Public sentiment towards business stumbles as Germany records the weakest annual growth since 2013.

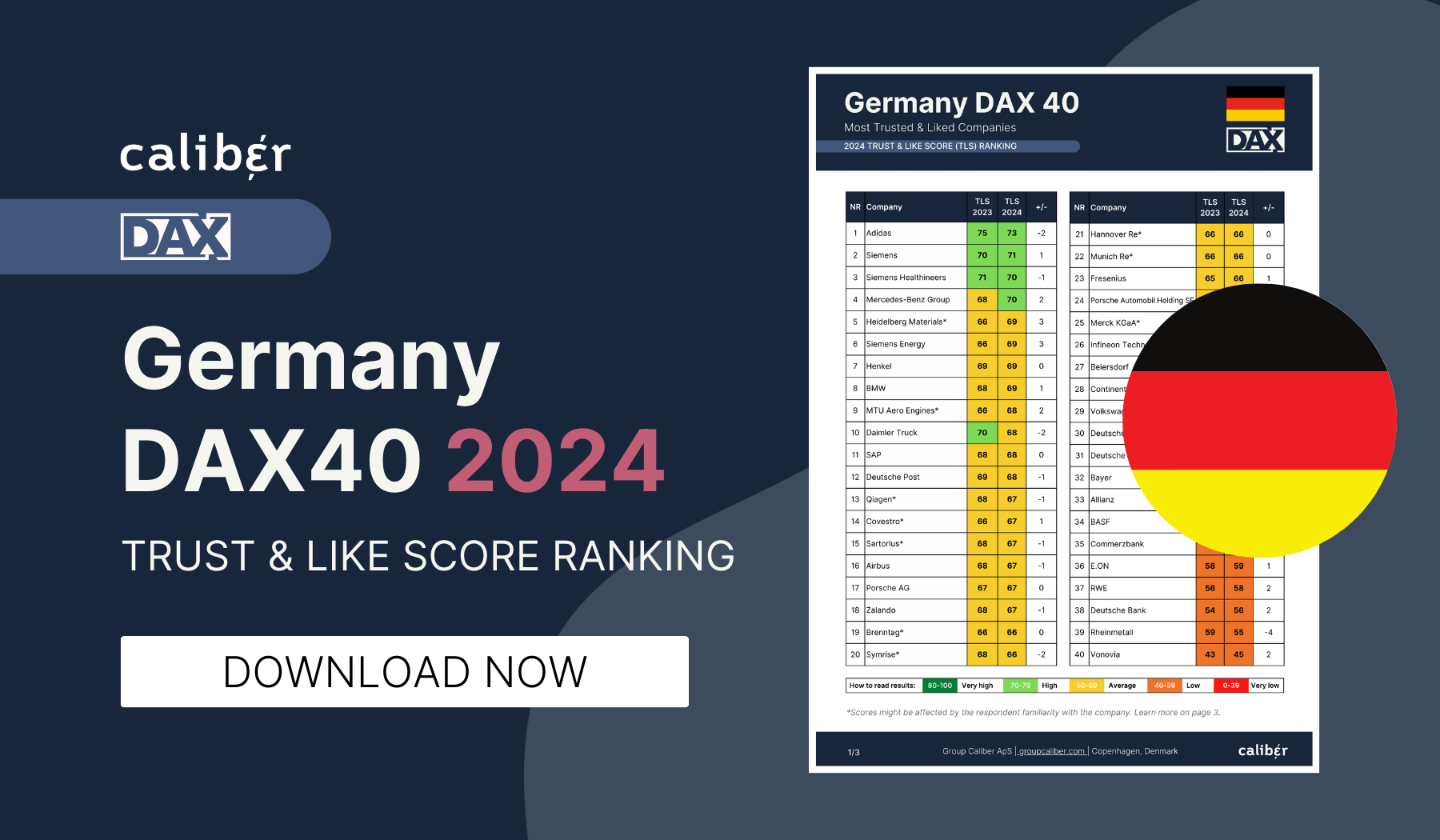

Production slowed, worldwide demand for capital goods declined and the overall average Trust & Like Score (TLS) for Germany’s DAX 30 companies fell by more than one point in 2019.

