Global perceptions of America have plummeted amid Donald Trump’s second term — and the conventional wisdom is that the president is tarnishing Brand America’s reputation, too. From Axios to Newsweek, a slew of headlines warn of trouble for US companies overseas in the form of boycotts, slowing sales, and the need to downplay their Americanness. The thinking is that America’s polarizing president, who’s slapped tariffs on dozens of countries and steered his country sharply to the right, must also be bad for American business abroad.

But the evidence suggests otherwise.

Our stakeholder intelligence data reveals that the reputation of corporate America has remained strong outside the US during Trump’s presidency. In Europe and Asia, household names are holding their ground — in some cases, even gaining in trust and likeability since Trump’s second term of office began. In other words, American companies are more resilient to the “Trump effect” than you might think.

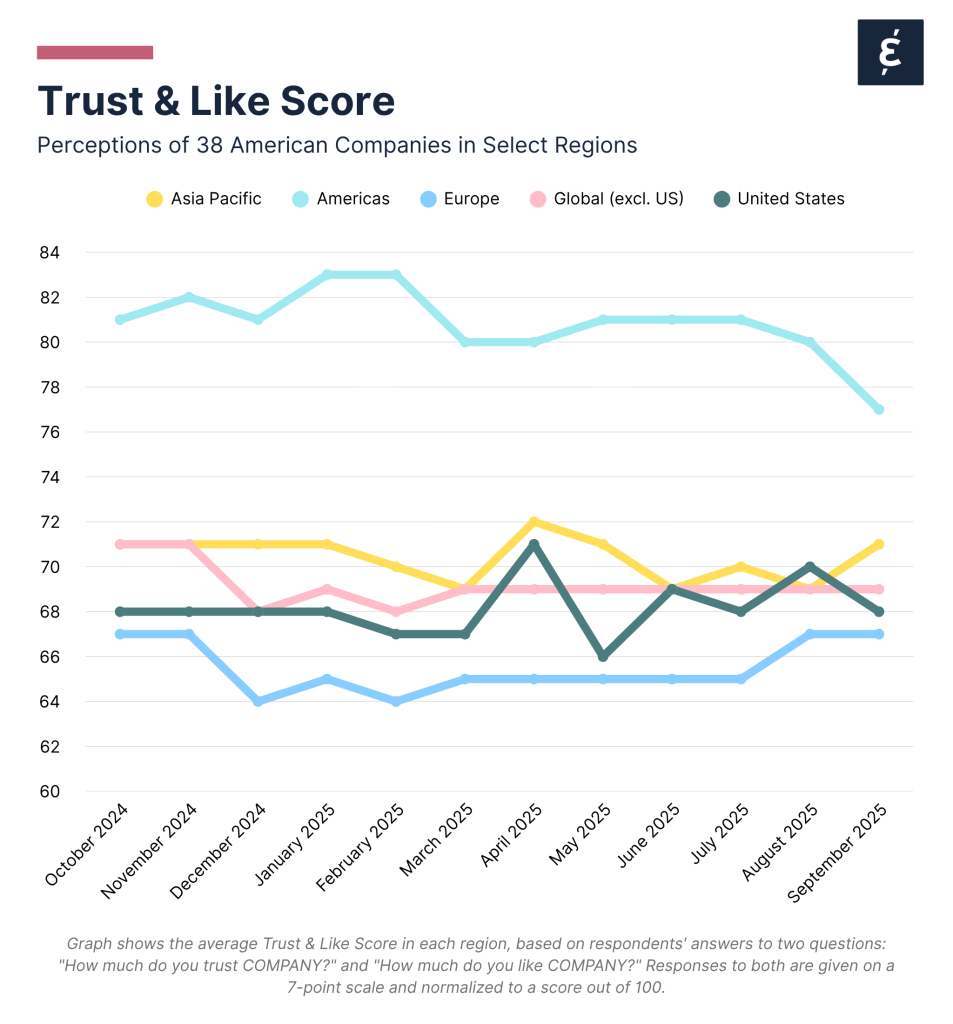

We analyzed 38 American companies continuously tracked in our industry indices and compared their average Trust & Like Scores before and after Trump’s return to the White House.* The results may come as a surprise:

So while Trump may be reshaping America’s reputation abroad since January 2025, he isn’t reshaping how people abroad see American companies.

Take Coca-Cola, McDonald’s, and Procter & Gamble — all of which launched “we’re actually local” ad campaigns in Europe this year. The implication was obvious: don’t hold our Americanness against us.

And yet, our data suggests those campaigns may not just be defensive — they may be working.

Instead of being punished for their US roots, these brands are thriving — perhaps because their carefully tailored campaigns reassure consumers that they belong everywhere, not just in America.

