Caliber is setting a new standard for ESG reputation tracking, helping companies close the often-overlooked gap between what they do and how those efforts are perceived.

As businesses face increasing pressure to address and report on their environmental, social, and governance performance, understanding ESG reputation – the public’s perception of those efforts – has become more important than ever. Stakeholders are paying closer attention, expectations are rising, and transparency has become the default rather than the exception.

There’s no doubt that many companies are genuinely doing more to meet their ESG goals. In many cases, they’re motivated not only by compliance but also by the desire to become more attractive to investors, talent, and customers.

But that leads to a crucial question:

Do companies really know how their efforts are perceived by the public?

Time and again, we see a disconnect between reality and perception, often unintentionally created by gaps in communication, visibility, or familiarity.

At Caliber, we strongly believe that simply measuring ESG performance is not enough.

Companies need to understand how those efforts land with the people who matter most. Without stakeholder intelligence, ESG strategies risk becoming disconnected from audience expectations and from the corporate reputation they are meant to strengthen.

This is why ESG reputation tracking has become an indispensable component of our stakeholder intelligence platform. It helps corporate communications leaders understand how stakeholders interpret their ESG efforts, identify blind spots, and communicate progress more clearly and confidently.

Ultimately, tracking ESG reputation allows companies to manage risks more effectively, build trust, and sharpen their competitive edge.

This connection between CSR and ESG reputation becomes even clearer when you look at how CSR influences the relationship between companies and their stakeholders.

When CSR is done well, it helps build a positive emotional bond with both employees and customers who want to support organizations that reflect their own values. People feel more engaged and motivated when their company contributes to causes they care about and customers are more inclined to choose brands that demonstrate genuine social responsibility.

But for these efforts to truly strengthen a company’s ESG reputation, stakeholders must know about them and believe they are authentic.

That’s precisely why tracking perceptions is so important: it closes the gap between the CSR initiatives a company invests in and the trust those initiatives are meant to create.