At the beginning of the year, public sentiment remained rather stable but began to drop off as political uncertainty rose prior to the European Parliament election in the second quarter.

The decline in TLS continued after the election and bottomed out in Q3 with a hint of optimism as we were nearing the new decade. The cumulative Trust & Like Score for 2019 totaled 61.2.

With half of the DAX30 companies experiencing a significant drop in reputation amongst the German public, which ones managed to overcome the barriers of 2019?

Adidas earned 1st place in the ranking and the title of Germany’s most trusted and liked company. The sportswear giant has been using business as a force for good last year helping to solve the pay gap between men and women athletes in the FIFA World Cup.

The company also released an inclusive, gender-neutral clothing line with Beyoncé, as well as a 100% recyclable running shoe to help move into a more circular economy. While Adidas is still largely perceived as being product-driven, the German public is viewing the company as becoming more purpose-driven with improvements in integrity, authenticity, and relevance.

Last year’s favorite, Siemens, moves down to 2nd place in the ranking, perhaps due to the company’s latest restructuring resulting in job losses, something that typically has a negative pull on a company’s reputation.

More negative news came later in the year when the conglomerate faced criticism over the controversial Adani deal as a ‘carbon bomb the world cannot afford’.

While the restructuring announcements happened throughout the year, Siemens’ most significant drop in reputation occurred in the 4th quarter – suggesting the Adani deal may in fact be affecting people’s perceptions of Europe’s largest industrial manufacturing company.

Following Adidas and Siemens, Linde moves into 3rd place. The world’s largest provider of industrial gases has had a good year following the merger with Praxair in late 2018 and has been recognized as a leader in diversity and inclusion.

As the finance industry has been working hard towards overcoming the damages of the financial crisis, it appears to be a good year for Munich Re and Commerzbank seeing significant improvements in TLS for 2019.

Allianz also saw improvements – though not statistically significant ones. Deutsche Bank, however, was the only German financial player to miss the trend. The raid late in 2018 regarding Deutsche Bank’s relation to the Danske Bank money laundering scandal may have left a bad taste in people’s mouths as the most significant drop occurred in Q1 2019, and the bank’s woes continued throughout 2019 as it struggled to regain lost ground.

German auto giants BMW (-3.1 points) and Daimler (-3.0 points), as well as component manufacturer Continental (-2.6 points), seem to have started feeling the heat in the wake of recent structural changes in the automotive industry.

As companies navigate falling profits, a global trade war, and the transition from combustion engines to electric vehicles, improving reputation in the German automotive industry may start feeling like the transmission is impossible.

However, it appears one player has managed to rise from the crashes. Volkswagen scraped the bottom of the DAX30 reputation ranking since the ‘dieselgate’ incident – which we later learned applied to other German carmakers as well, possibly adding another reason for the industry’s overall downward trend in 2019.

Yet despite the decline in the industry, VW is finally beginning to see significant improvements in perceptions. While it may be a sign that perceptions of the automotive industry are becoming less polarized, it may also have to do with the successful release of the all-electric ID.3 to help signal a new climate-friendly direction for the company to lead the way to become the world market leader in e-mobility.

