ESG perception tracking – why it matters and how Caliber can help

Companies are doing more to meet their ESG goals – but do they really know how their efforts are perceived?

Body TextThe ESG landscape is constantly evolving. The latest topics on ESG profoundly impact the world around us, requiring an increased focus on putting in place an ESG strategy.

From the growing urgency of addressing climate change to the rising demand for more equitable and diverse workplaces, ESG issues have taken center stage in the corporate world and beyond.

"Companies we have seen that have not taken ESG strategy seriously face a risk in terms of branding, investors' preference, or in transforming at a time when business models need to be sustainable. Overall, we believe that doing 'business as usual' is no longer a valid option."

Proof of this growth is plainly evident in investments. Inflows into sustainable funds, for example, rose from $5 billion in 2018 to more than $50 billion in 2020—and then to nearly $70 billion in 2021. The environmental component of ESG and responses to climate change have driven a major part of ESG growth.

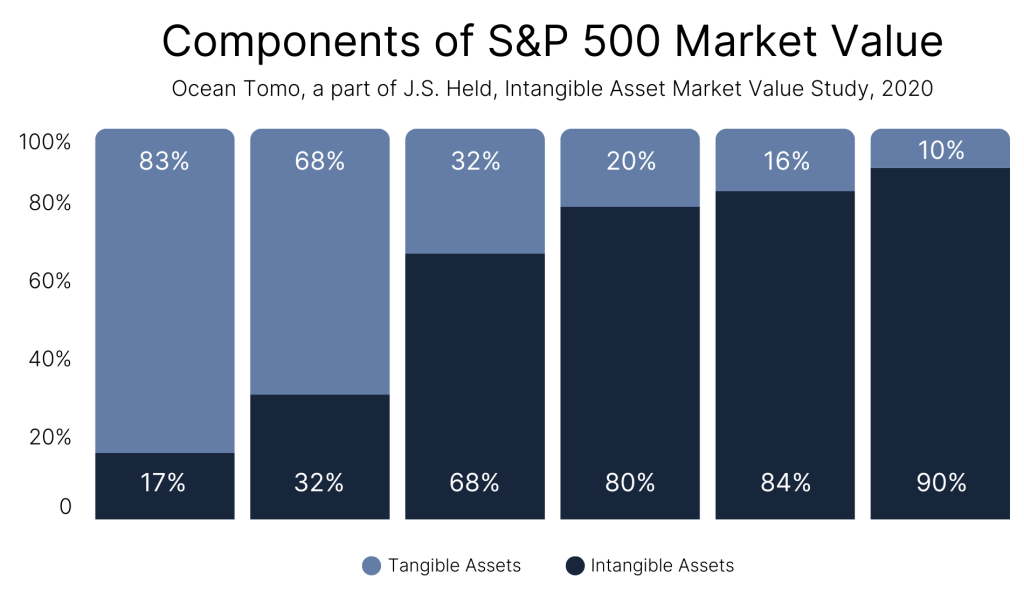

Reputation and ESG play a critical role in a company’s evaluation, especially now when 90% of the market value of a company is assigned to intangibles.

Also at Caliber, we have seen an increase in topics discussed and measured by our clients around the following criteria:

“In our work with multinational companies around the world, we have seen ESG becoming the key reputational battleground - to secure customer loyalty, talent attraction, and advocacy from opinion leaders. Those who do it well and do it differently, win.”

In today’s business landscape, strategic ESG considerations are crucial for companies. This is because sustainability and ethical practices are becoming increasingly important to investors and stakeholders.

Companies must integrate ESG into their strategies to thrive in this environment, keep themselves updated with the latest developments, and evaluate their impact on the public and investors.

Failure to prioritize ESG can have serious consequences, including damage to the company’s reputation and risk profile, leading to financial failures and a loss of trust.

The prevalence of social media and digital platforms means that negative stories related to ESG issues can spread quickly, underscoring the need for proactive management of ESG perception tracking.

This article will examine the significance of stiffening the ESG strategy and the critical distinction between ratings and perceptions, explaining why both are equally vital for assessing a company’s commitment to sustainability as well as building stakeholder trust.

The growing pressure from stakeholders is fueling ESG momentum all around the world. In 2021, 42% of investors said that their approach to ESG is mainly driven by client expectations and reputational concerns.