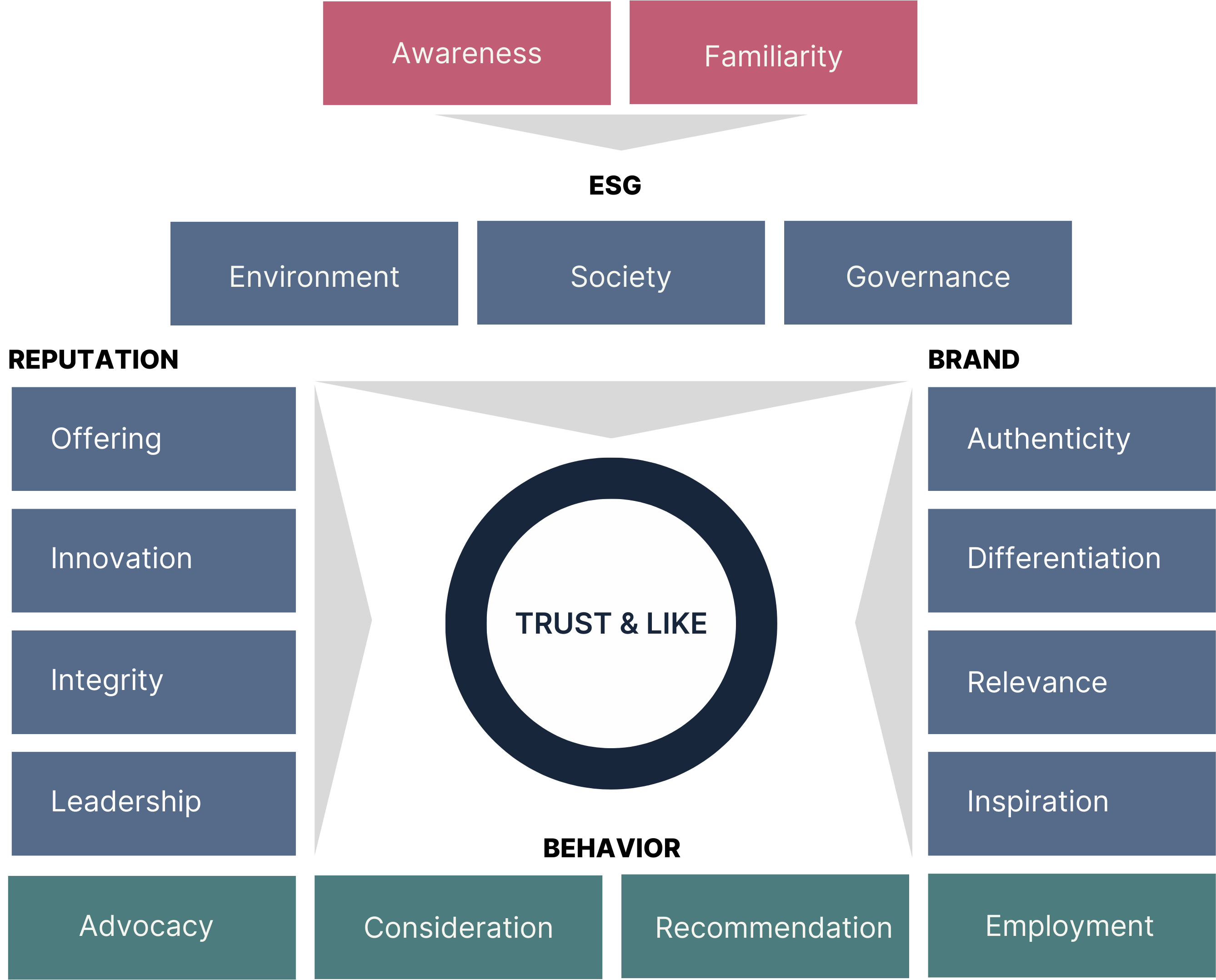

Caliber’s approach to ESG reputation tracking focuses on how a company is perceived across the three ESG pillars. Instead of relying solely on published facts or reports, our model captures real-world stakeholder evaluations:

Impact on people, the planet, and society

Ethical behavior and integrity

Awareness and familiarity with the company’s ESG activities

The data is gathered through Caliber’s stakeholder intelligence platform and is designed to reveal both strengths and gaps in how a company’s ESG commitments are understood.

Crucially, our scores are based on evaluations from people who are highly familiar with the companies they assess, making the results a meaningful indicator of whether the company’s ESG efforts are actually being recognized by its target audiences.

Companies that address ESG issues effectively, and are seen as doing so, can strengthen trust and brand credibility. This can translate into higher customer loyalty, stronger employee engagement, and greater appeal to investors.

From consumers to regulators, stakeholders are increasingly aware of ESG issues. Tracking ESG perceptions helps companies understand whether their actions meet stakeholder expectations or if communication needs to improve.

Reputational risks often emerge from perception gaps. Understanding how ESG efforts are viewed allows companies to anticipate and mitigate potential issues before they escalate.

Publicizing ESG efforts is not enough. Tracking perceptions helps companies communicate more effectively, build trust, and ensure their progress resonates with different stakeholder groups.

A strong ESG reputation can be a significant differentiator. Companies that are trusted to act responsibly tend to attract more attention, more candidates, and more investment.

