Our latest energy sector reputation report provides a snapshot of an entire industry – but it also includes rankings of the industry’s best-known companies.

These rankings are based on Trust & Like Scores – our chief metric of a company’s reputation. In other words, they indicate which companies are the most – and least – trusted and liked by the stakeholders we surveyed for the report.

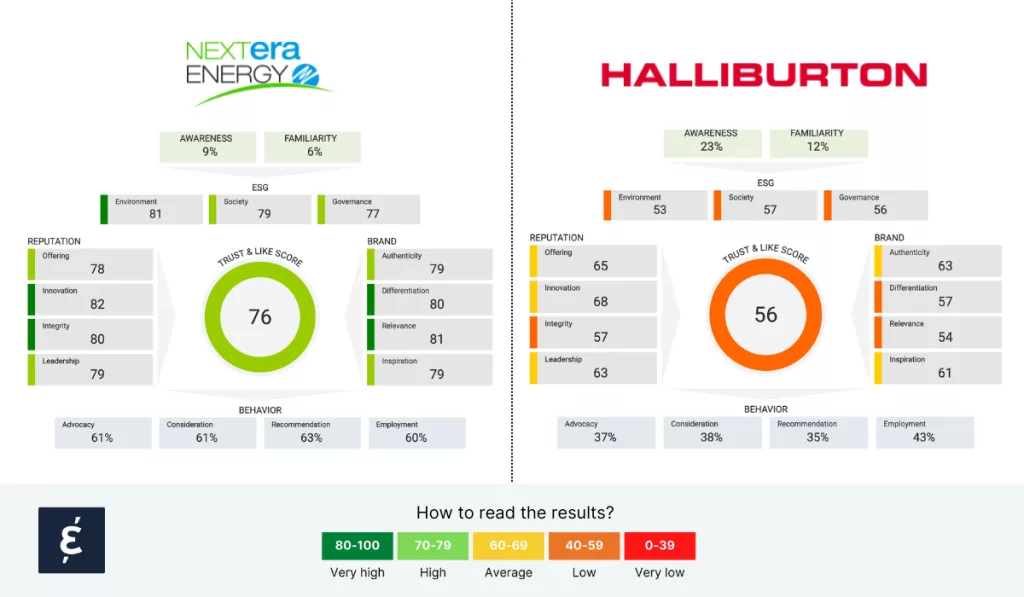

This year, the most trusted and liked American energy company was NextEra Energy.

The world’s largest utility company by market cap, NextEra has been described by Bloomberg as “the closest thing the utilities sector has to a tech darling”.

It generates more wind and solar energy than any other company in the world and its goal is to be emissions free by 2045 – meaning zero carbon emissions, 100% clean energy, at no incremental cost to its customers.

The least trusted and liked American energy company this year was Halliburton.

Founded in 1919, Halliburton is the world’s second largest oil service company and, according to Bloomberg, responsible for most of the world’s largest fracking operations.

Its Wikipedia page lists no fewer than 10 entries under “Controversies and criticism”, including illegal retaliation against a whistleblower, its role in the Deepwater Horizon explosion, which saw the company plead guilty to destroying evidence, and, in the run-up to the Iraq War, a government contract potentially worth $7 billion – for which only Halliburton was allowed to bid.

Do these two biographies explain why these companies find themselves at the opposite ends of the Trust & Like Score ranking?

It’s hard to say. We can only speculate as to what causes one company’s reputation to rise and another’s to fall.

But, as the graphics below show, the differences in stakeholder perceptions of each company go well beyond Trust & Like Scores.

Across every single brand and reputation attribute, NextEra Energy beats Halliburton.

Unsurprisingly, NextEra Energy gets much higher scores for ESG – which reflects the extent to which stakeholders think it has a positive impact on people and the planet, and is ethical in how it conducts business.

But there’s also a 24-point difference in the two companies’ scores for Innovation – which reflects the extent to which stakeholders perceive them as innovative in their field.

And there’s a 27-point difference in their Relevance scores – which reflects the extent to which stakeholders can relate to what they stand for.

NextEra Energy also scores much higher on behavioral attributes – which reflect stakeholders’ willingness to support them, recommend their products or services, or consider working for them if they were looking for a job.

So we’ve got two huge American energy companies, two reputations, and – right now, at least – two different sets of shareholders.

While Halliburton’s share price has gone up in value by 45% over the past year – thanks largely to production cuts by OPEC to support oil prices – “NextEra Energy investors are sitting on a loss of 30% if they invested a year ago,” as one recent headline put it.

Share prices are influenced by numerous factors, of course – input costs, competition, operational efficiency, market sentiment and so on.

Undeniably, the oil sector has thrived in recent years amid supply disruptions and soaring prices driven by geopolitical unrest.

In comparison to the fiercely competitive electricity market, it’s no wonder that oil companies outperform utility providers in stock performance. Still, companies must remain vigilant of reputational blindspots.

For Caliber, of course, doing so is a matter of principle.

We believe that companies that listen to their relevant stakeholders and understand what they think can build more trust – and that being more trusted and trustworthy is one of the keys to being a better business.