Today, a growing number of investors use ESG rankings to determine whether to invest in a company or not, and even governments worldwide have started using the scores to determine which companies will be allowed to operate within their borders – and which ones won’t.

It is no longer just a desire by the public for companies to behave ethically, sustainably, and responsibly. It’s an expectation.

Tracking an ESG score enables companies to detect the problem areas, benchmark their success toward sustainable and ethical transition, as well as communicate the progress to all stakeholders.

A recent study by MSCI found that companies with better ESG scores usually deliver a higher return to shareholders over the past decade.

Developing a strong ESG proposition can help your company gain access to new markets and further expand into existing ones. Governing authorities are more likely to offer access, approvals, and licenses if they trust the corporate actors.

“Evidence is emerging that a better ESG score translates to about a 10 percent lower cost of capital, as the risks that affect your business are reduced.”

Additionally, the ESG initiatives of a company can make a significant difference in how consumers perceive the brand. Therefore, it’s imperative that they are in line with the purpose of the company, and the image it wishes to portray.

By working on improving ESG ratings, companies can improve their relationships with stakeholders, increase investments, gain access to lower-cost capital, and win trust.

Improving the ESG scores may require a long-term approach and commitment, but it is clear that the investor interest in ESG standards is here to stay. As Gen Z becomes a significant consumer segment, it is expected that ESG considerations will be at the heart of mainstream investing.

Therefore working toward a higher ESG score is not only beneficial for our society as a whole but can also help drive strong financial results in the future.

Before you commit to developing an ESG strategy, ensure that the management team is willing to allocate resources for meeting the ESG goals. Depending on the size, age, and culture of the organization, getting things right can be a time-consuming and expensive process, which may involve several departments.

In spite of the most sincere intentions, it is nearly impossible to address every issue equally, so it’s crucial to select ESG topics that are most relevant to your organization and sector. There are two major factors to consider when choosing which ESG goals to address first:

An in-depth materiality assessment is needed to make the business case for any ESG strategy because it helps to prioritize topics by creating inherent business cases for initiatives previously dismissed due to their cost or lack of evidence.

More people are interested in ESG investing than ever. The public increasingly expects transparency in environmental, social, and corporate policies, so ESG strategies have become a necessity for businesses.

Investors pay close attention to how companies are responding to environmental concerns, macroeconomic trends, ESG risks and opportunities, and how they are positioning themselves for success in the long run. A lack of focus on ESG factors can leave your organization behind the competition.

By demonstrating a commitment to ethical business practices, a company can enhance its reputation as a responsible and sustainable organization.

Identify the specific initiatives needed to meet ESG goals, define the key steps required to implement those initiatives, and assign tasks to the appropriate people. Remember to define what success should look like and include timelines to reinforce accountability.

You can avoid stretching resources too thin by focusing on a limited number of ESG strategies at a time. Keep employees and other stakeholders engaged by starting off with low-effort and low-cost narratives to build confidence in your team. Pick the right communication channels and messages.

Moreover, consistency in communication can also help a company proactively identify and address ESG issues.

By regularly communicating about its ESG strategy and performance, a company can receive feedback from stakeholders and take corrective actions to address any concerns or gaps in its performance.

Waiting for a crisis to speak up can breed skepticism among audiences. By communicating ESG impact consistently you will build authenticity with consumers and other stakeholders.

ransparency in a company’s ESG strategies can positively impact its:

Reputation: (demonstrate accountability and ethical business practices, building stakeholder trust and confidence).

Differentiation: (stand out in a crowded marketplace and attract socially responsible customers, employees, and investors who prioritize sustainability and ethical practices).

Integrity: (show a willingness to be held accountable, and a commitment to act in the best interests of stakeholders).

Consideration: (attract socially responsible investors who are looking for long-term value, socially responsible customers who want to support sustainable and ethical companies, and talented employees who are looking for companies that share their values).

By sharing information about its ESG performance, a company can build trust, enhance its reputation, and attract socially responsible stakeholders.

In the past, many companies have been called out for publicly sharing commitments that didn’t live up to internal business practices.