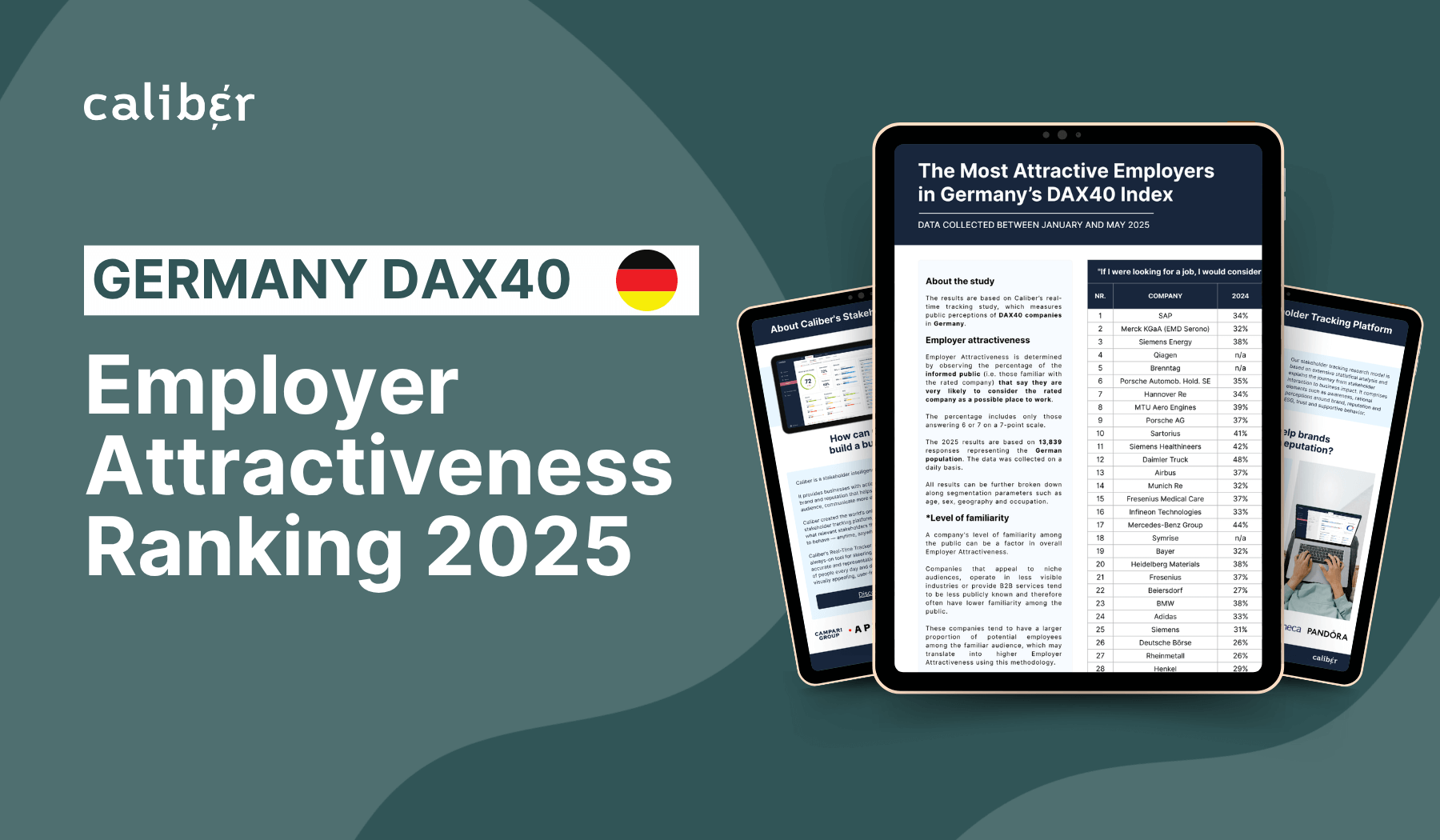

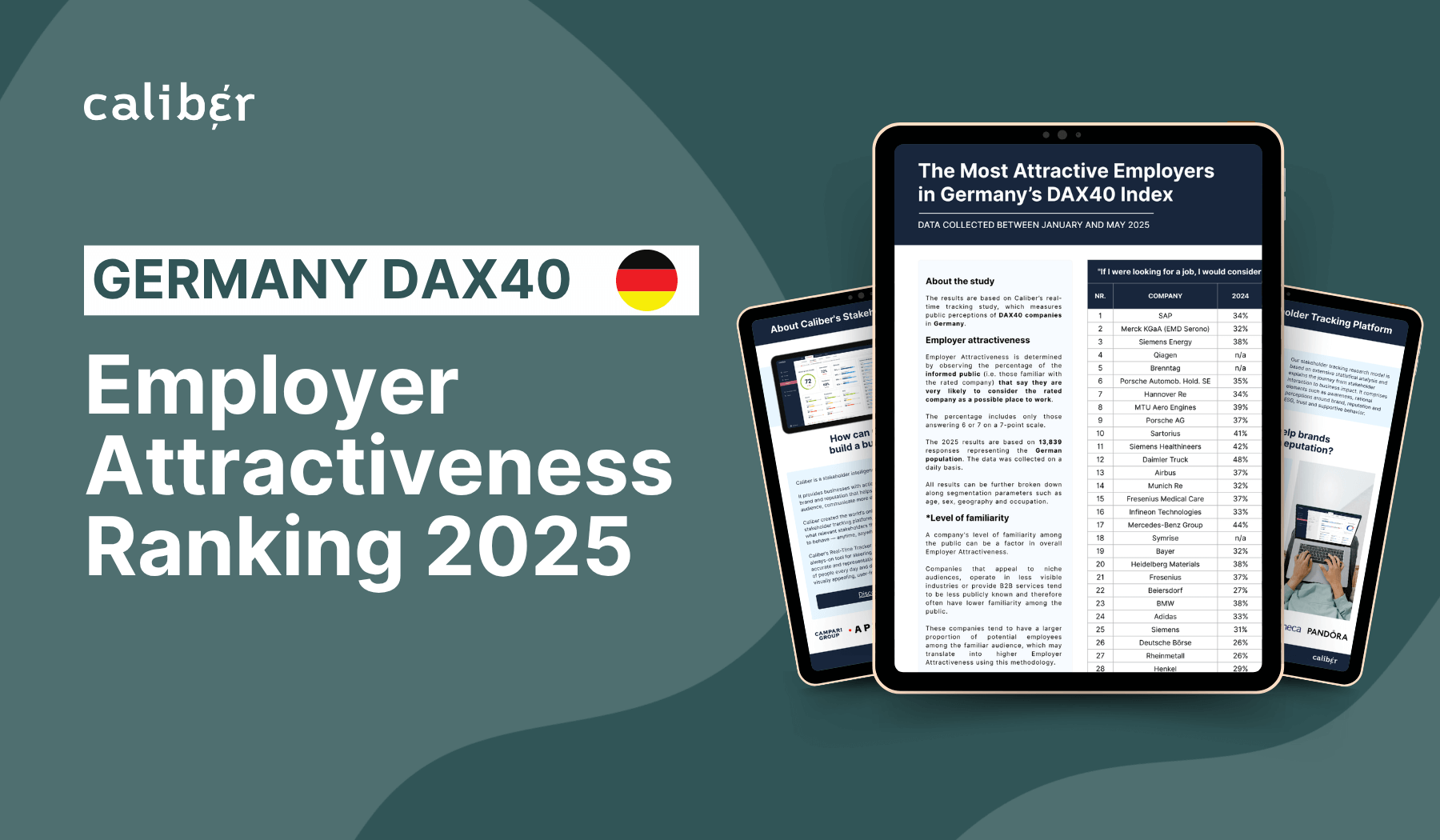

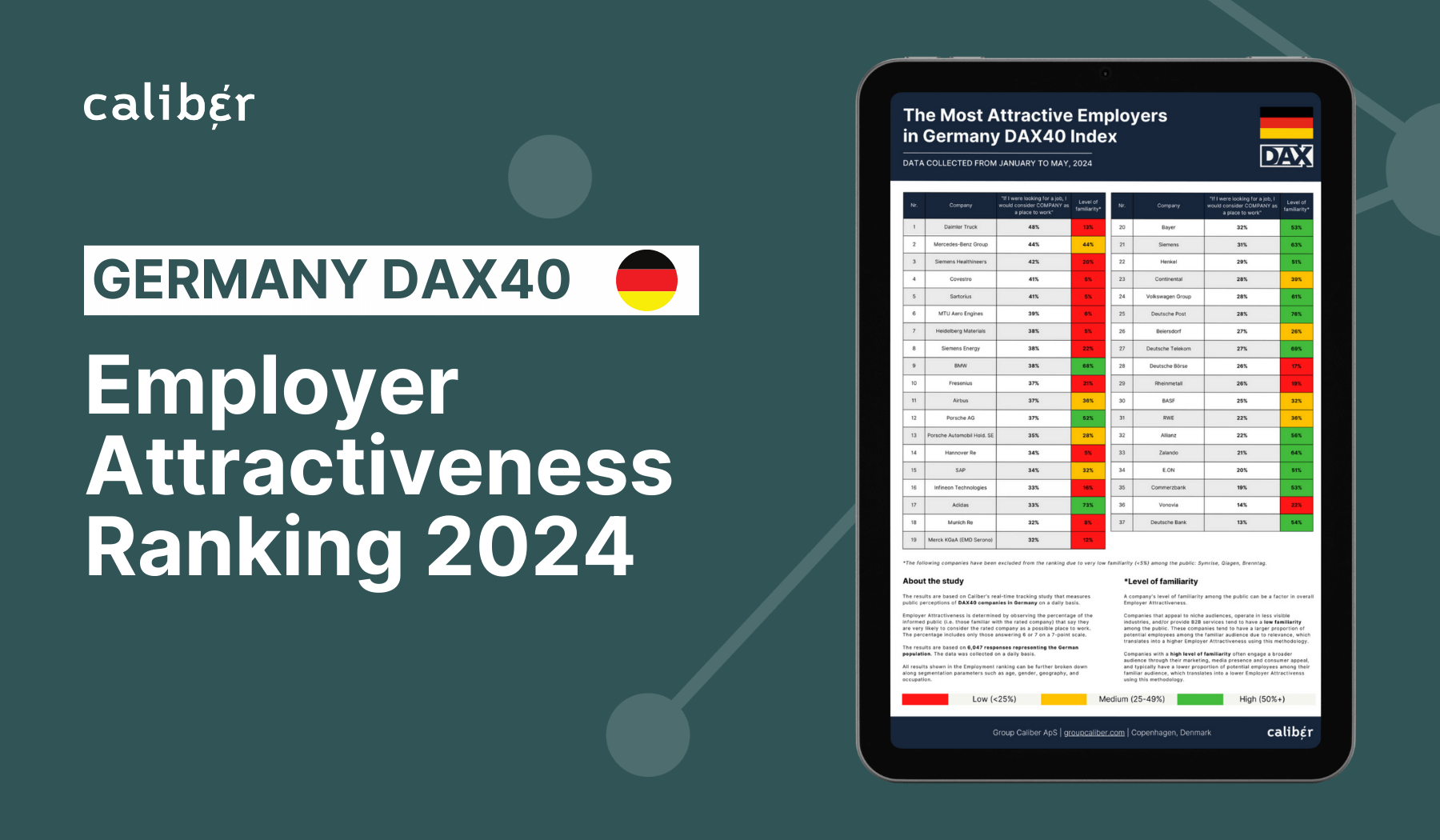

When it comes to public perceptions of the DAX30 companies as attractive employers, it was interesting – and surprising – to find somewhat of an inverse relationship between familiarity levels and employer attractiveness.

While companies like BMW and Daimler (in the green quadrant below) are some of the most attractive employers despite declining TLS – it’s companies like SAP and Munich Re (blue quadrant) who may have a brighter future in this respect, given their high employer attractiveness despite low familiarity levels, and considering their stable or improving reputations.