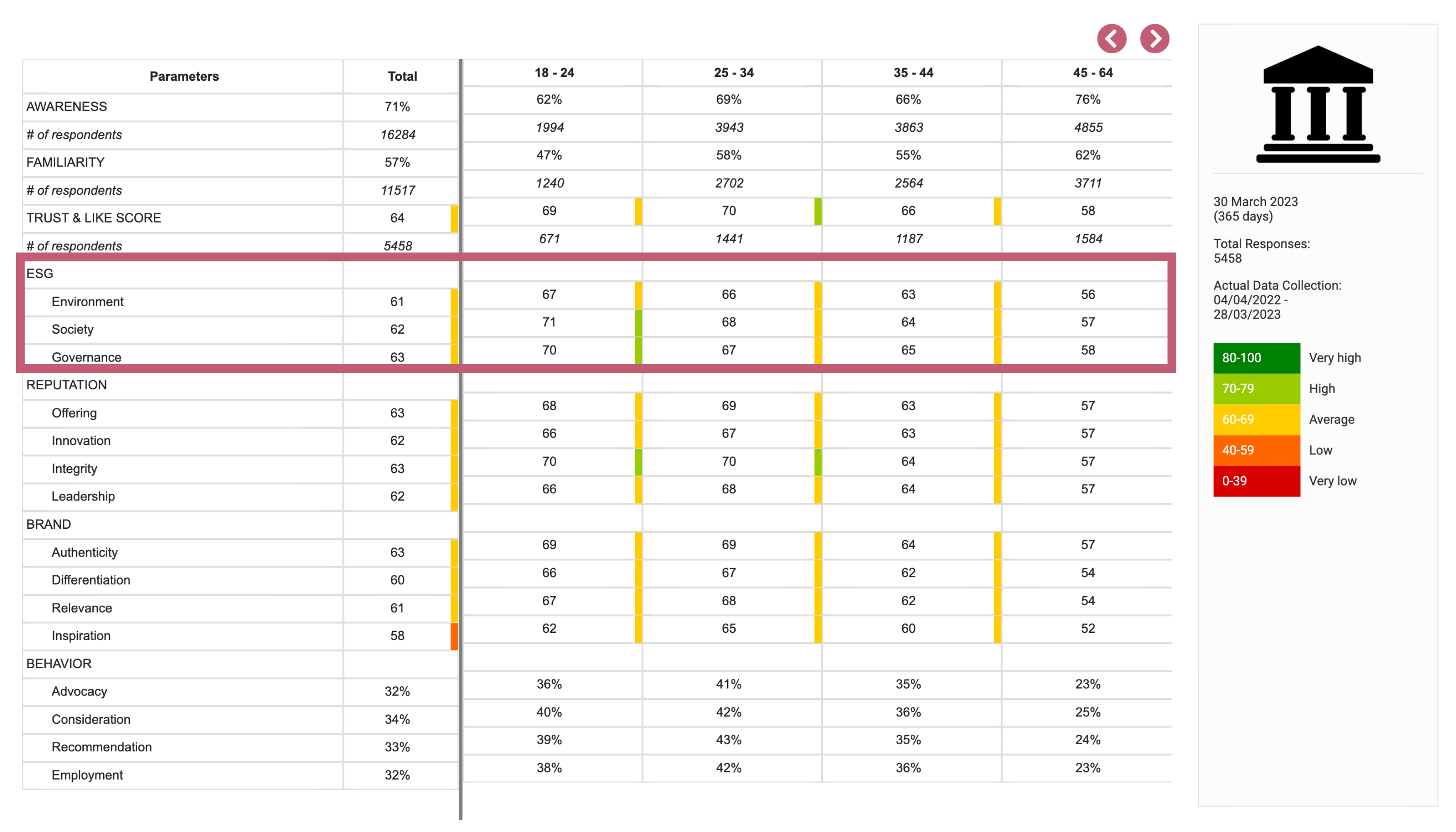

Caliber’s methodology is built for clarity, actionability, and real-time insight. Our evaluation statements are intentionally simple and direct, ensuring consistency across markets and audiences.