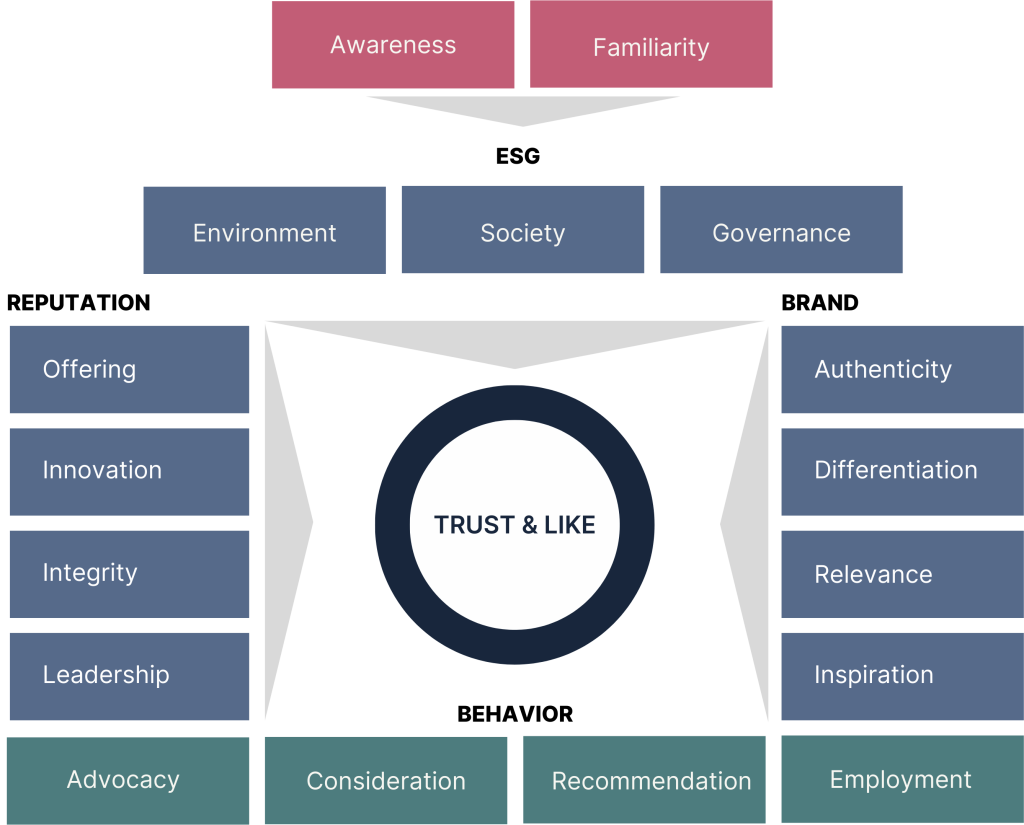

Simply being aware of a company’s consciousness or intentions doesn’t necessarily influence how people perceive that organization.

Ultimately, it’s the stakeholders’ familiarity with a company’s actions that shape its reputation – whether positively or negatively.

If a company communicates its positive actions effectively, this can enhance its reputation. Conversely, if stakeholders become aware of wrongdoing or a crisis within the company, this can harm its reputation.

Therefore, companies must establish a clear mission and ensure that their internal operations and company culture align with stakeholder expectations and that these are communicated transparently.

Additionally, companies can enhance their familiarity levels by demonstrating legitimacy and authenticity in their external communications, such as by sharing information on their progress in areas such as pay equality, diversity, inclusion, and other relevant issues.

A key consideration for any ESG program is how to report progress. There are hundreds of ESG reporting frameworks out there with no internationally-accepted standard. While it’s really up to your company to decide how to communicate the progress, it’s recommended to choose better-known frameworks.

Here are some examples:

The framework aims to enhance and consolidate existing reporting practices and move towards a framework that provides the information necessary to develop a global economic model that meets the challenges of the 21st century.

The GRI Standard is one of the world’s most widely used standards for sustainability reporting, which aims to help businesses, governments, and other organizations understand, develop and communicate sustainability metrics. The guidelines can be downloaded for free on the GRI website.

SASB is a great choice to communicate the value your ESG program creates in a language that investors understand best. With the SASB framework, you’ll be able to identify, manage and communicate financially-relevant sustainability information to investors. It is common for SASB standards to be used alongside other frameworks, for example, GRI.

With growing interest in ESG criteria, investors need a way to assess a company’s ESG performance objectively. This has led to the flourishing of several ESG Rating Agencies, such as Sustainalytics, MSCI, and FTSE ESG, which assess companies globally on their ESG performance and make this data available to their clients.