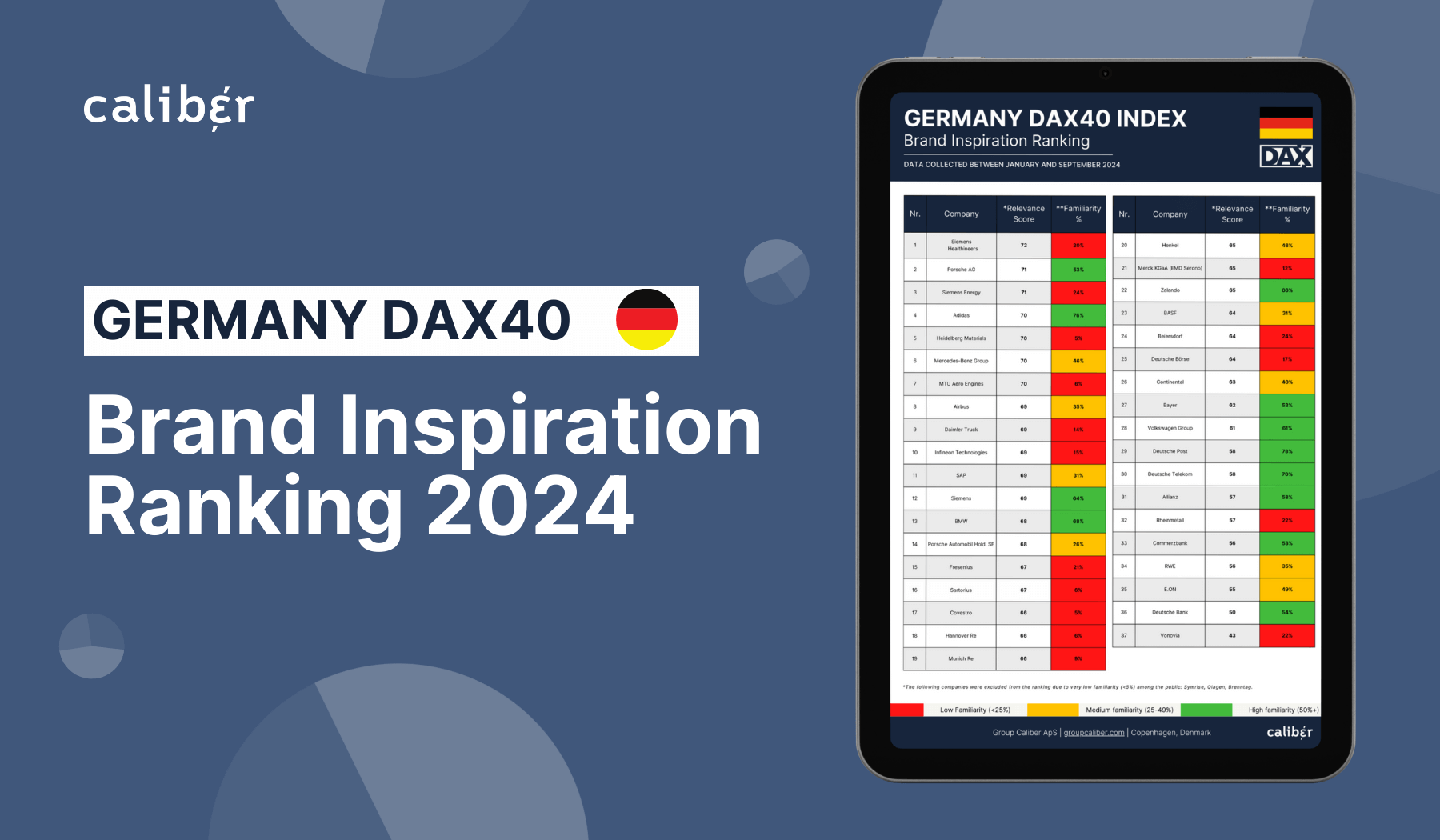

Overall, trust in and affection for the DAX30 companies are falling. The older generations feel companies aren’t responsible enough while the younger generations feel business overall lacks differentiation. Regional differences have people in disagreement, yet nearly everyone agrees German companies need more purpose.

It seems people want to see more of the iconic German engineering put towards helping solve problems in society. We are on the cusp of radical transformation across numerous industries which will require radical corporate changes and with it the dawn of a new form of corporate character.

© 2024 Group Caliber | All Rights Reserved | VAT: DK39314320