The DAX 40 index underwent a major change in 2021, as it expanded from DAX 30 to DAX 40, adding 11 new companies to the index.

The expansion means that 94 percent of the value of listed companies in Germany is represented in the DAX 40 – and, as a result, the index can now be considered an even better yardstick for stakeholder perceptions of large companies in Germany.

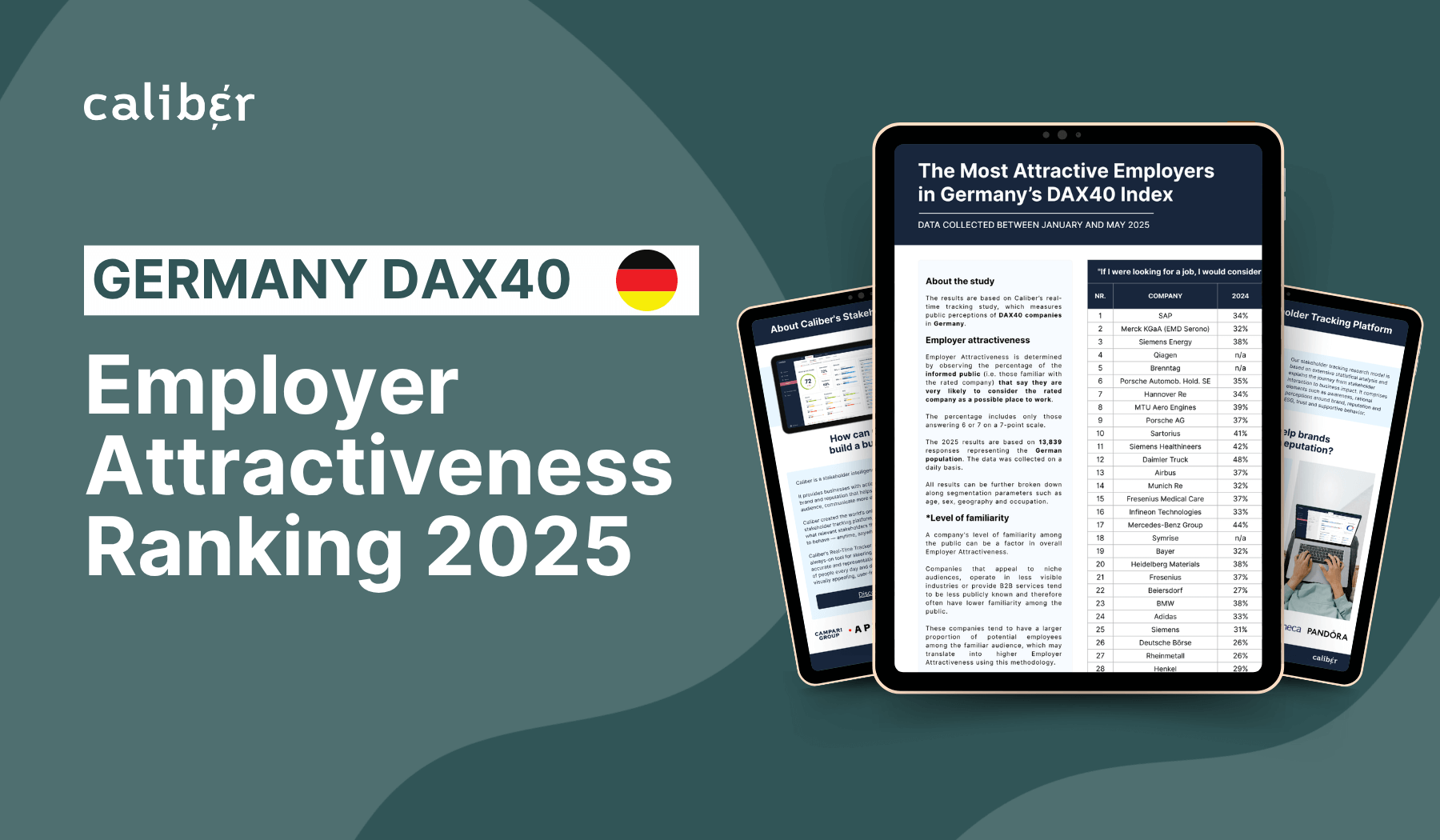

The top 5 changes yet again; new entrants disrupt the ranking, and several companies at the bottom of the list significantly improve their scores.