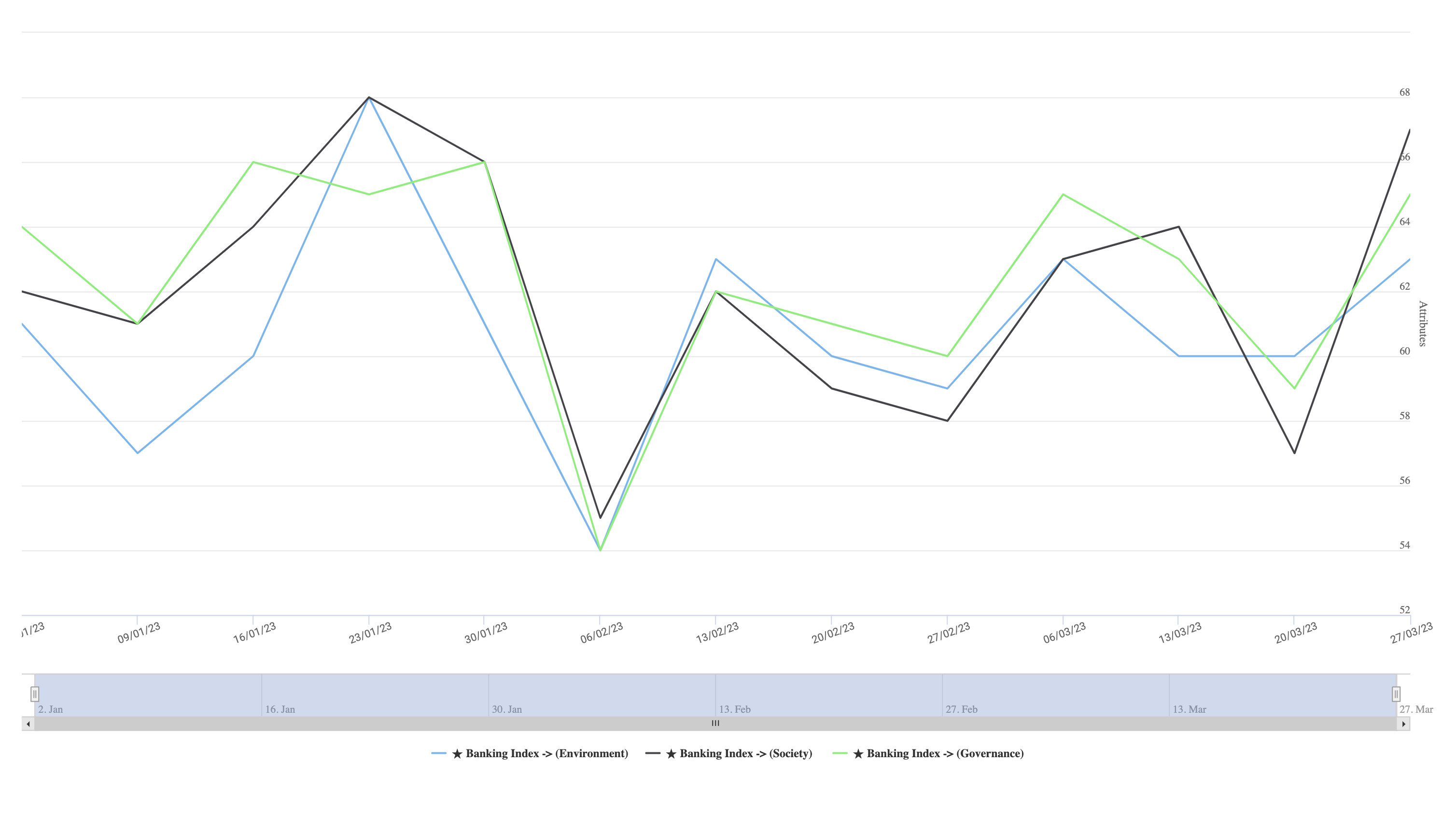

What sets our approach apart is the continuous, multi-stakeholder nature of the measurement. Rather than relying on occasional surveys or static reports, we track ESG reputation day by day, enabling companies to detect shifts, monitor crises, and better understand when and why perceptions change.

Another unique feature is our ESG awareness layer, which shows not only how stakeholders evaluate a company but also how well they know about its ESG activities. This adds critical nuance to the data and helps companies tailor communication for maximum impact.

Tracking ESG reputation with Caliber helps companies:

Understand what stakeholders truly know and believe about their ESG activities

Identify what resonates and what doesn’t

Align internal actions with external perceptions

Pinpoint gaps between the three ESG elements

Segment insights by country, stakeholder group, or demographic

Support more agile and informed communication strategies

This level of granularity gives corporate communications teams the insight needed to drive real change.

Common ESG frameworks like GRI, SASB, and IIRC focus on reporting progress to investors. While essential, they do not measure how that progress is perceived by the public.

Caliber’s solution does not replace these standards – it complements them. By adding the perception dimension, companies ensure their stakeholders understand, appreciate, and trust their ESG performance.

In other words, reporting shows what companies are doing. ESG reputation reveals whether those efforts are believed.

Caliber’s ESG score is based on three straightforward questions evaluating perceptions of:

Environmental impact

Societal impact

Ethical governance

Respondents rate each on a 1–7 Likert scale. The results are averaged, normalized to a 0–100 scale, and can be broken down by individual question to identify specific strengths or weaknesses.

All Stakeholder 360 (our flagship product) clients now have ESG reputation tracking built in at no extra cost. Companies can also customize metrics to ensure alignment with ESG strategy and priorities.

Caliber’s ESG reputation data shows:

What stakeholders know about your ESG activities

How you compare with benchmarks, countries, or sectors

Where you excel and where you underperform

Which themes or messages need strengthening

How perception evolves over time

These insights can inform communication strategies, stakeholder engagement, reporting, and ESG target-setting.

As awareness of ESG issues continues to grow, understanding how stakeholders interpret your efforts will only become more important. Many existing tools offer limited, static, or overly complex data. Caliber takes a different approach, providing clear, actionable, real-time insights rooted in reputation science.

Our mission is simple: to help companies continuously improve and communicate their progress more effectively. If you want to understand how your ESG performance is truly perceived by your stakeholders, get in touch with us.

ESG reputation refers to how stakeholders perceive a company’s environmental, social, and governance performance. It goes beyond what the company reports in sustainability or ESG disclosures and focuses on whether people believe the company is acting responsibly.

ESG reputation reflects awareness, familiarity, credibility, and trust—and it plays a major role in shaping overall corporate reputation, brand strength, and stakeholder confidence.

ESG performance reflects what a company actually does, while ESG reputation reflects how those actions are perceived. A company may score highly on official ESG ratings but still struggle with public trust if its efforts are not known, understood, or believed. Measuring both provides a complete picture of impact.

Yes – more than ever. Investors increasingly consider ESG factors because they view responsible business practices as indicators of lower risk, stronger governance, and long-term resilience. While expectations vary by market and investor type, ESG reputation is becoming a major signal for future performance: companies seen as ethical, sustainable, and trustworthy tend to attract more stable investment, enjoy better access to capital, and face fewer reputational risks.

CSR plays a major role in shaping the “social” dimension of ESG. Community programs, ethical commitments, and social impact initiatives can significantly strengthen ESG reputation—but only if stakeholders are aware of them. Tracking perceptions helps companies understand whether their CSR efforts are visible, credible, and aligned with stakeholder expectations.

CSR plays a major role in shaping the “social” dimension of ESG. Community programs, ethical commitments, and social impact initiatives can significantly strengthen ESG reputation—but only if stakeholders are aware of them. Tracking perceptions helps companies understand whether their CSR efforts are visible, credible, and aligned with stakeholder expectations.

You may also be interested in

Follow Caliber

Get the results of our latest research directly in your inbox!