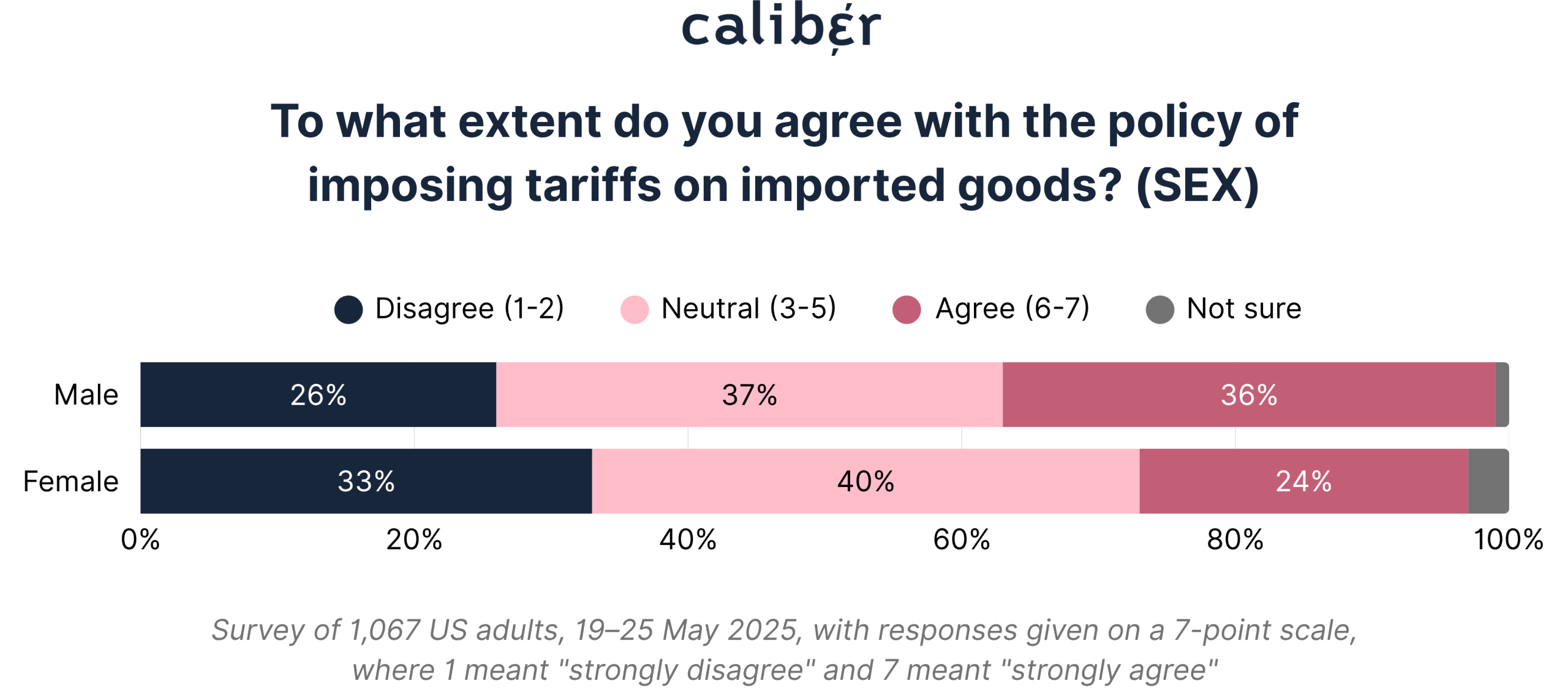

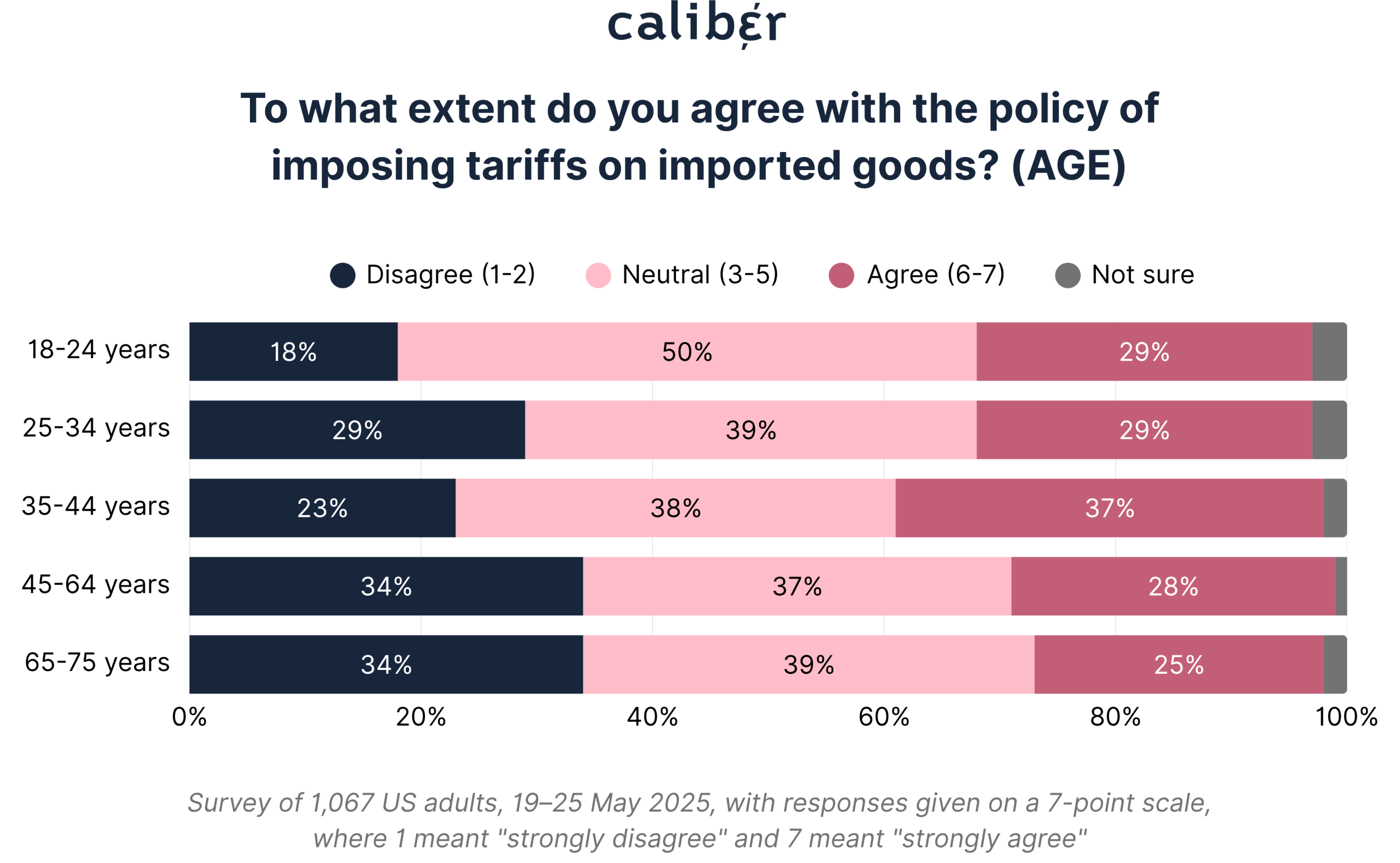

There are also noteworthy sex and age splits:

This suggests support for tariffs rises among working-age adults who may feel more economically vulnerable to global competition, before tapering off among older age groups who may be more insulated from labor market pressures.

Takeaway:

Tariffs are not just trade policy: they are political signals and economic identity markers. Public support reflects how secure, vulnerable or ideologically aligned people feel. Corporate messaging around tariffs must be nuanced, not one-size-fits-all.

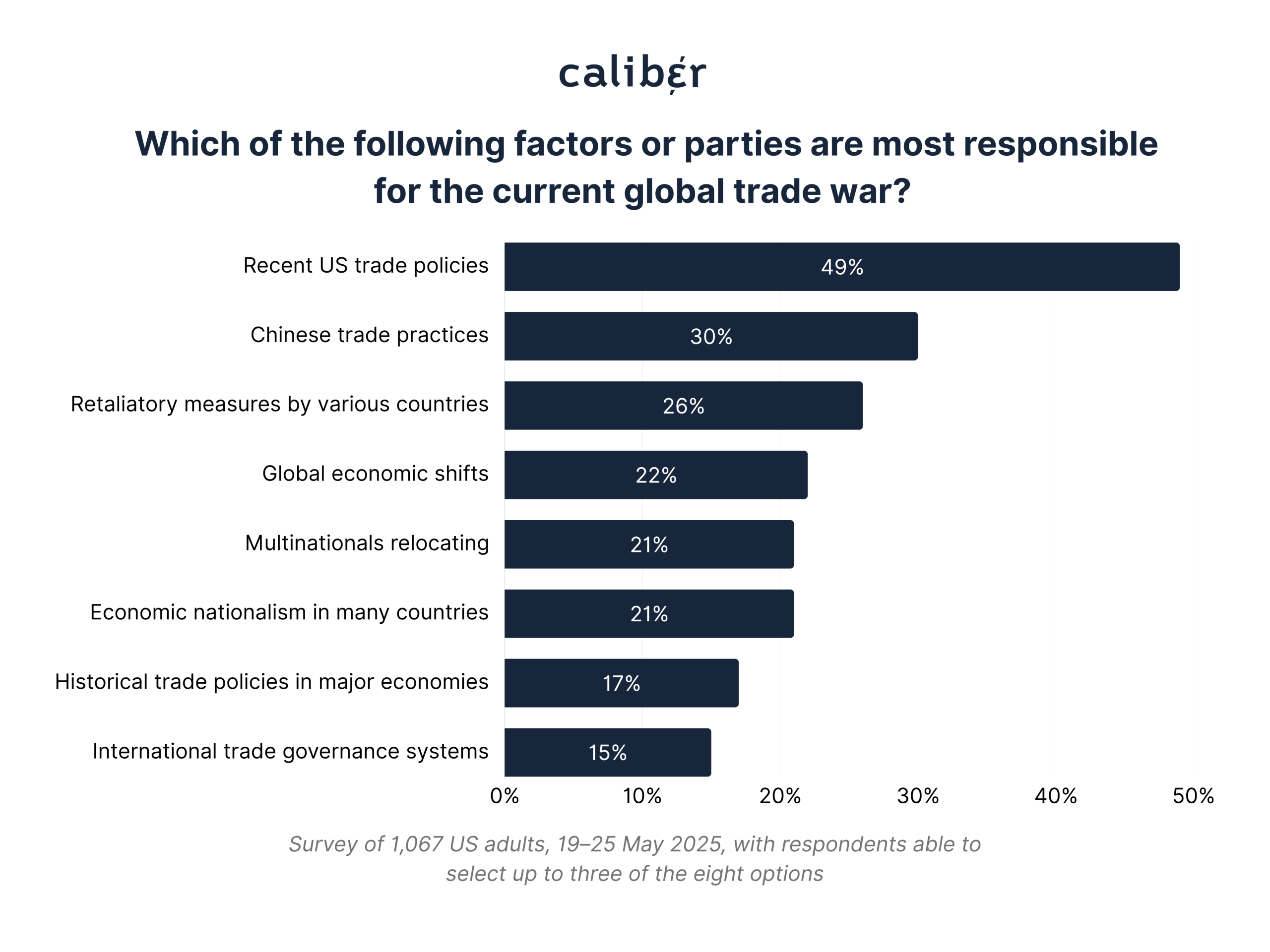

Next, we asked respondents to identify what they believe is most responsible for the current global trade war. The leading culprit? Recent US trade policies — cited by almost half of respondents. This answer was followed by Chinese trade practices (30%) and retaliatory measures by various countries (26%).

But politics reshapes this perception. When asked what factors or parties have contributed most to trade tensions, political identity emerged as a fault line:

Age and income again shape views:

Takeaway:

There is no consensus on cause — only ideological lenses. Companies weighing whether to publicly support or oppose tariff policy must first understand which narrative their stakeholders believe. Assumptions could misfire.