Overall, the average score for the index trends positively and signals a returning optimism around large companies in the German market.

Adidas remains the most trusted and liked company by the German public, but now it shares top billing with Siemens Healthineers – one of three Siemens companies now in the DAX 40 index.

Close behind them is Puma, while BMW comes in fourth. The top 5 is rounded off by Deutsche Post.

Adidas remains the most trusted and liked company by the German public, but now it shares top billing with Siemens Healthineers – one of three Siemens companies now in the DAX 40 index.

Close behind them is Puma, while BMW comes in fourth. The top 5 is rounded off by Deutsche Post.

One of the companies with a strong performance in 2021 is BMW, whose Trust & Like Score (TLS) jumped by an impressive 7 points.

It is likely attributable to record sales and ambitious sustainability targets.

This increase catapults the company from 16th place in 2020 to 4th place in 2021, making it the biggest climber of the year.

In addition to BMW, Volkswagen Group and Mercedes Benz Group (formerly Daimler) also saw improved stakeholder perceptions in 2021 despite being heavily challenged by supply chain issues and semiconductor shortages during the year.

The strong performance of the industry could be related to these main players’ increasing focus on the transition to electric vehicles.

Another strong recovery in 2021 is seen with Deutsche Bank. The company improved its score by 7 points, though without a change in its relative position in the index.

The improved perception among stakeholders most likely can be traced to a general shift in direction from the bank.

In September, CEO Christian Sewing emphasized the need to invest more in sustainability and entrepreneurship to make sure that the German economy stays robust and healthy for the future.

In November, the bank was named the best private bank in Germany and additionally improved its S&P rating, both factors showing growing confidence in the bank.

Overall, the DAX 40 index average increased by 2 points, and eight companies showed significant increases that helped them recover from declines in TLS in 2020.

Volkswagen Group is the only company to have a significant improvement in stakeholder perceptions both in 2020 and 2021, which could be an indication that the company has begun a path to recovery in stakeholder perceptions.

The new ranking also means that the TOP 5 looks vastly different from last year, where Munich Re, Henkel, and Fresenius Medical Care were all represented.

This year, only the latter is found in the TOP 10 Regrettably, the success story of Munich Re in 2020 has reversed as it dropped 3 points and now sits as 21st in the ranking, its lowest placement in three years.

A strong indication of a general recovery for the index is that most of the TLS improvements are found in the bottom 10 companies. Deutsche Bank and Bayer both greatly improve scores, while BASF, Volkswagen Group, and RWE also tick upward.

These companies are all in industries that are typically more scrutinized when it comes to reputations, and the significant improvements they make are a signal that public trust in German companies was growing in general in 2021.

It appears that large companies in Germany for the most part have shed the negative influence of the pandemic over the course of 2021.

The trajectory for the index in 2021 held a strong promise with fresh new entrants and a recovering economy.

However, with two months into 2022, we can already see that the DAX 40 reputation index has suffered significant losses and is now at the same level it was at the beginning of 2021.

2022 will hold many challenges for public trust in business. New crises are brewing with factors like rising inflation, a global energy crisis, and not least the war in Ukraine looking to significantly impact the financial performance and stakeholder perceptions of companies in Germany in 2022.

ABOUT THE STUDY:

The results are based on Caliber’s Real-Time Tracker which measures public perceptions of the DAX 40 companies in Germany on a daily basis. The scores underpinning the ranking are based on the average responses to 2 separate questions on a 1-7 scale: To what extent do respondents trust and like each company?

The scores are then normalized into a 0-100 scale without any weighting or adjustments. The 2021 Full Year results are based on more than 22,000 evaluations collected on a daily basis throughout the year from approx. 11,000 unique respondents, representing the German population along key demographic indicators.

© 2024 Group Caliber | All Rights Reserved | VAT: DK39314320