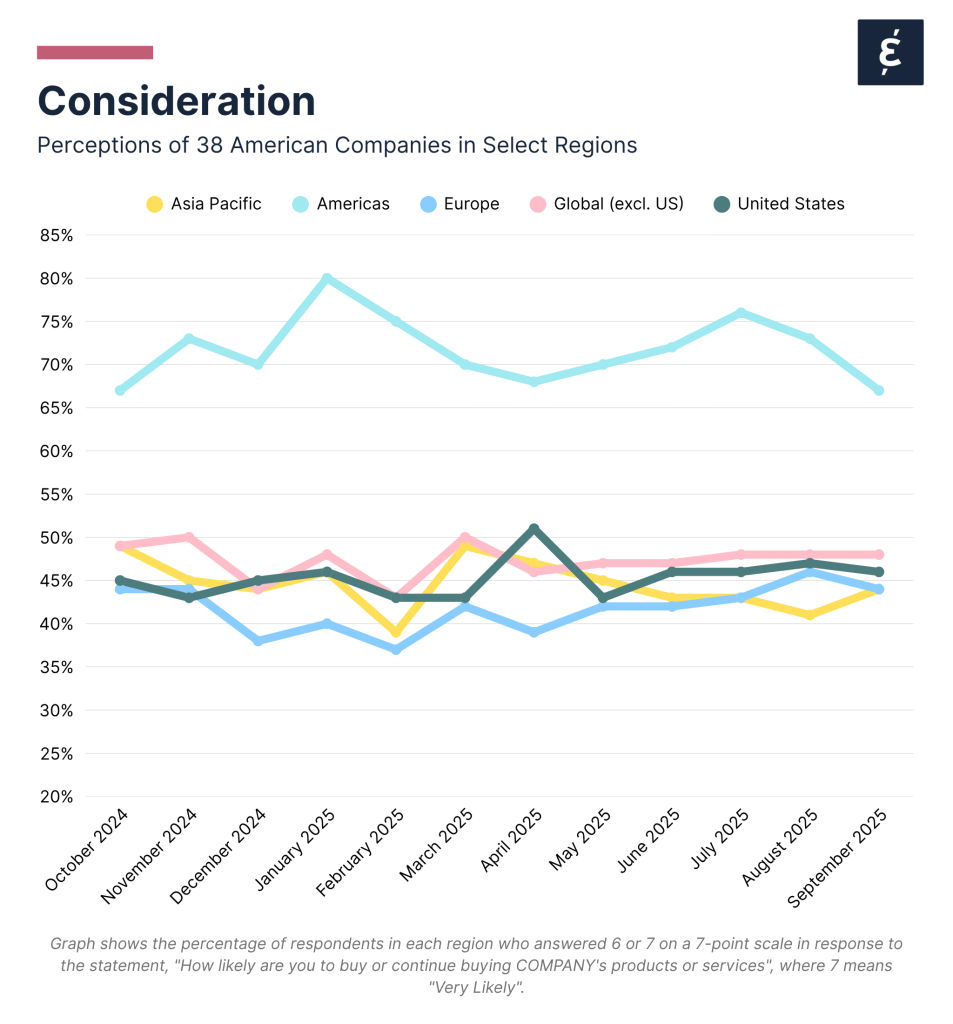

Of course, trust is one thing, actual stakeholder behavior another. According to a recent Ipsos survey, global purchase intent for US brands has plummeted. But our data tells a more nuanced story.

Across the 38 companies we track, the overall share of people outside the US saying they would “buy or continue to buy” those companies’ products and services — aka the Consideration rate — hasn’t changed since Trump returned. In fact, it’s still slightly higher abroad (48%) than it is at home (47%).

But the regional picture is shifting:

So while buying behavior hasn’t collapsed, it is moving. And in some regions, the political climate may be starting to bite.