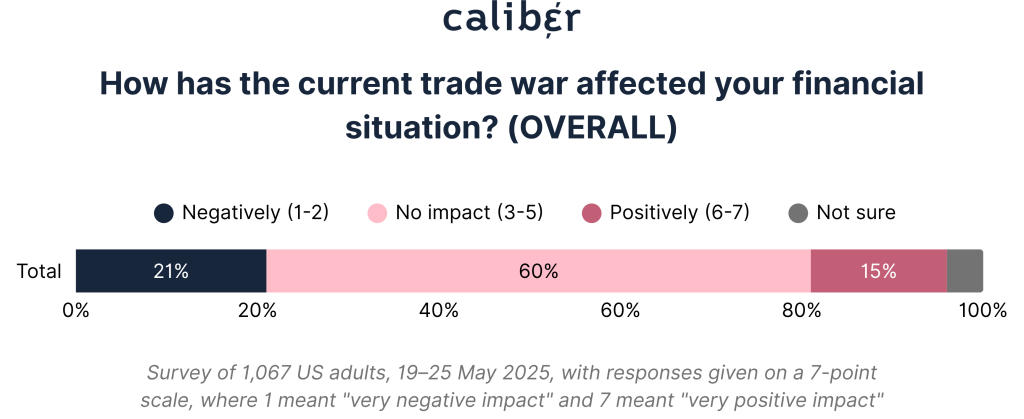

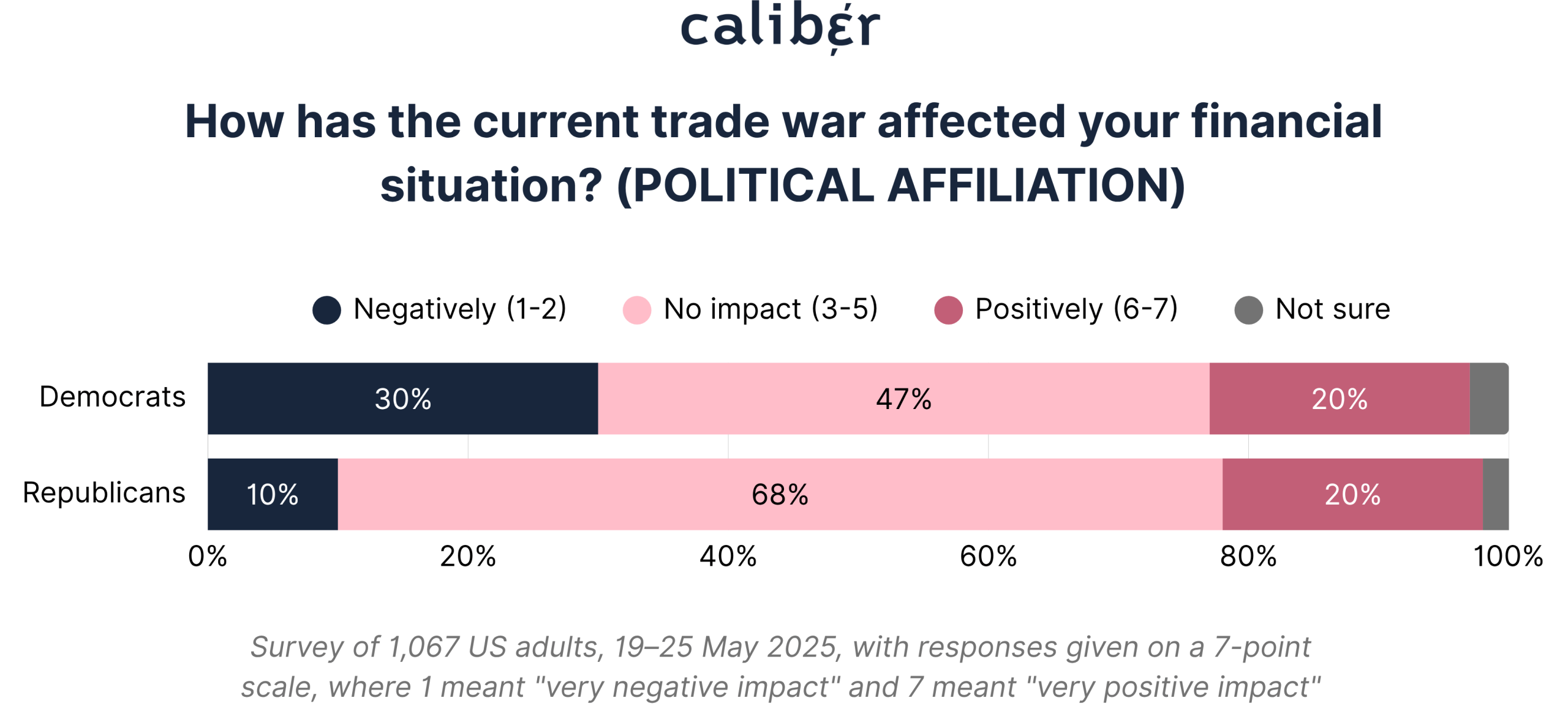

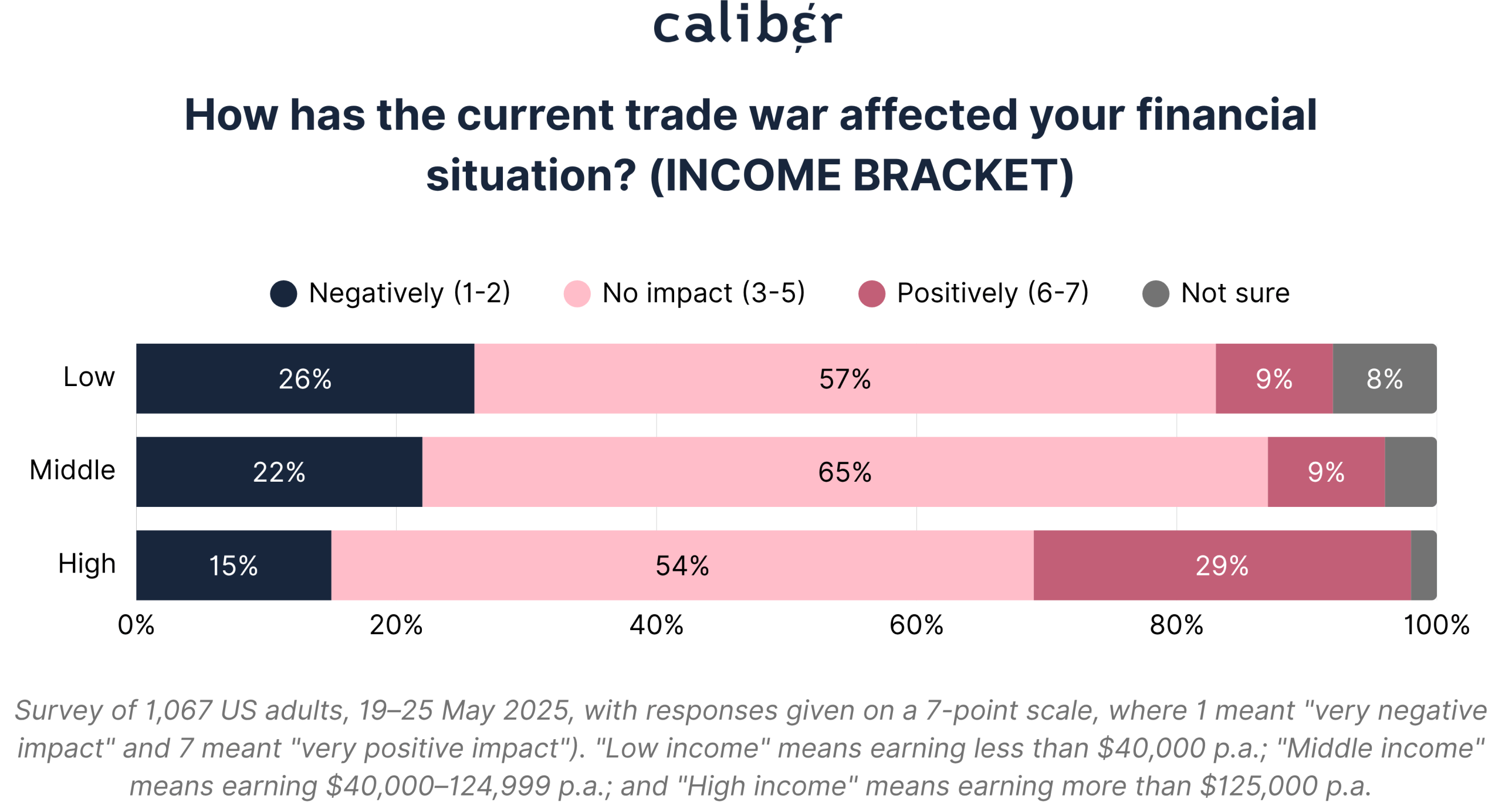

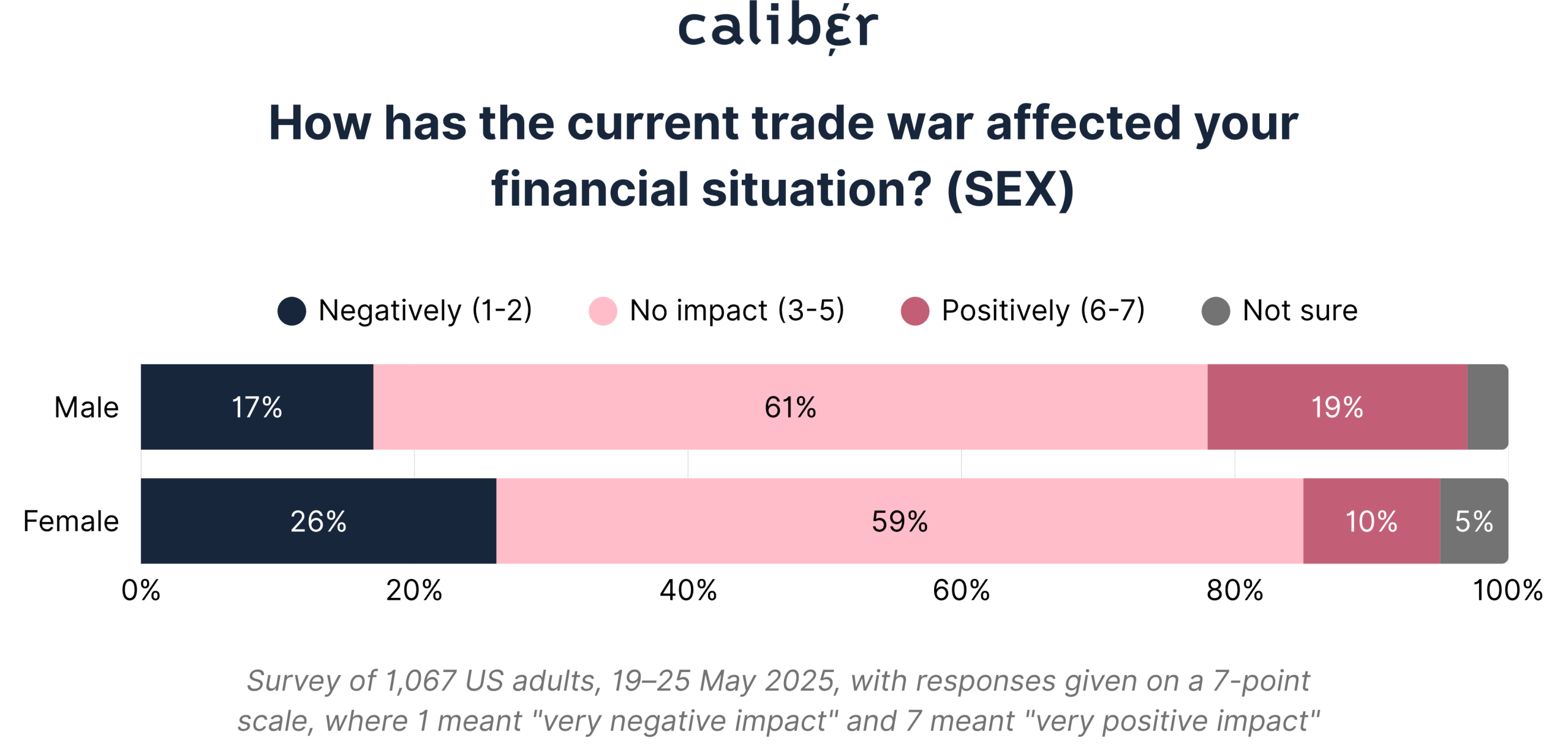

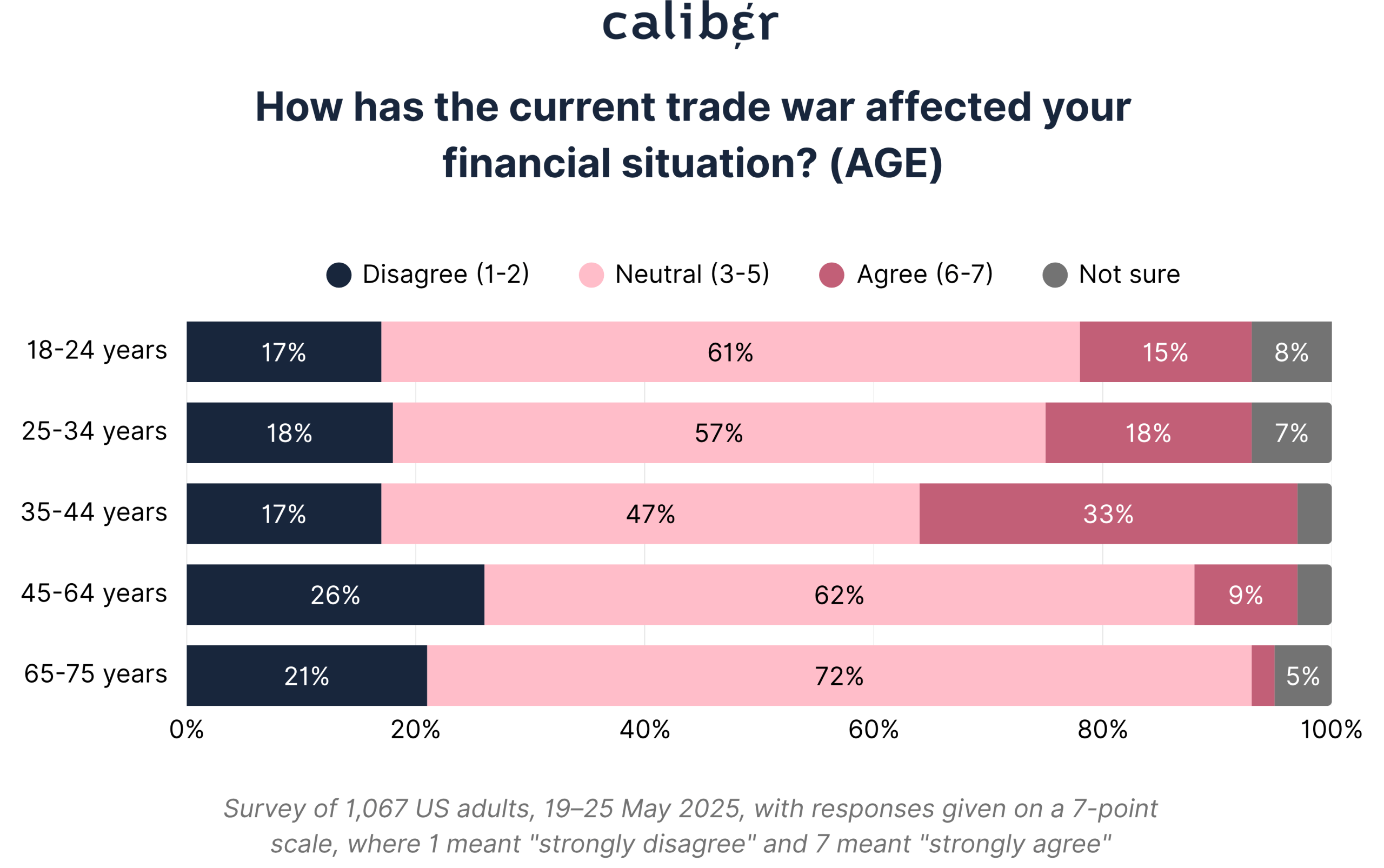

When asked about how the trade war has affected their financial situation, the majority (60%) said it has had no impact. But among those who have felt something:

These effects are not evenly felt:

Sex and age again reveal differences:

Takeaway:

Tariffs may be invisible to many, but for others, they are a direct cost-of-living issue. Companies should resist the temptation to downplay price rises or disruptions — for certain stakeholders, these effects are tangible and potentially resented.

