Our research reveals that European stakeholders have clear expectations — and that corporate silence, while often seen as risky, isn’t always viewed negatively.

We asked over 4,000 people across five European markets* how companies should act and communicate when tariffs hit.

Here’s what we found.

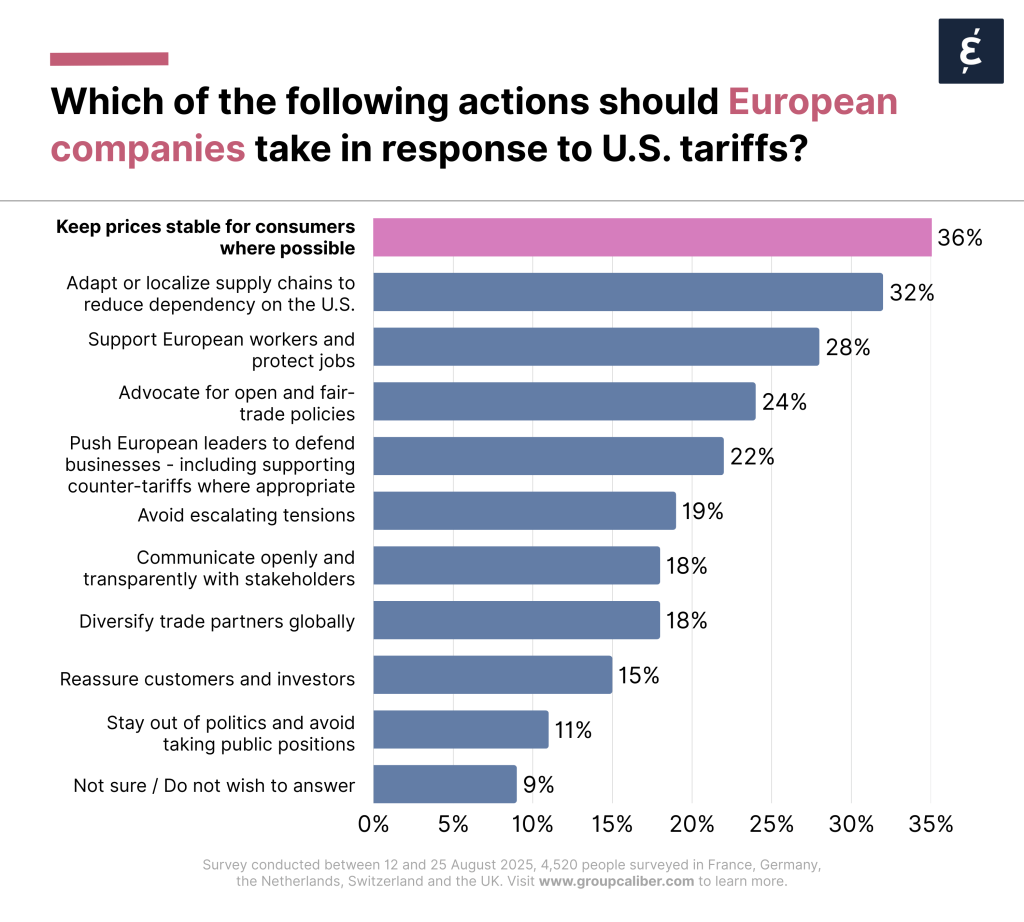

The top responses to how companies should react to tariffs were:

While these were consistent across most markets, there were notable regional differences.

“Advocate for open and fair-trade policies” ranked fourth overall (24%) — but was higher in the UK (28%, Germany (29%), and the Netherlands (28%) — where it was the number-two answer. In France, though, just 12% supported this option, making it the least popular answer. Similarly, only 19% of Swiss respondents chose it.

A clear majority of Europeans (34%) want companies to communicate proactively with clear updates across multiple channels when US tariffs affect their operations. In the UK, that figure is 45%. The next highest response — “Only when there’s concrete impact” — trails at 17%, and gets the most support in the Netherlands (23%).

Only 8% of respondents believe companies should stay silent or communicate “quietly” — and fewer still in the Netherlands (4%).

