Energy prices in Europe have been on a sharp incline in the past months as the market reacts to an unprecedented low supply of energy.

The reasons for recent price hikes can mostly be considered “force majeure” for energy distributors, however, in a market that appears complex and highly opaque to the regular consumer, the likelihood of energy companies suffering the blame for increases in energy prices is high.

Below, we will investigate the reputational impact of the soaring energy prices on Europe’s energy companies.

In our Energy Industry report 2021 (published in June), the industry looked to have recovered from a reputational deficit suffered during the Coronavirus pandemic. Like many of the companies and industries that Caliber measures, the Energy Industry saw perceptions improve on the back of global economies returning to normal.

However, the return to a normal world – with offices reopening, traffic increasing, shops and restaurants filling up, and overall consumer demand rising – has spelled trouble for the Energy Industry in an unprecedented way.

A unique market situation is driving prices up

Although the demand for energy in the market is not unusually high by normal standards, several factors have caught out the industry, particularly in Europe, and have had a considerable effect on the overall reputation of electricity providers.

The ongoing EU-wide transition away from fossil fuels has meant less supply of natural gas, coal and oil in Europe’s energy grid.

On the flip side, a season with less wind and rainfall than usual has meant that renewable energy sources could not cover demand. As a result, there has been an urgent need for electricity providers to import fossil fuels, in particular natural gas, from countries outside the EU, and here the high-priced global market, fueled by the reopening of economies, and coupled with high EU CO2 emission taxes, has created an explosion in energy prices.

For more background on EU’s energy crisis be sure to read these two articles from World Economic forum and Euronews

As a result, electricity providers have seen themselves forced to raise consumer prices to cover the costs of a more expensive market, and many European consumers are therefore seeing their energy bills being more expensive by as much as 40% – and potentially more over the coming months of winter.

The public blames electricity providers, and hopes for political intervention

Despite not seeing any additional profit, electricity providers and grid operators stand as the most obvious first-in-line culprits of increasing prices in the eye of the public.

The reputational impact of the rising energy prices on European electricity providers has been palpable, as consumer perceptions have changed from the year’s highest to the year’s lowest in a matter of weeks.

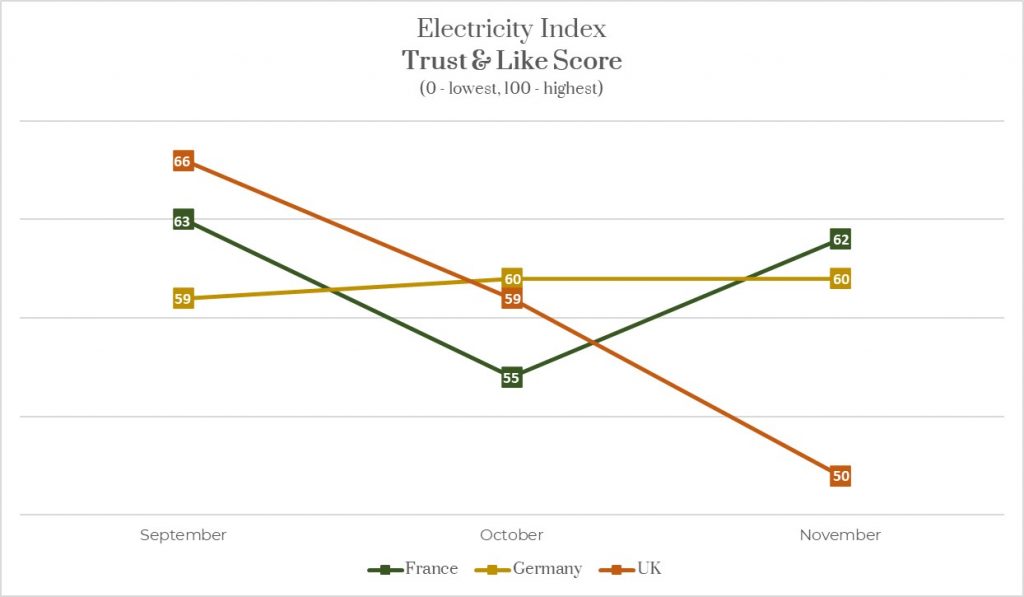

Viewed as an index, the European distributors across France, Germany and UK have seen a 6-point drop in TLS (Trust & Like Score – Caliber’s central metric to assess overall reputation) from September to the beginning of November.