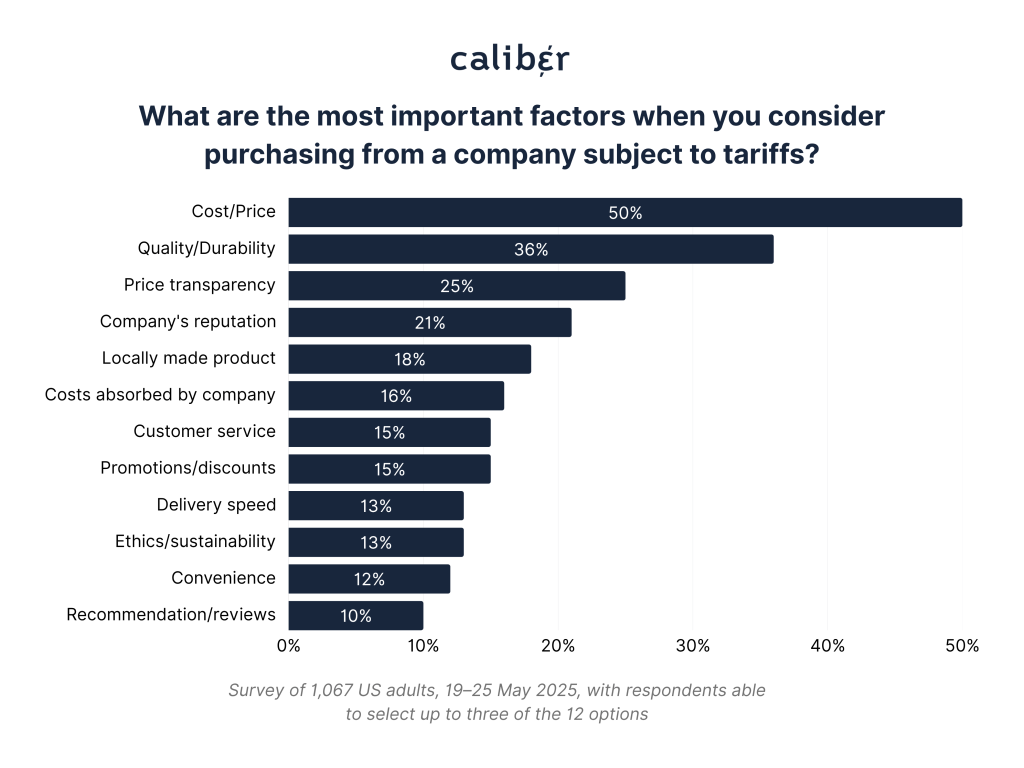

Next, we asked respondents to identify the most important factor when buying goods from a company subject to tariffs.

Cost/price was the clear winner, selected by a resounding 50% of respondents.

This finding holds important implications for policy and business alike: even in an era of growing economic nationalism, Americans prioritize affordability over loyalty to domestic products.

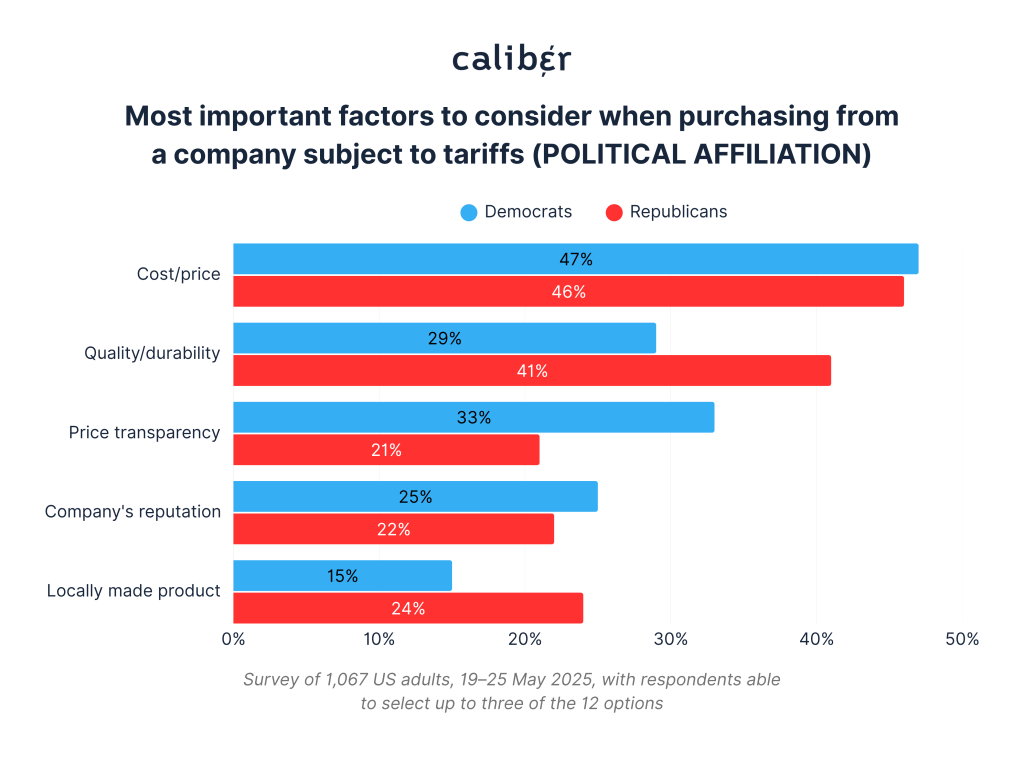

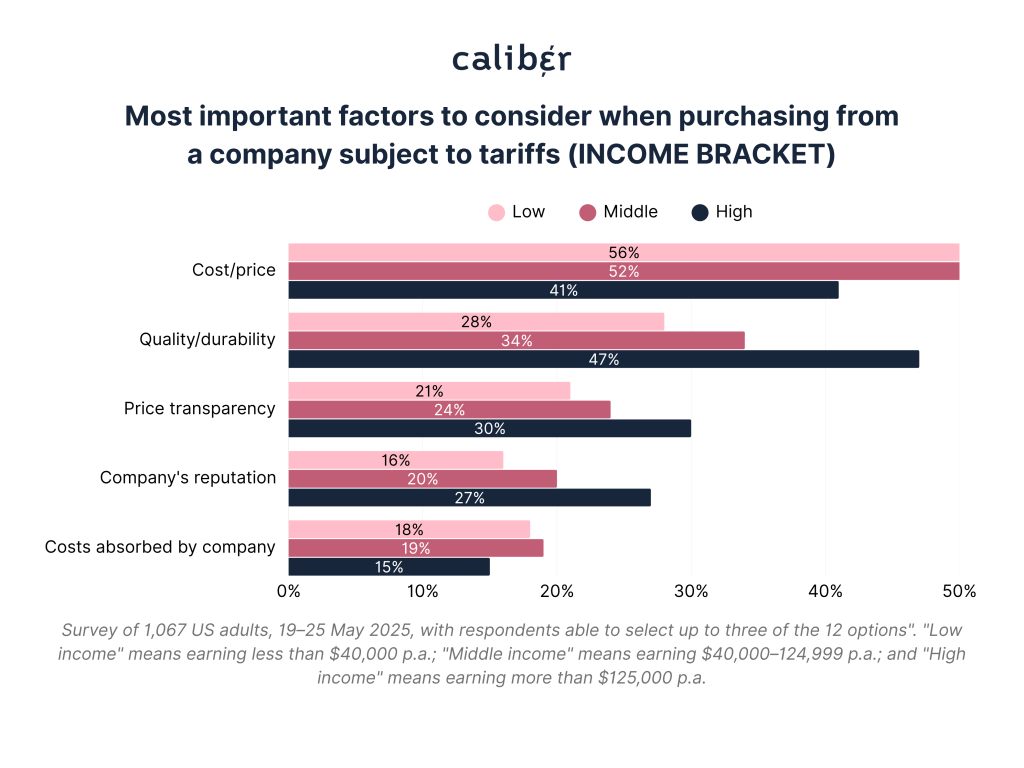

Political and income distinctions echo this:

Takeaway:

Tariffs disproportionately affect those most vulnerable to price rises — and self-interest shapes ideology as much as ideology shapes perception.