ESG ratings matter because they are used by different stakeholders to evaluate a company’s performance on sustainability, social responsibility, and ethical practices, providing a standardized and objective measure of a company’s ESG performance.

Companies are doing more to meet their ESG goals – but do they really know how their efforts are perceived?

On the other hand, the general public’s opinion about a company’s ESG actions matters because it reflects the views and beliefs of a broader group of people other than investors that impact an organization’s performance.

The level of familiarity towards these initiatives – not associated with an agency’s rating – can define reputation levels, ultimately influencing stakeholder behavior like consideration, recommendation, advocacy, etc.

ESG ratings and ESG perceptions are both critical for companies to consider because they can significantly impact a company’s reputation, the support it gets from stakeholders, and ultimately its financial performance.

High ESG ratings combined with positive perceptions are a sign the company’s efforts are being noticed and recognized by the right audiences. In today’s competitive environment, where every brand tries hard to win the trust of its stakeholders, the perception metrics are critical, when trying to measure the impact of the brand’s ESG activities.

ESG ratings can impact investor preferences and decisions. Investors may use ESG ratings to evaluate a company’s long-term sustainability and risk management practices, which can affect a company’s access to capital and cost of capital.

If not reflected in positive stakeholder perceptions, investors may worry that the company’s actions are not sufficient to secure external buy-in, which in turn may negatively impact the company’s evaluation.

ESG perceptions can influence customer preferences and buying decisions. Customers may prefer to do business with companies perceived as socially responsible and sustainable, which can impact a company’s market share and revenue.

Having an ESG perception level that is different from the company’s ESG ratings can indicate a reputation risk, impact investor relations, highlight the need for better stakeholder engagement, and put the company at a competitive disadvantage.

Therefore, companies should prioritize addressing gaps or discrepancies between ESG ratings and perceptions with the general public. In other words – bridge the gap between perception and reality.

Without an understanding of how stakeholders perceive ESG performance, companies may fail to address their concerns before it’s too late, resulting in a loss of trust from investors, customers, and employees, leading to financial losses and a tarnished brand image.

Despite the fact that CSR (Corporate Social Responsibility) has been one of the pillars of ethical social behavior for many years, ESG is what dominates the corporate agenda today. In the blink of an eye, it shifted from a marginal consideration to an integral indicator of business performance.

A CEO survey conducted by EY in 2022 found that 82% of respondents viewed ESG as a core value driver for their business.

It is likely that this trend will continue to accelerate given the importance governments are now placing on solving the climate crisis and ensuring equal treatment for all. In the near future, ESG reporting may be treated the same as financial reporting, with each company required to disclose its ESG results according to globally accepted standards.

The time is now for all businesses to get serious about sustainability as stakeholder pressure on companies and governments are only expected to increase.

Those who demonstrate leadership have the greatest chance of getting ahead of the curve in their industries. As ESG issues gain momentum day by day, there is no time to waste.

At Caliber, we believe that true ESG measurement should also consider stakeholder perceptions; therefore, the ESG Perception Tracker is becoming an indispensable function of our corporate reputation monitoring platform.

Our analysis has confirmed that ESG is heavily correlated with our model’s “purpose” attributes Integrity, Authenticity, and Relevance.

By measuring brand and reputation attributes, as well as the 3 attributes of ESG, Caliber helps companies identify areas where they can improve their ESG strategies and practices, communicate more effectively with stakeholders, and enhance their reputation as socially responsible and sustainable organizations.

With Caliber, companies can not only comprehensively understand stakeholder opinions and beliefs about their ESG performance through the standard measurement of E, S, and G, but also by incorporating and measuring their unique ESG drivers.

The perception data collected via Caliber’s platform show how much various stakeholder groups know about the company’s ESG activities and where the company leads or falls short compared to benchmarks, country, or sector indexes.

“What we’re finding most interesting about the ESG data Caliber collects and analyzes is how little stakeholders know about companies’ ESG performance, and how much reputational impact is gained by purely informing audiences and increasing knowledge levels.”

By incorporating media events and campaigns to correlate with fluctuations and trends of perceptions, combined with the proprietary measurements of purpose and ESG, brands can build better communication narratives and establish themselves as socially responsible and sustainable organizations.

Contact us today to learn more about how Caliber can help you enhance your ESG performance and start build trust with your stakeholders.

© 2024 Group Caliber | All Rights Reserved | VAT: DK39314320