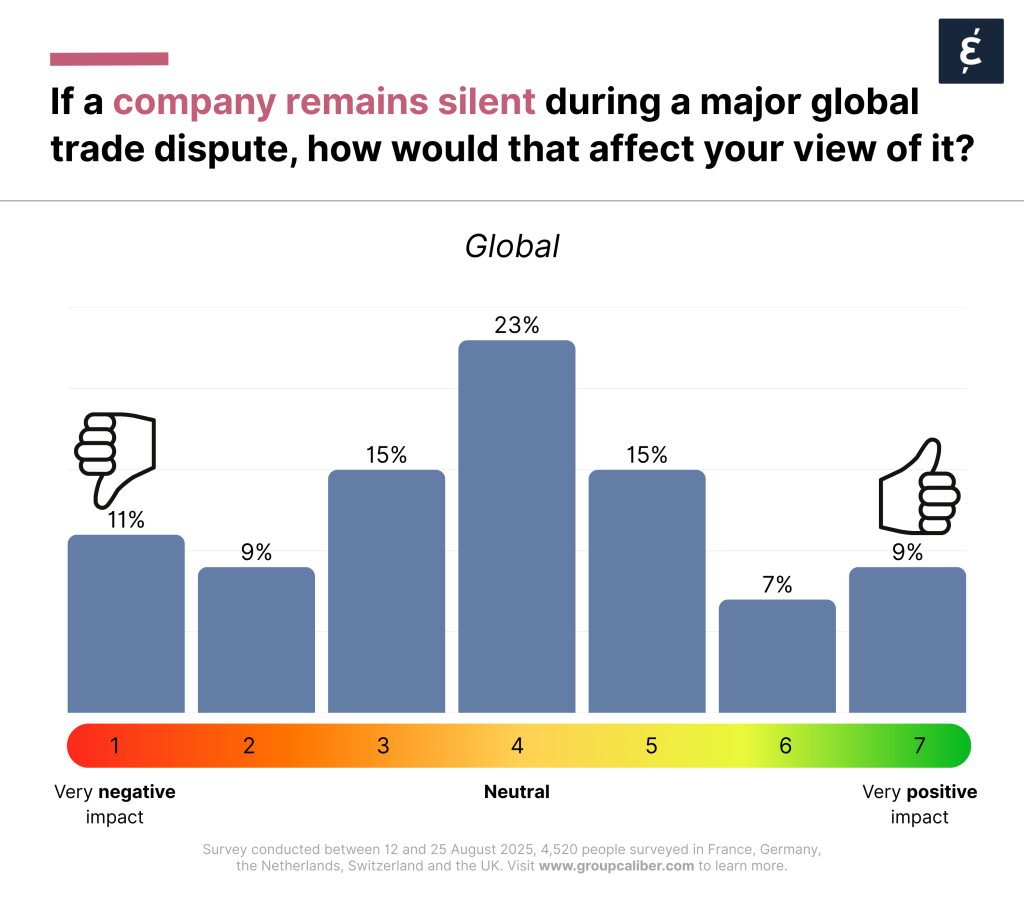

When asked how “remaining silent during a major trade dispute” would affect their perception of a company:

Uncertainty is twice as high among women (12%) as it is among men (5%). Women are slightly more likely to prioritize price stability (38% vs. 34%), while men favor more assertive approaches, like pushing European leaders (25% vs. 20%).

Younger people (18–34) are also much more likely to support communicating openly and transparently with stakeholders (22%) compared to those aged 45–75 (13%).

On both sides of the Atlantic, stakeholders want companies impacted by the trade war to be transparent and communicate clearly with them.

As we saw above, 34% of respondents in Europe said companies subject to US tariffs should communicate “proactively with clear updates across multiple channels”.

In the US, 37% said companies impacted by tariffs should “be transparent about the impact” (and these were the top answers in each region).

A minor difference is that Europeans place slightly more emphasis on keeping prices stable (36% vs. 26% of Americans, though the question was framed slightly differently).

But overall, stakeholders in both regions see corporate openness around tariffs as key.

1. Align messages with public priorities

Keep communication focused on stability, action, and fairness. “Keep prices stable” and “Adapt or localize” resonate across most markets — messaging should reflect that.

2. Don’t underestimate silence — but use it wisely

While proactive communication is the public’s top choice, silence isn’t always harmful. Among younger stakeholders, high earners, and SoMe influencers, restraint may build trust, support, and positive perceptions.

3. Tailor messaging by age and gender

Women are more uncertain but lean toward stability. Men prefer assertiveness. Younger groups want transparency and reassurance; older groups are less focused on comms.

4. Localize by market and mindset

Different countries respond to different cues. Relatively speaking, the Dutch expect proactive communication, Germans lean towards more operational responses, and the French prioritize protecting jobs. Use local insights to shape tone, priorities, and timing — a single message won’t work everywhere.

James is a communications strategist and senior content lead at Caliber, where he writes about corporate reputation, stakeholder intelligence, and brand trust. He draws on more than a decade of experience helping organizations turn data into stories that build credibility and connection.

Follow Caliber

Get the results of our latest research directly in your inbox!