Brands should be especially thoughtful about how they communicate price changes to these audiences: empathy, transparency and specificity matter.

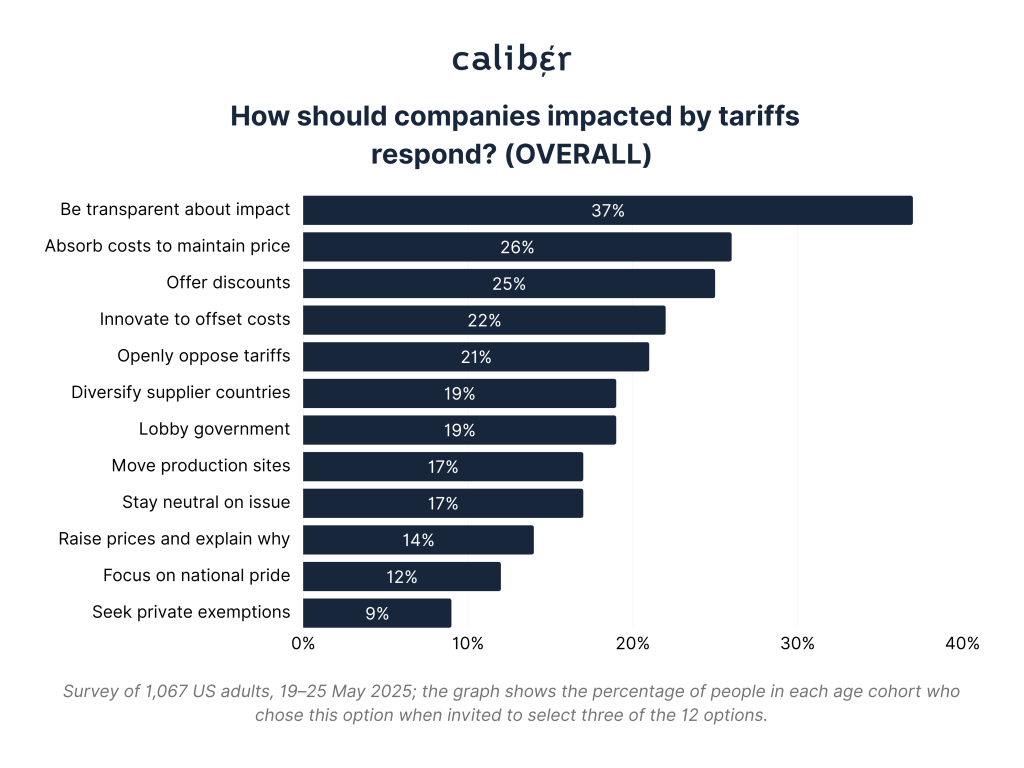

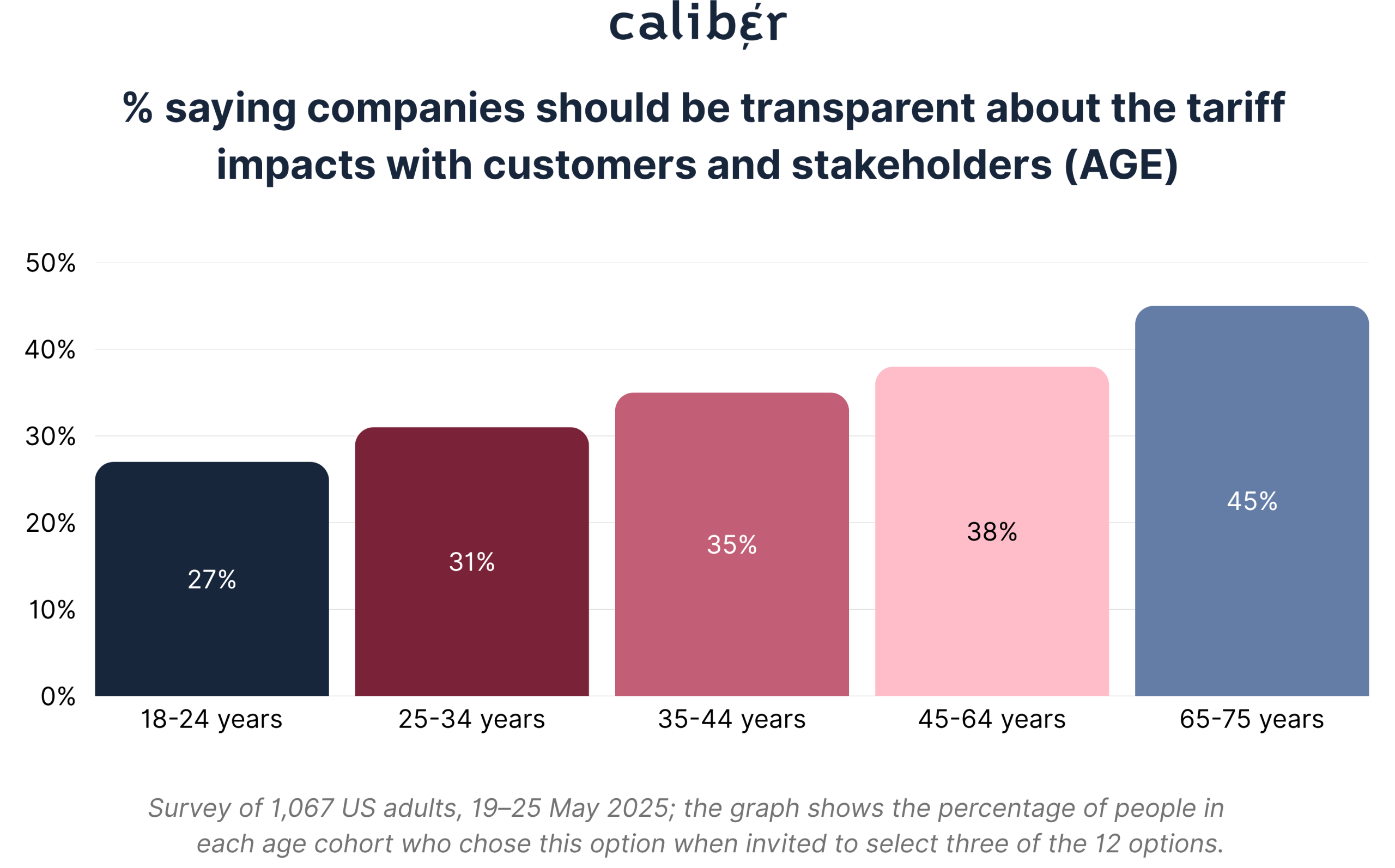

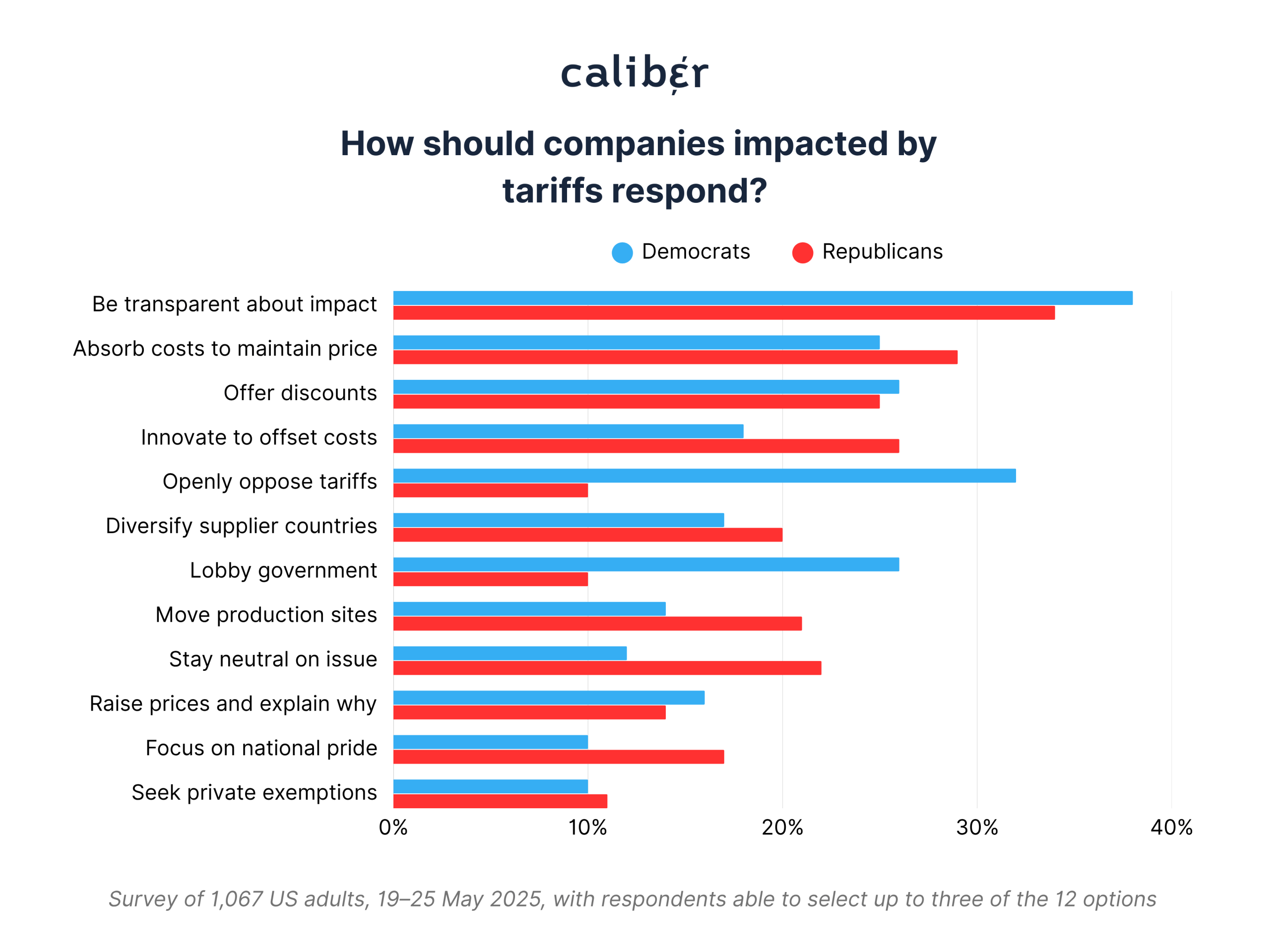

Finally, we asked respondents what companies subject to tariffs should do. The top answer? Be transparent about the impact of tariffs with customers and stakeholders — chosen by 37% of respondents.

Closer inspection of the data again reveals divisions:

But it also reveals significant common ground among Republicans and Democrats

Takeaway:

Transparency builds trust — and has appeal across the political spectrum. Even so, companies must tread carefully. While openly opposing tariffs carries some risk, remaining neutral on the issue might too. When, where, and how companies explain the impact of tariffs — and knowing their audience — very much matters.

Tariffs today are more than tools of trade policy — they are deeply symbolic markers of identity, vulnerability and value.

Americans don’t experience them equally, and they certainly don’t interpret them the same way. Views are shaped by a complex blend of politics, economic standing, life stage and everyday exposure to rising prices or supply chain disruptions.

This fragmented sentiment creates both risk and opportunity for companies. In a tariff economy, they must recognize that audiences bring their own context to every pricing decision, public stance or supply change. What builds trust with one group may alienate another.

So what should companies do?

Above all, companies should treat tariffs not just as a policy issue, but as a reputation and relationship issue. In this environment, credibility comes from clarity, consistency, and contextual awareness, not a one-size-fits-all approach.