But even on a practical level, having a strong reputation can help a company in many ways, from increasing customer loyalty to attracting high-quality talent to retaining employees.

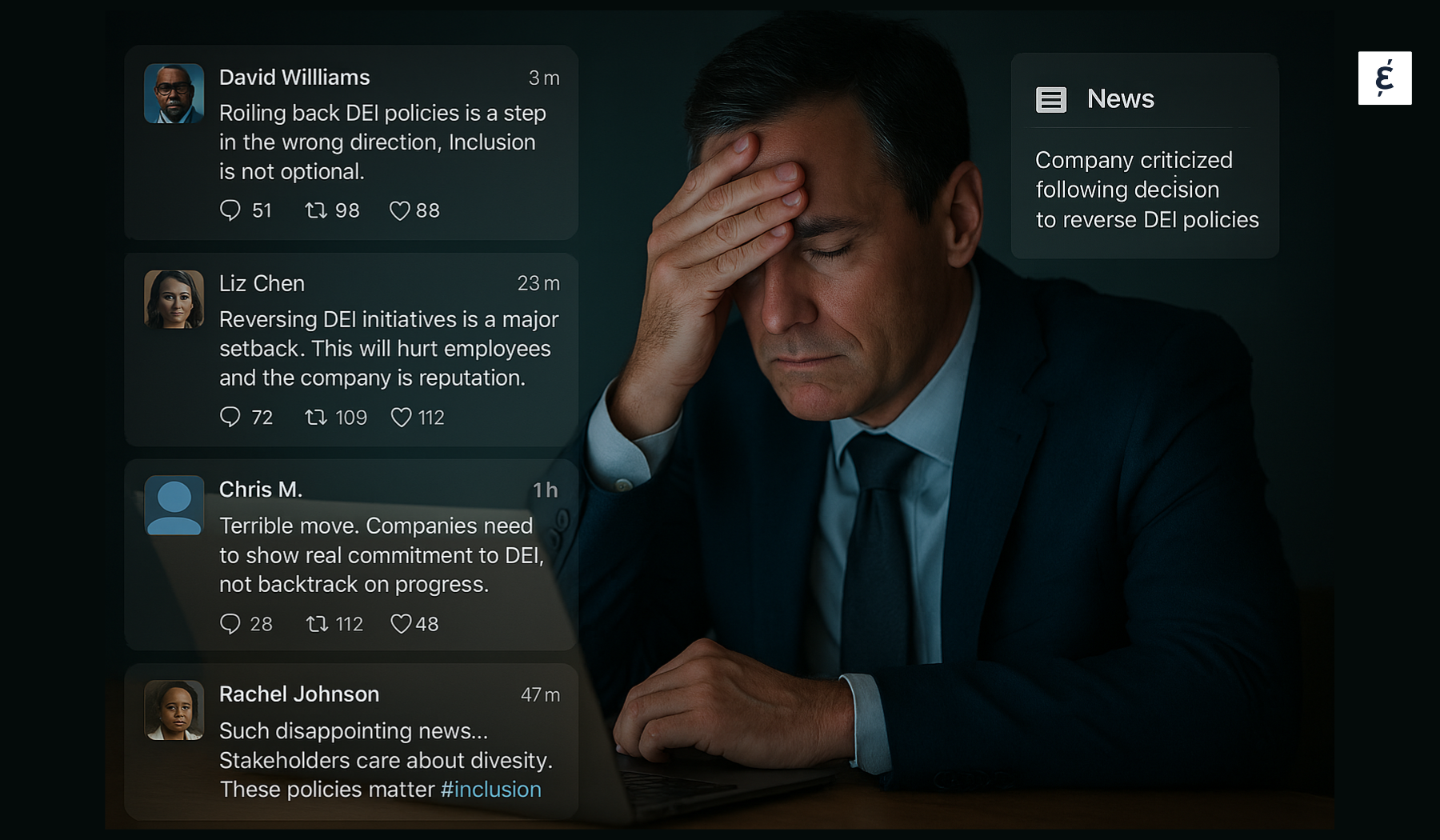

A solid reputation is also a bulwark in any crisis.

For one thing, it can mitigate reputational damage and make crisis recovery shorter and easier.

It can also guide a company’s internal activities and external communications, in real time, allowing it to explain its positions and actions widely and clearly.

Remember – those stakeholders potentially include employees, consumers, customers, partners, suppliers, regulators, shareholders, opinion leaders and the media.

And a crisis need not be sudden or external.

If a company fails to please shareholders by providing returns at or above expectations, then a less scrutinized rival – with a better reputation – may well take its place.

In other words, a company’s reputation is the foundation it’s built on.

A company built on sand can easily rise higher and higher – but there’s little to stop it from tumbling down when the hurricane strikes.

By contrast, the company whose foundations extend deep into solid ground – that is, the company that maintains a strong reputation with its stakeholders, the company that’s actively building trust – is much more likely to withstand the mightiest of storms.

The lessons for both NextEra Energy and Halliburton should be abundantly clear.

© 2024 Group Caliber | All Rights Reserved | VAT: DK39314320