In each market, it is the largest energy distributors that have suffered the brunt of the negative impact on reputation for the industry. In the UK, the index of electricity providers drops from a TLS of 66 in September to 50 in November, largely due to negative perceptions of Centrica and National Grid – respectively the largest gas provider and gas distributor in the UK.

A similar pattern was seen in France with the index dropping from a TLS of 63 in September to a score of 55 in October, due to weakening perceptions of the largest grid operators EDF and Engie.

The perceptions of these energy distributors in France have bounced back in November, possibly because of the French government stepping in to cover all energy price increases for consumers.

Germany stands out, with the index overall holding steady from September to start-November, which may be explained by the position of German Chancellor Angela Merkel on the need to stay on course with the current transition to renewable energy sources to avoid similar situations in the future.

Customers are losing faith in their providers

Not surprisingly, people across Europe have less trust in and affinity for electricity providers than prior to the price crisis. However, more painful for these providers is the perception from those paying the bills, who, to an even larger degree, are voicing a loss of faith.

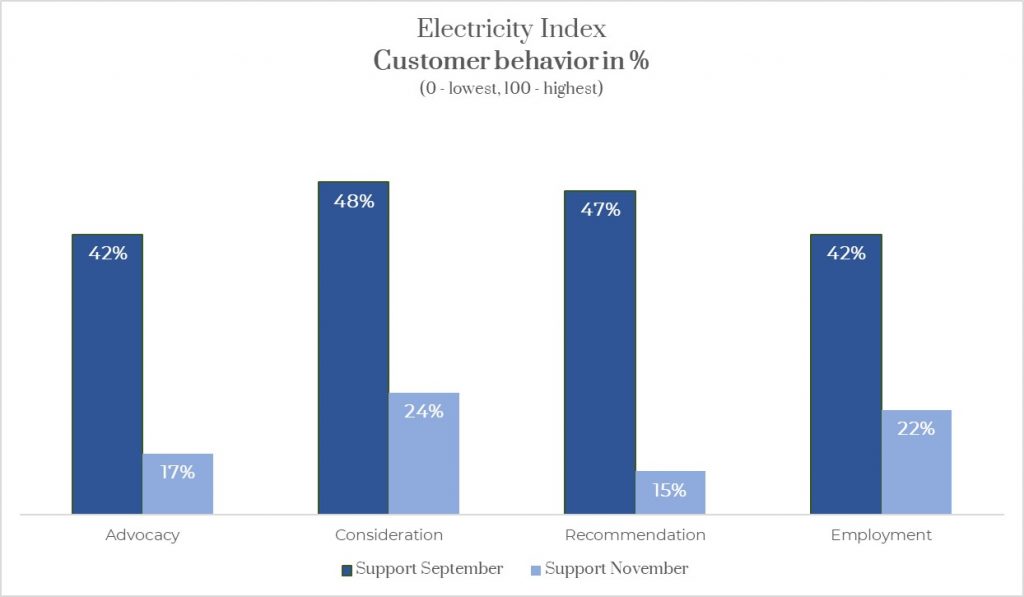

Looking at the likelihood of recommending or considering these companies, customers are putting the hammer down on their service providers. Across markets, customer support drops decisively to levels not seen before, with only 24% indicating an intention to keep buying services from their current providers, and just 15-17% willing to recommend them or advocate on their behalf.

Electricity providers should engage the public – not stick their heads in the sand

While the market situation causing the increase in prices is something largely out of control for the electricity providers, none of the large European providers seems to be focusing on explaining the situation to the public.

Providers are instead focusing on a narrative related to the ongoing COP26, the transition to renewable energy, as well as what consumers can do to be more conscious users of electricity.

While these are valid topics and should by no means be ignored, providers should acknowledge the ongoing price crisis and address this with the public, broadly and specifically, to make sure that perceptions are not driven by an understanding that companies are raising prices for own gains.

Not taking the opportunity to engage will only leave a void to be filled by media and public speculation, which in turn could have more damaging effects on their reputation.

© 2024 Group Caliber | All Rights Reserved | VAT: DK39314320