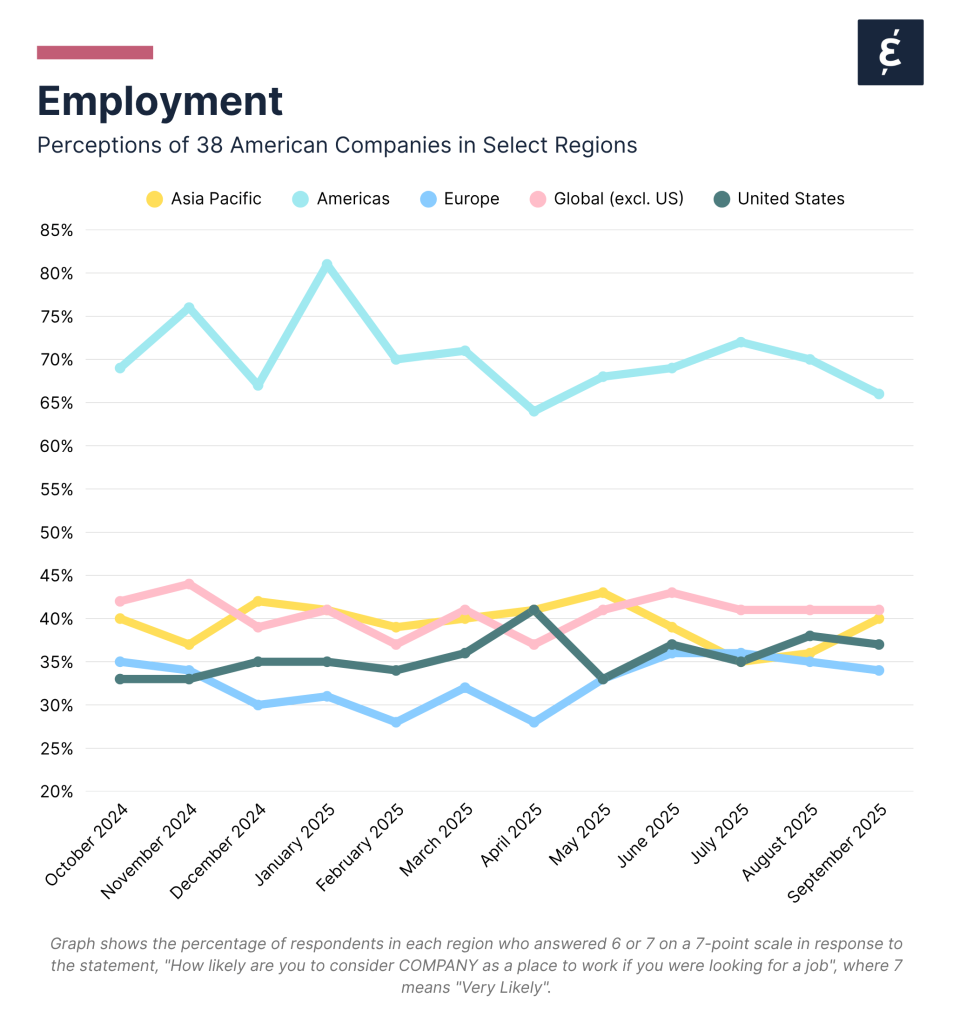

Reputation isn’t just about whether people buy your products — it’s also about whether they’d want to work for you. Caliber’s Employment rate — the share of respondents who say they’d consider a company if they were looking for a job — offers another lens on how US brands are faring during Trump’s second term.

Here, the story is more mixed.

Regional patterns sharpen the picture:

In short, it’s in the Americas, not Europe or Asia, where Brand America’s reputational stock has fallen most sharply.

Three insights stand out for corporate reputation, brand, and communications teams:

1. Trust is steady, but buying behavior is shifting — and it’s not uniform. Across the board, people still trust American brands. But their intention to buy is moving, especially in the Americas, where the Consideration rate is falling fast. Europe looks more stable, while Asia shows early interest that’s now cooling. These trends matter for local marketing and commercial strategy.

2. People still trust American companies — but working for one is a different story. Trust and purchase intent remain relatively strong, even in regions where America’s political brand is under pressure. But when it comes to employer appeal, the bar is higher. In the Americas and parts of Asia, fewer people say they’d consider working for a US company. That suggests a job carries more personal weight than a product — and political perceptions may be making that leap harder. HR and comms teams will need to work harder to rebuild that sense of belonging.

3. Strong reputations are still the best insurance. Coca-Cola, McDonald’s, and P&G show that trusted brands can weather political storms. Their reputations as employers and consumer brands alike are cushioned by decades of equity. For others, the lesson is clear: build trust now, so politics can’t erode it later.

The takeaway: America’s political brand may be bruised, but corporate America can still thrive abroad — provided companies actively shore up trust, localize where it counts, and pay attention to how their employer brand plays in different regions. Indeed, armed with Caliber’s stakeholder intelligence insights, now could be the perfect time to double down on awareness and promotion outside the US.

* The companies tracked are: 3M, Allstate, Alphabet, Amazon, Apple, AT&T, Bank of America, Caterpillar, Citibank, Comcast, Costco, CVS Health, Dow, Duke Energy, DuPont, ExxonMobil, Ford, General Electric, GM, IBM, J&J, JPMorgan Chase, Kimberly-Clark, McDonald’s, Merck, Meta, Metflife, NextEra Energy, P&G, Pepsico, Pfizer, Coca-Cola Company, The Home Depot, Walt Disney Company, Verizon, Walmart, and Whirlpool. All data was collected between 1 January 2024 and 3 October 2025. The average monthly sample size in the US was 2,000; the average monthly sample size outside the US was 5,000.

You may also be interested in: